Understanding Foreign Investment Regulations in Nepal

Foreign investors seeking to establish a business presence in Nepal must comply with the Foreign Investment and Technology Transfer Act, 2019 (FITTA 2019) and the Industrial Enterprises Act, 2020. These laws govern foreign direct investment and specify sectors where foreign participation is permitted, restricted, or prohibited. The Department of Industry serves as the primary regulatory body for company registration and foreign investment approval. Foreign investors can establish private limited companies, public limited companies, or branch offices depending on their business objectives and capital requirements.

Mistake 1: Failing to Verify Sector Eligibility for Foreign Investment

Many foreign investors proceed with incorporation without confirming whether their intended business sector permits foreign participation. FITTA 2019 categorizes industries into automatic approval sectors and prior approval sectors. The Foreign Investment and Technology Transfer Act prohibits foreign investment in certain sectors including cottage industries, personal services, arms and ammunition manufacturing, and real estate business (except for industrial infrastructure development). Foreign investors must consult the Industrial Enterprises Act’s schedules and obtain sector-specific clearances from relevant ministries before initiating the incorporation process.

Restricted Sectors Requiring Special Approval:

| Sector Category | Approval Authority | Legal Provision |

|---|---|---|

| Financial Services | Nepal Rastra Bank | Bank and Financial Institutions Act, 2017 |

| Tourism Industry | Ministry of Culture, Tourism and Civil Aviation | Tourism Act, 1978 |

| Media and Broadcasting | Ministry of Communications | Media Council Act, 2007 |

