Non-Resident Nepalis (NRNs) often wonder about their property ownership rights in Nepal. This comprehensive guide explores the legal framework, requirements, and processes for NRNs to purchase property in their homeland. Understanding these regulations is crucial for NRNs looking to invest in Nepali real estate.

Introduction to Property Ownership Rights for NRNs

The Nepali government recognizes the importance of NRN investments in the country’s economy. As such, it has established specific provisions allowing NRNs to own property in Nepal. The Non-Resident Nepali Act 2064 (2008) and its subsequent amendments provide the legal basis for NRN property ownership.

NRNs are defined as individuals of Nepali origin who have acquired foreign citizenship or those who have lived abroad for an extended period. These individuals retain a special status in Nepal, granting them certain rights, including property ownership.

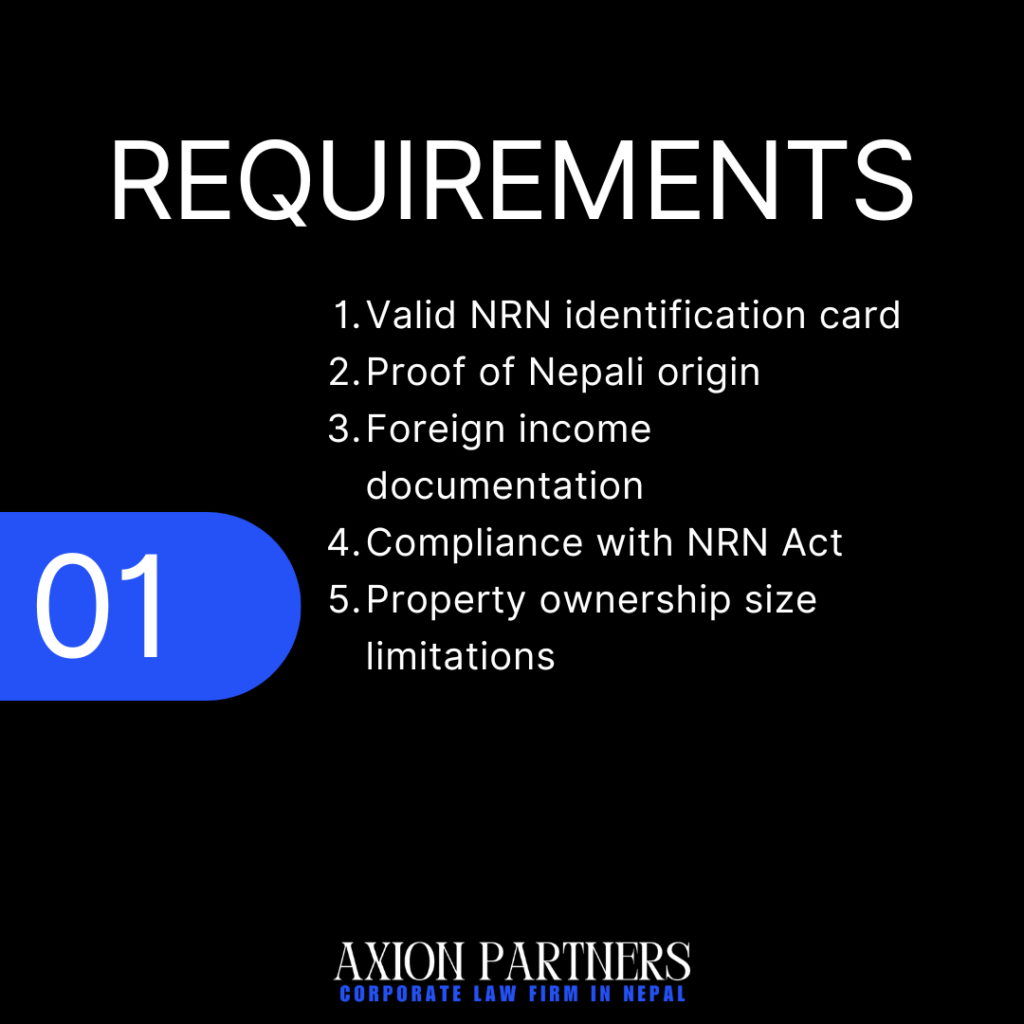

Legal Requirements for NRN Property Purchase Process

To purchase property in Nepal, NRNs must meet several legal requirements:

