Table of Contents

- 1 Steps to Conduct Vendor Due Diligence in Nepal

- 2 What Is Vendor Due Diligence in Nepal?

- 3 Where to Conduct Vendor Due Diligence in Nepal?

- 4 What Laws Govern Vendor Due Diligence in Nepal?

- 5 How to Conduct Vendor Due Diligence in Nepal?

- 6 What Documents Are Required for Vendor Due Diligence?

- 7 What Are the Key Verification Areas in Vendor Due Diligence?

- 8 How Long Does Vendor Due Diligence Take in Nepal?

- 9 What Are the Costs of Vendor Due Diligence in Nepal?

- 10 What Are Post-Due Diligence Requirements?

- 11 What Types of Vendor Due Diligence Exist?

- 12 What Benefits Does Vendor Due Diligence Provide?

- 13 FAQs

- 13.1 Should I do Vendor Due Diligence in Nepal?

- 13.2 How much does vendor due diligence cost in Nepal?

- 13.3 What Documents are Required for Vendor Due Diligence?

- 13.4 How long does the due diligence process take?

- 13.5 Where can I verify company registration in Nepal?

- 13.6 What Law conducts Vendor Due Diligence in Nepal?

- 13.7 Can I conduct due diligence without vendor?

- 13.8 Who Provides Due Diligence Service in Nepal?

Understanding vendor due diligence in Nepal is essential for businesses to assess supplier credibility, legal compliance, financial stability, and operational capacity before entering commercial relationships, ensuring risk mitigation and regulatory adherence throughout procurement processes.

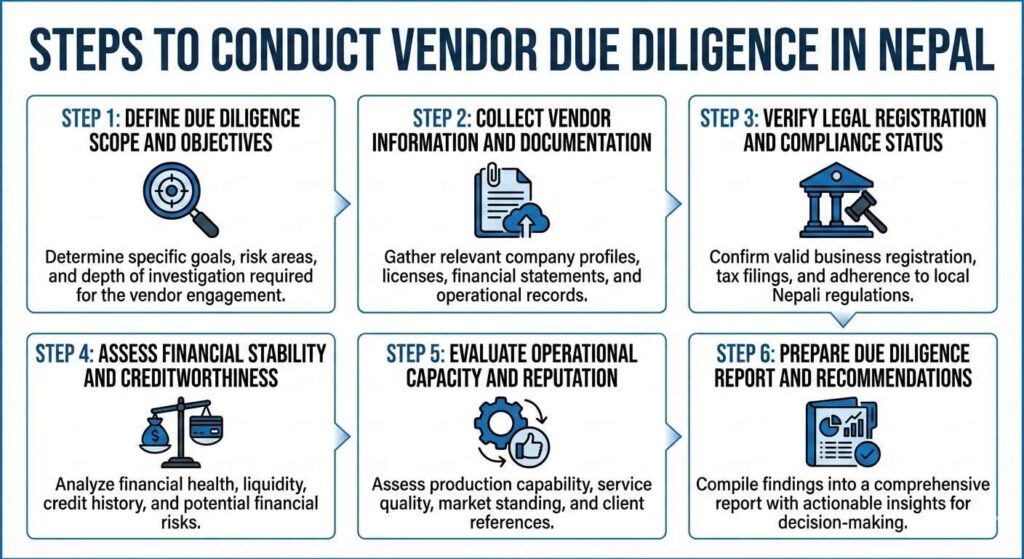

Steps to Conduct Vendor Due Diligence in Nepal

- Step 1: Define Due Diligence Scope and Objectives

- Step 2: Collect Vendor Information and Documentation

- Step 3: Verify Legal Registration and Compliance Status

- Step 4: Assess Financial Stability and Creditworthiness

- Step 5: Evaluate Operational Capacity and Reputation

- Step 6: Prepare Due Diligence Report and Recommendations

What Is Vendor Due Diligence in Nepal?

Vendor due diligence in Nepal refers to the systematic process of investigating and evaluating potential suppliers, contractors, or service providers before establishing commercial relationships. This process involves comprehensive assessment of a vendor’s legal status, financial health, operational capabilities, compliance history, and reputation in the market. Businesses conduct vendor due diligence nepal procedures to minimize procurement risks, ensure regulatory compliance, and protect their commercial interests.

The vendor due diligence process in Nepal encompasses verification of company registration documents, tax compliance certificates, financial statements, operational licenses, and past performance records. Companies examine whether vendors maintain proper legal standing with the Office of Company Registrar, Department of Industry, or relevant regulatory authorities. This investigation helps businesses identify potential red flags such as pending litigation, tax defaults, regulatory violations, or questionable business practices before committing to contractual arrangements.

Conducting thorough vendor due diligence nepal assessments has become increasingly important as Nepalese businesses expand their supply chains and engage with diverse suppliers across different sectors. The process protects companies from financial losses, reputational damage, legal liabilities, and operational disruptions that may arise from partnerships with unreliable or non-compliant vendors. Proper due diligence establishes a foundation for sustainable business relationships built on transparency, accountability, and mutual trust.

Where to Conduct Vendor Due Diligence in Nepal?