| Education Services | Ministry of Education | Education Act, 1971 |

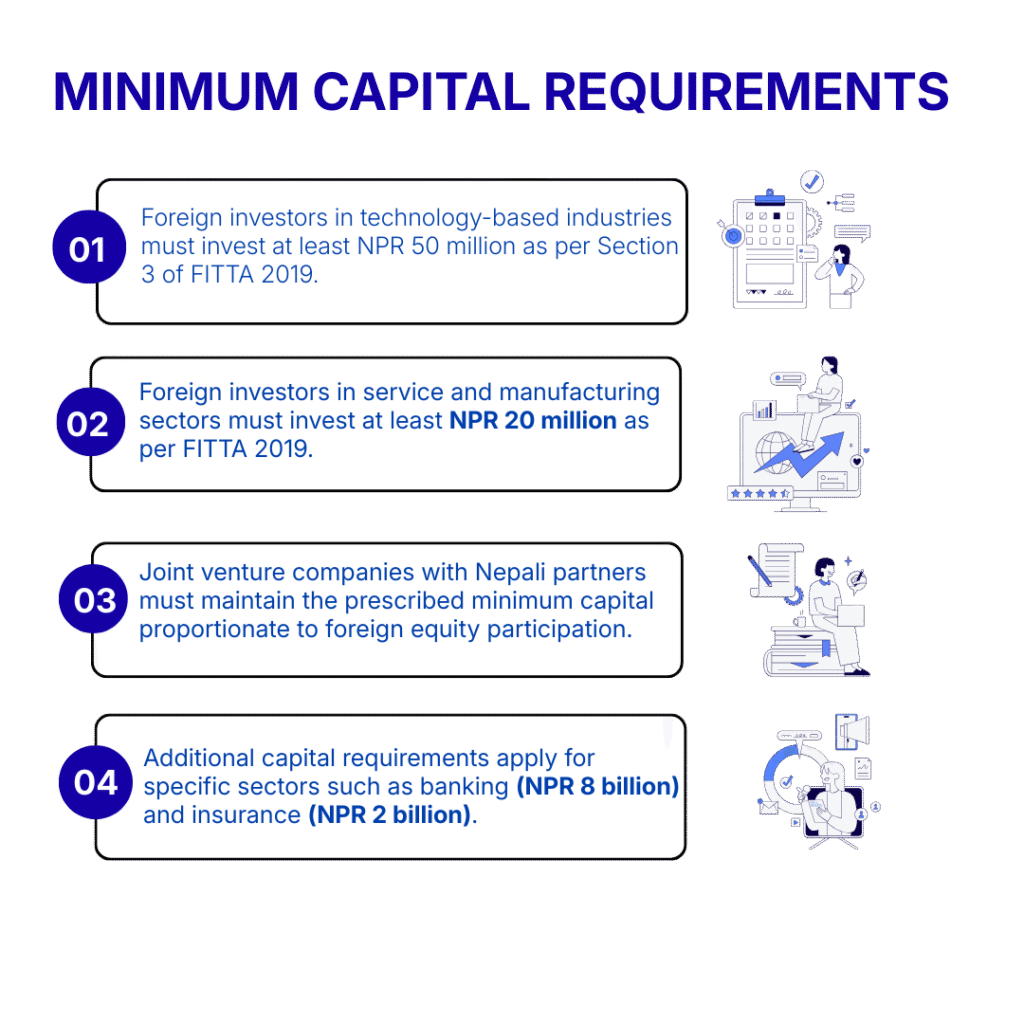

Mistake 2: Inadequate Minimum Capital Investment

Foreign investors frequently underestimate the minimum capital requirements mandated by Nepali law. According to FITTA 2019, foreign investors must invest a minimum of NPR 50 million (approximately USD 375,000) for technology-based industries and NPR 20 million for other industries. The Industrial Enterprises Act, 2020 further specifies capital requirements based on industry classification. Foreign investors must deposit the minimum capital in a Nepali bank and obtain a capital verification certificate before company registration. Failure to meet these thresholds results in application rejection by the Department of Industry.

Mistake 3: Incorrect Company Structure Selection

Foreign investors often select inappropriate company structures without understanding the legal implications and operational limitations. The Companies Act, 2006 permits foreign investors to establish private limited companies, public limited companies, or branch offices. Private limited companies require a minimum of two shareholders and can have up to 101 shareholders. Public limited companies must have at least seven shareholders and can raise capital through public offerings. Branch offices can only conduct liaison activities and cannot engage in profit-generating operations. Foreign investors must align their company structure with their business objectives and compliance capabilities.

Mistake 4: Non-Compliance with Name Reservation Requirements

The company name reservation process under the Companies Act, 2006 requires strict adherence to naming conventions and availability verification. The Office of Company Registrar (OCR) rejects names that are identical or similar to existing companies, contain prohibited words, or violate public morality. Foreign investors must submit name reservation applications with three alternative names and obtain approval before proceeding with incorporation. The reserved name remains valid for 35 days from the approval date. Companies must include “Private Limited” or “Public Limited” in their registered names as per Section 7 of the Companies Act, 2006.

Name Reservation Checklist:

- The proposed company name must not be identical or deceptively similar to any existing registered company name.

- The name must not contain words suggesting government patronage such as “National,” “Federal,” or “Nepal Government” without authorization.

- The name must include appropriate suffixes like “Private Limited” (Pvt. Ltd.) or “Public Limited” (Ltd.) as per the company type.

- Foreign language names require official Nepali translation and must comply with the Official Language Act.

Mistake 5: Improper Documentation and Authentication

Foreign investors frequently submit improperly authenticated documents, causing significant delays in the incorporation process. All foreign documents must undergo legalization through the apostille process or embassy authentication as per the Evidence Act, 2031. Personal documents such as passports, educational certificates, and proof of address require notarization and authentication by the Nepali embassy in the investor’s home country. The Department of Industry and Office of Company Registrar reject applications with unauthenticated documents. Translation of foreign language documents into Nepali by authorized translators is mandatory under the Official Language Act.

Required Documents for Foreign Investors:

- Passport copies of all foreign shareholders and directors must be notarized and authenticated by the Nepali embassy.

- Board resolution from the parent company authorizing investment in Nepal must be properly authenticated and translated.

- Bank solvency certificates or financial statements demonstrating investment capacity must be certified by authorized banks.

- Proof of registered office address in Nepal requires a rental agreement or ownership documents with recent tax clearance certificates.

- Memorandum and Articles of Association must be drafted in Nepali language and signed by all shareholders.

Mistake 6: Neglecting Tax Registration and PAN Acquisition

Many foreign investors delay or overlook mandatory tax registration requirements after company incorporation. The Income Tax Act, 2058 requires all companies to obtain a Permanent Account Number (PAN) within 30 days of registration. The Inland Revenue Department issues PAN certificates upon submission of company registration certificates and shareholder details. Companies must also register for Value Added Tax (VAT) if their annual turnover exceeds NPR 5 million as per the Value Added Tax Act, 2052. Failure to obtain timely tax registration results in penalties and prevents companies from opening bank accounts or conducting business transactions.

| Tax Registration Type | Issuing Authority | Timeline | Legal Basis |

|---|---|---|---|

| Permanent Account Number (PAN) | Inland Revenue Department | Within 30 days of incorporation | Income Tax Act, 2058 |

| VAT Registration | Inland Revenue Office | Before commencing business | VAT Act, 2052 |

| Employer Registration | Social Security Fund | Within 30 days of hiring | Contribution Based Social Security Act, 2074 |

Mistake 7: Misunderstanding Foreign Equity Limitations

Foreign investors often misinterpret the equity participation limits specified in various sectoral laws. While FITTA 2019 generally permits 100% foreign ownership in most sectors, specific industries impose equity caps. The Industrial Enterprises Act, 2020 reserves certain industries for Nepali nationals or requires mandatory Nepali partnership. Foreign investors in restricted sectors must structure joint ventures with Nepali partners meeting the prescribed equity ratios. The Foreign Investment and Technology Transfer Act requires foreign investors to maintain their equity stake for a minimum period and restricts equity transfer without prior approval.