- Valid NRN card issued by the Non-Resident Nepali Association (NRNA)

- Proof of Nepali origin (citizenship certificate or birth certificate)

- Valid passport of current country of residence

- Compliance with foreign exchange regulations for fund transfers

- Adherence to property ownership limits set by Nepali law

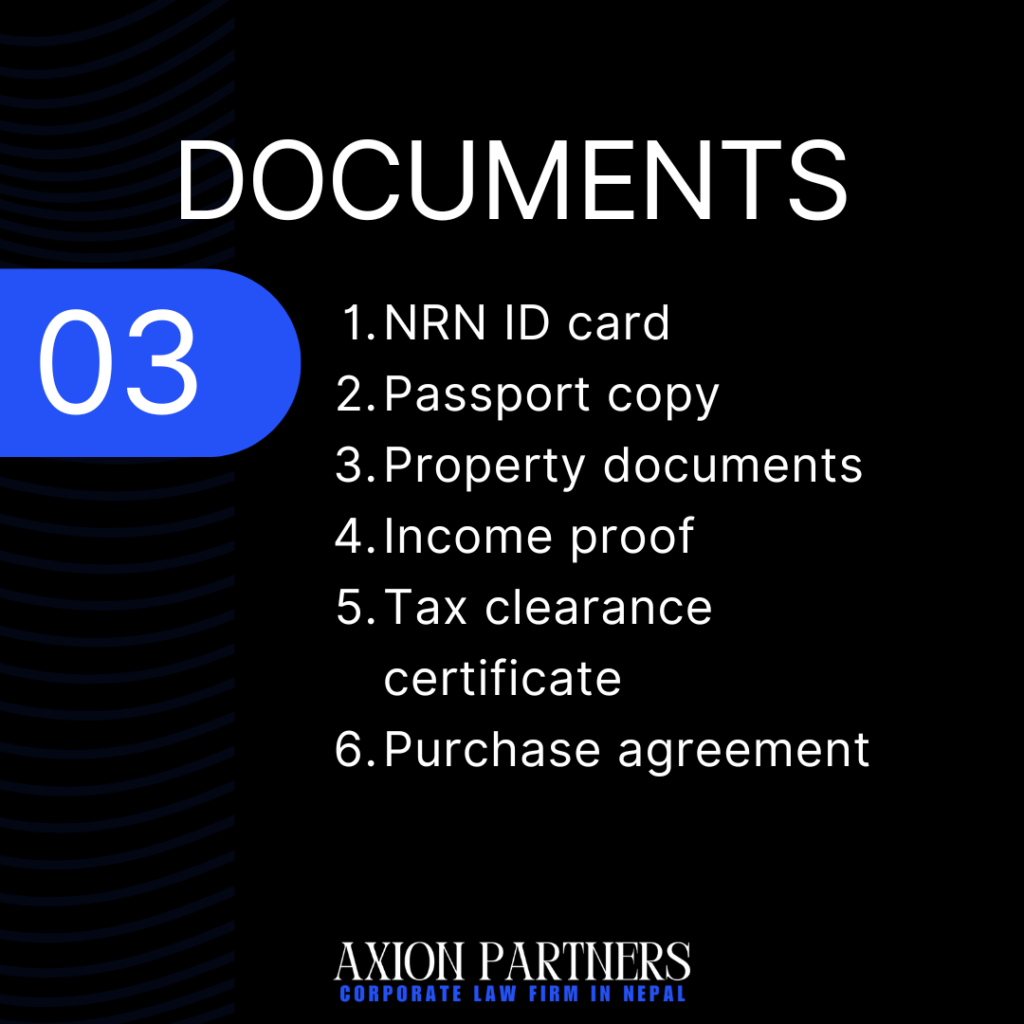

Documentation Requirements for NRN Property Registration Process

NRNs must prepare and submit the following documents for property registration:

- Original NRN card

- Notarized copy of passport

- Property sale agreement (Rajinama)

- Land ownership certificate (Lalpurja) of the seller

- Tax clearance certificates

- Citizenship certificate or proof of Nepali origin

- Recent photographs

- Power of attorney (if applicable)

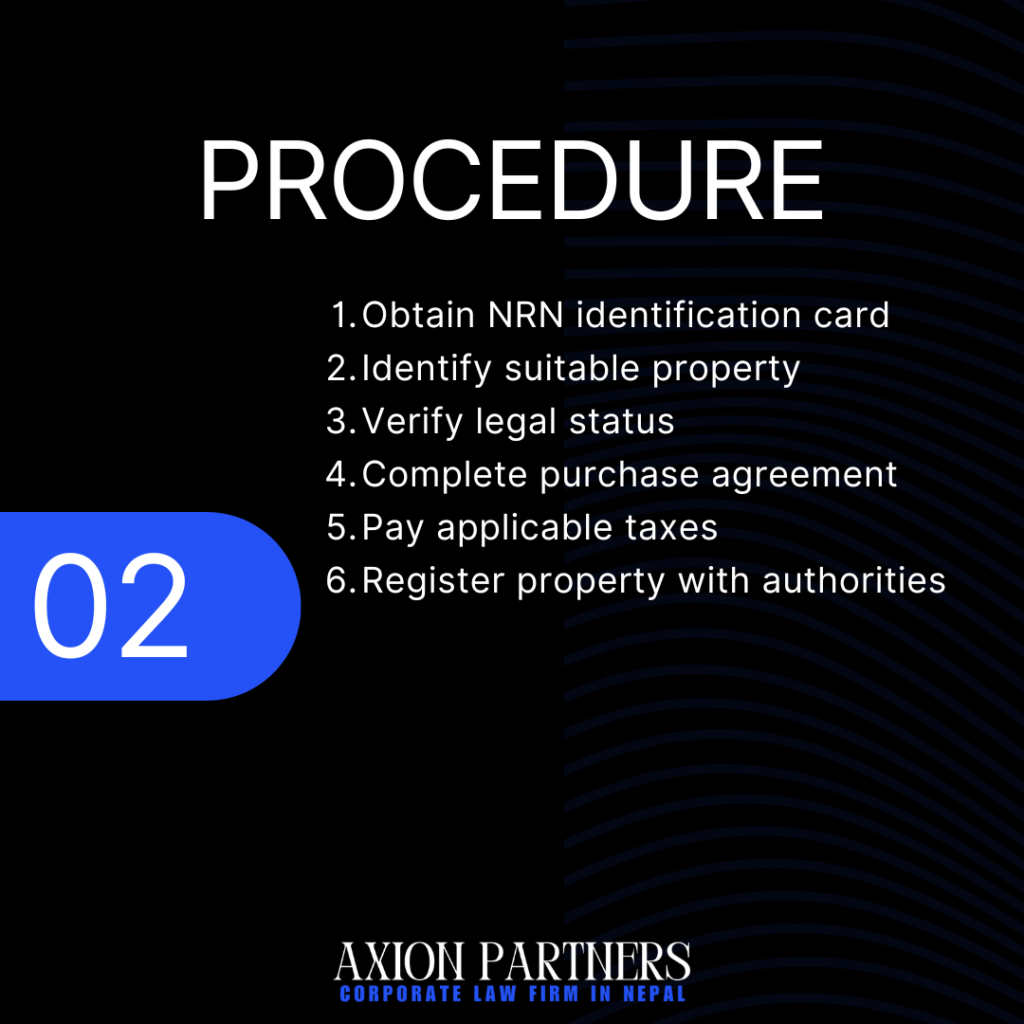

Step-by-Step Process for NRN Property Acquisition

The property acquisition process for NRNs involves several steps:

- Identify the desired property and negotiate terms with the seller

- Conduct due diligence on the property’s legal status

- Prepare and sign the sale agreement (Rajinama)

- Obtain necessary clearances from local authorities

- Submit documents to the Land Revenue Office for registration

- Pay applicable taxes and registration fees

- Receive the new land ownership certificate (Lalpurja)

Government Fees for NRN Property Registration Process

NRNs must pay various fees during the property registration process:

- Registration fee (4-6% of property value, varies by location)

- Capital gains tax (2.5% for seller, if applicable)

- Local development fee (typically 0.5% of property value)

- Service charges and miscellaneous fees

Time Duration for NRN Property Purchase Completion

The duration of the NRN property purchase process can vary depending on several factors:

- Document preparation: 1-2 weeks

- Due diligence: 1-3 weeks

- Registration process: 1-2 weeks

- Total estimated time: 3-7 weeks

However, complex cases or bureaucratic delays may extend this timeline.

Restrictions on NRN Property Ownership in Nepal

While NRNs can own property in Nepal, certain restrictions apply:

- Land ownership limit: Maximum of 10 Ropani (5,476 sq. meters) in urban areas or 25 Ropani (13,690 sq. meters) in rural areas

- Prohibited areas: Certain border regions and protected zones

- Usage restrictions: Property must be for personal or business use, not speculation

Legal Framework Governing NRN Property Rights Nepal

The primary laws governing NRN property rights in Nepal include:

- Non-Resident Nepali Act 2064 (2008)

- Land Act 2021 (1964) and its amendments

- Land Revenue Act 2034 (1978)

- Foreign Exchange Regulation Act 2019 (1962)

These laws collectively define the rights, restrictions, and procedures for NRN property ownership.

Property Registration Process at Land Revenue Office

The Land Revenue Office (Malpot Karyalaya) handles property registration in Nepal. The process involves:

- Document submission and verification

- Property valuation assessment

- Fee calculation and payment

- Registration of the deed (Rajinama)

- Issuance of new land ownership certificate (Lalpurja)

Authorized Institutions for NRN Property Registration Process

Several institutions are involved in the NRN property registration process:

- Land Revenue Office (Malpot Karyalaya)

- Non-Resident Nepali Association (NRNA)

- Department of Land Management and Archives

- Local municipal offices

- Nepal Rastra Bank (for foreign currency transactions)

Professional Services Required for Property Purchase Process

NRNs are advised to seek professional assistance during the property purchase process:

- Legal counsel: To review documents and ensure compliance

- Real estate agent: To help identify suitable properties

- Notary public: For document authentication

- Translator: If official documents require translation

- Financial advisor: For tax and investment guidance

Property Verification Process for NRN Purchase Applications

Before finalizing a property purchase, NRNs should conduct thorough verification:

- Check the seller’s land ownership certificate (Lalpurja)

- Verify property boundaries and measurements

- Investigate any existing liens or encumbrances

- Confirm zoning regulations and permitted land use

- Review historical ownership records

Financial Considerations for NRN Property Purchase Process

NRNs must navigate specific financial considerations when purchasing property:

- Foreign currency transfer regulations

- Tax implications in Nepal and country of residence

- Property valuation and fair market price assessment

- Ongoing costs of property ownership and maintenance

- Potential rental income and related tax obligations

Read More

- Agriculture Company Registration in Nepal

- Company Share Transfer Process in Nepal

- Corporate Social Responsibility in Nepal

Common Challenges in NRN Property Purchase Process

NRNs may encounter several challenges during the property purchase process:

- Navigating complex bureaucratic procedures

- Ensuring compliance with foreign exchange regulations

- Dealing with potential language barriers

- Managing the process remotely, if not present in Nepal

- Understanding local property market dynamics

Post-Registration Requirements for NRN Property Ownership

After successfully registering property, NRNs must fulfill ongoing obligations:

- Regular tax payments (property tax, rental income tax if applicable)

- Compliance with local building and zoning regulations

- Maintenance of property records and documentation

- Periodic renewal of NRN status and related permits

- Adherence to any usage restrictions or conditions

Frequently Asked Questions (FAQs)

How much property can an NRN buy in Nepal?

NRNs can purchase up to 10 Ropani (5,476 sq. meters) of land in urban areas or 25 Ropani (13,690 sq. meters) in rural areas. These limits are set by Nepali law to balance NRN investment opportunities with local land availability.

What documents do NRNs need for property purchase?

Essential documents include a valid NRN card, passport, proof of Nepali origin, property sale agreement, seller’s land ownership certificate, tax clearance certificates, and recent photographs. Additional documents may be required depending on specific circumstances.

Can NRNs sell their property in Nepal?

Yes, NRNs can sell their property in Nepal. However, they must comply with applicable laws, including tax regulations and foreign exchange rules when repatriating the proceeds of the sale.

How long does the property registration process take?

The property registration process typically takes 3-7 weeks, depending on document preparation, due diligence, and administrative procedures. Complex cases may require additional time.

Are there any restrictions on property location?

Yes, NRNs are prohibited from purchasing property in certain border regions and protected zones. It’s crucial to verify the eligibility of the desired location before proceeding with a purchase.

What are the tax implications for NRN property owners?

NRN property owners are subject to various taxes, including property tax, rental income tax (if applicable), and capital gains tax upon sale. Tax rates and regulations may vary based on location and property type.

Can NRNs get loans for property purchase?

NRNs may be eligible for loans from Nepali banks for property purchases, subject to specific conditions and credit assessments. However, loan availability and terms can vary, and NRNs should consult with financial institutions directly for current options.

In conclusion, while NRNs have the right to purchase property in Nepal, the process involves navigating complex legal and administrative requirements. By understanding these regulations and seeking professional assistance when needed, NRNs can successfully invest in Nepali real estate while complying with all relevant laws and procedures.

Resources: Shearman & Sterling Insights, Linklaters News, Davis Polk & Wardwell Insights

Table of Contents

- 0.1 Introduction to Property Ownership Rights for NRNs

- 0.2 Legal Requirements for NRN Property Purchase Process

- 0.3 Documentation Requirements for NRN Property Registration Process

- 0.4 Step-by-Step Process for NRN Property Acquisition

- 0.5 Government Fees for NRN Property Registration Process

- 0.6 Time Duration for NRN Property Purchase Completion

- 0.7 Restrictions on NRN Property Ownership in Nepal

- 0.8 Legal Framework Governing NRN Property Rights Nepal

- 0.9 Property Registration Process at Land Revenue Office

- 0.10 Authorized Institutions for NRN Property Registration Process

- 0.11 Professional Services Required for Property Purchase Process

- 0.12 Property Verification Process for NRN Purchase Applications

- 0.13 Financial Considerations for NRN Property Purchase Process

- 0.14 Common Challenges in NRN Property Purchase Process

- 0.15 Post-Registration Requirements for NRN Property Ownership

- 1 Frequently Asked Questions (FAQs)

- 1.1 How much property can an NRN buy in Nepal?

- 1.2 What documents do NRNs need for property purchase?

- 1.3 Can NRNs sell their property in Nepal?

- 1.4 How long does the property registration process take?

- 1.5 Are there any restrictions on property location?

- 1.6 What are the tax implications for NRN property owners?

- 1.7 Can NRNs get loans for property purchase?