Sector-Specific Equity Limitations:

- Foreign investors can hold 100% equity in manufacturing, tourism, and information technology sectors as per FITTA 2019.

- Financial institutions permit maximum 67% foreign equity as per Bank and Financial Institutions Act, 2017.

- Insurance companies allow maximum 50% foreign equity under Insurance Act, 2049.

- Hydropower projects permit 100% foreign investment but require technology transfer agreements as per Electricity Act, 2049.

Mistake 8: Inadequate Visa and Work Permit Planning

Foreign investors frequently encounter operational disruptions due to improper visa and work permit arrangements. The Immigration Act, 2049 and Immigration Regulations, 2051 govern entry and stay of foreign nationals in Nepal. Foreign investors must obtain business visas for initial entry and convert them to work visas after company registration. The Department of Labor and Employment Protection issues work permits to foreign employees based on company recommendations and skill requirements. Companies must demonstrate that the foreign employee possesses specialized skills unavailable in the Nepali labor market. Work permits remain valid for one to five years depending on the employment contract duration.

Visa and Work Permit Process:

- Step 1: Foreign investors obtain business visas from Nepali embassies or on-arrival at Tribhuvan International Airport for initial company setup activities.

- Step 2: After company registration, investors apply for work visas through the Department of Immigration by submitting company registration certificates and investment approval letters.

- Step 3: Companies submit work permit applications to the Department of Labor with employment contracts, educational certificates, and skill verification documents.

- Step 4: Foreign employees must obtain tax clearance certificates and renew work permits before expiration to maintain legal employment status.

Mistake 9: Overlooking Sector-Specific Licenses and Permits

Foreign investors commonly focus solely on company registration while neglecting mandatory sector-specific licenses. The Industrial Enterprises Act, 2020 requires all industries to obtain industry registration certificates from the Department of Industry. Manufacturing units must secure environmental clearance from the Ministry of Forest and Environment under the Environment Protection Act, 2019. Service sector businesses require trade licenses from local municipalities under the Local Government Operation Act, 2074. Failure to obtain requisite licenses before commencing operations results in penalties, business closure orders, and potential criminal liability under respective sectoral laws.

Common Sector-Specific Requirements:

| Business Sector | Required License | Issuing Authority | Legal Provision |

|---|---|---|---|

| Manufacturing | Industry Registration | Department of Industry | Industrial Enterprises Act, 2020 |

| Food Business | Food Business License | Department of Food Technology | Food Act, 2023 |

| Construction | Construction Business License | Department of Urban Development | Building Act, 2055 |

| Import/Export | Importer/Exporter Registration | Department of Commerce | Foreign Trade Act, 1992 |

Mistake 10: Insufficient Understanding of Repatriation Rules

Foreign investors often lack clarity regarding profit repatriation and capital transfer regulations. FITTA 2019 guarantees foreign investors the right to repatriate profits, dividends, and proceeds from technology transfer after paying applicable taxes. The Foreign Exchange Regulation Act, 2019 governs foreign currency transactions and requires Nepal Rastra Bank approval for capital repatriation. Companies must maintain audited financial statements and obtain tax clearance certificates before initiating repatriation. The Income Tax Act, 2058 imposes withholding tax on dividend distributions to foreign shareholders. Foreign investors must comply with double taxation avoidance agreements between Nepal and their home countries to optimize tax liability.

Repatriation Requirements:

- Foreign investors must pay all applicable taxes including corporate income tax (25%) and dividend withholding tax (5-10%) before repatriation.

- Companies must submit audited financial statements certified by chartered accountants registered with the Institute of Chartered Accountants of Nepal.

- Nepal Rastra Bank requires documentary evidence of original investment, tax payment receipts, and board resolutions authorizing repatriation.

- Repatriation applications must be submitted through authorized commercial banks with complete documentation as per Foreign Exchange Regulation Act, 2019.

Legal Framework Governing Foreign Investment

The legal framework for foreign investment in Nepal comprises multiple statutes and regulations administered by different government agencies. The Foreign Investment and Technology Transfer Act, 2019 serves as the primary legislation governing foreign direct investment. The Companies Act, 2006 regulates company formation, governance, and dissolution. The Industrial Enterprises Act, 2020 provides for industry classification, registration, and operational requirements. Foreign investors must also comply with the Income Tax Act, 2058, Value Added Tax Act, 2052, Labor Act, 2074, and Foreign Exchange Regulation Act, 2019. Understanding the interplay between these laws is essential for successful business establishment and operation.

Registration Process with Department of Industry

Foreign investors must register their investment projects with the Department of Industry before company incorporation. The registration process involves submitting detailed project proposals including business plans, financial projections, and technology transfer agreements. The Department evaluates applications based on sector eligibility, minimum capital compliance, and economic viability. Upon approval, the Department issues a foreign investment approval letter valid for six months. Investors must complete company registration within this validity period. The Department of Industry also monitors foreign investment implementation and requires periodic progress reports as per FITTA 2019 and Industrial Enterprises Act, 2020.

Company Registration with Office of Company Registrar

The Office of Company Registrar administers company registration under the Companies Act, 2006. Foreign investors must submit incorporation applications with Memorandum and Articles of Association, shareholder details, and director information. The OCR verifies document completeness, name availability, and statutory compliance before registration. Upon approval, the OCR issues a company registration certificate and assigns a unique company registration number. Registered companies must file annual returns, financial statements, and director changes with the OCR. Non-compliance with filing requirements results in penalties and potential company dissolution under Section 168 of the Companies Act, 2006.

Compliance Obligations for Foreign-Owned Companies

Foreign-owned companies in Nepal face ongoing compliance obligations under multiple laws. The Companies Act, 2006 requires annual general meetings, board meetings, and maintenance of statutory registers. The Income Tax Act, 2058 mandates quarterly advance tax payments and annual tax return filing. The Labor Act, 2074 requires compliance with minimum wage, working hours, and social security contributions. Companies must maintain proper accounting records as per Nepal Accounting Standards and conduct annual audits by registered chartered accountants. The Department of Industry monitors foreign investment implementation and can revoke approvals for non-compliance with investment commitments or sectoral regulations.

Read More:

- https://lawaxion.com/gambling-and-betting-case-in-nepal-process-fine-lawyer/

- https://lawaxion.com/establishing-bpo-business-in-nepal-process-time-cost/

- https://lawaxion.com/digital-service-tax-registration-and-compliance-in-nepal/

- https://lawaxion.com/foreign-currency-crime-in-nepal-fines-prison-and-lawyer/

- https://lawaxion.com/medical-negligence-in-nepal-law-fines-and-case-precedents/

Frequently Asked Questions

What is the minimum investment required for foreign investors in Nepal?

Foreign investors must invest at least NPR 50 million for technology-based industries and NPR 20 million for other sectors as per FITTA 2019. These amounts must be deposited in Nepali banks before company registration.

Can foreign investors own 100% equity in Nepali companies?

Foreign investors can hold 100% equity in most sectors except those specifically restricted by sectoral laws. Financial institutions, insurance companies, and certain service sectors impose equity caps requiring Nepali partnership.

How long does the company incorporation process take in Nepal?

The complete incorporation process typically takes 30-45 days from application submission, assuming all documents are properly authenticated and meet statutory requirements. Delays occur with incomplete documentation or sector-specific clearances.

What taxes apply to foreign-owned companies in Nepal?

Foreign-owned companies pay 25% corporate income tax, 13% VAT on taxable supplies, and withholding taxes on various payments. Dividend distributions to foreign shareholders attract 5-10% withholding tax under the Income Tax Act, 2058.

Are there restrictions on profit repatriation from Nepal?

FITTA 2019 permits profit repatriation after paying applicable taxes and obtaining Nepal Rastra Bank approval. Companies must submit audited financial statements and tax clearance certificates for repatriation approval under Foreign Exchange Regulation Act, 2019.

What work permit requirements apply to foreign employees?

Foreign employees require work permits from the Department of Labor and Employment Protection. Companies must demonstrate that foreign employees possess specialized skills unavailable locally and maintain valid work visas under Immigration Act, 2049.

Which sectors are prohibited for foreign investment in Nepal?

Foreign investment is prohibited in cottage industries, personal services, arms manufacturing, real estate business (except industrial infrastructure), and industries reserved for Nepali nationals under FITTA 2019 and Industrial Enterprises Act, 2020.

Do foreign investors need local partners in Nepal?

Local partners are not mandatory for most sectors, but certain industries like financial services and insurance require Nepali partnership to comply with equity caps. Joint ventures may provide operational advantages in understanding local markets.

What is the validity period of foreign investment approval?

Foreign investment approval letters issued by the Department of Industry remain valid for six months. Investors must complete company registration and commence operations within this period or apply for extensions with justification.

How are disputes resolved for foreign investors in Nepal?

FITTA 2019 provides for dispute resolution through arbitration under the Arbitration Act, 1999. Foreign investors can also access bilateral investment treaties between Nepal and their home countries for investment protection and dispute settlement mechanisms.Add to Conversation