Vendor due diligence in Nepal involves gathering information from multiple government offices, regulatory bodies, and commercial databases located primarily in Kathmandu and other major cities. The Office of Company Registrar, situated in Tripureshwor, Kathmandu, serves as the primary source for verifying company registration details, shareholding patterns, directorship information, and annual compliance status. Businesses can access company registration certificates, memorandum of association, articles of association, and annual return filings from this office.

The Inland Revenue Department offices across Nepal provide crucial information regarding vendor tax compliance, including permanent account number verification, value-added tax registration status, and tax clearance certificates. Companies conducting vendor due diligence nepal investigations must verify that potential vendors maintain current tax registrations and have no outstanding tax liabilities. The Department of Industry, located in Tripureshwor, Kathmandu, maintains records of industrial enterprises and issues industry registration certificates that businesses should verify during due diligence processes.

Sector-specific regulatory authorities also play important roles in vendor verification processes. The Nepal Rastra Bank regulates financial institutions, the Department of Food Technology and Quality Control oversees food-related businesses, and the Department of Mines and Geology supervises mining operations. Businesses can access official information through the Office of Company Registrar’s online portal at https://www.ocr.gov.np for preliminary company verification before conducting detailed on-site investigations.

What Laws Govern Vendor Due Diligence in Nepal?

Vendor due diligence in Nepal operates within a comprehensive legal framework that establishes requirements for business registration, financial reporting, tax compliance, and commercial transactions. While no single law specifically mandates vendor due diligence procedures, various statutes create obligations that businesses must verify during supplier assessments.

Key laws and regulations governing vendor due diligence nepal processes include:

- Companies Act, 2063 (2006) – Governs company registration, management, reporting obligations, and dissolution procedures

- Industrial Enterprises Act, 2076 (2020) – Regulates industrial enterprise registration and operational requirements

- Income Tax Act, 2058 (2002) – Establishes tax registration, filing, and compliance obligations for businesses

- Value Added Tax Act, 2052 (1996) – Mandates VAT registration and compliance for qualifying businesses

- Labor Act, 2074 (2017) – Sets employment standards and worker protection requirements

- Public Procurement Act, 2063 (2007) – Governs procurement processes for government contracts

- Foreign Investment and Technology Transfer Act, 2075 (2019) – Regulates foreign investment and technology transfer arrangements

- Contract Act, 2056 (2000) – Establishes legal framework for contractual relationships

- Insolvency Act, 2063 (2006) – Governs bankruptcy and insolvency proceedings

- Competition Promotion and Market Protection Act, 2063 (2007) – Prevents anti-competitive practices and market manipulation

How to Conduct Vendor Due Diligence in Nepal?

- Step 1: Define Due Diligence Scope and Objectives

- Step 2: Collect Vendor Information and Documentation

- Step 3: Verify Legal Registration and Compliance Status

- Step 4: Assess Financial Stability and Creditworthiness

- Step 5: Evaluate Operational Capacity and Reputation

- Step 6: Prepare Due Diligence Report and Recommendations

Step 1: Define Due Diligence Scope and Objectives

Establish clear objectives for the vendor due diligence nepal investigation based on transaction value, risk exposure, and business requirements. Determine which aspects require detailed examination including legal compliance, financial stability, operational capacity, or reputation assessment. Identify specific information sources, verification methods, and evaluation criteria that will guide the investigation process throughout all subsequent stages.

Step 2: Collect Vendor Information and Documentation

Request comprehensive documentation from potential vendors including company registration certificates, tax registration documents, financial statements, operational licenses, and references. Obtain permanent account number certificates, value-added tax registration certificates, industry registration certificates, and relevant sector-specific permits. Collect information about company ownership structure, management team, business history, and existing client relationships for thorough evaluation.

Step 3: Verify Legal Registration and Compliance Status

Confirm vendor legal status by verifying company registration details with the Office of Company Registrar and checking industry registration with the Department of Industry. Examine whether the company maintains good standing, has filed required annual returns, and possesses valid operational licenses. Review any pending litigation, regulatory violations, or compliance issues that may affect the vendor’s ability to fulfill contractual obligations.

Step 4: Assess Financial Stability and Creditworthiness

Analyze vendor financial statements including balance sheets, profit and loss accounts, and cash flow statements for the past three years. Evaluate financial ratios, liquidity positions, debt levels, and profitability trends to assess financial health. Verify tax compliance by obtaining tax clearance certificates and checking for any outstanding tax liabilities with the Inland Revenue Department.

Step 5: Evaluate Operational Capacity and Reputation

Assess vendor operational capabilities by examining production facilities, equipment, technology, workforce, and quality management systems. Conduct site visits to verify physical infrastructure and operational processes. Check vendor reputation through client references, market inquiries, and review of past performance records to ensure reliability and service quality standards.

Step 6: Prepare Due Diligence Report and Recommendations

Compile all findings into a comprehensive vendor due diligence nepal report documenting legal status, financial condition, operational capacity, compliance history, and identified risks. Provide clear recommendations regarding vendor suitability, risk mitigation measures, and contractual safeguards. Present the report to decision-makers with supporting documentation and suggested next steps for vendor engagement or rejection.

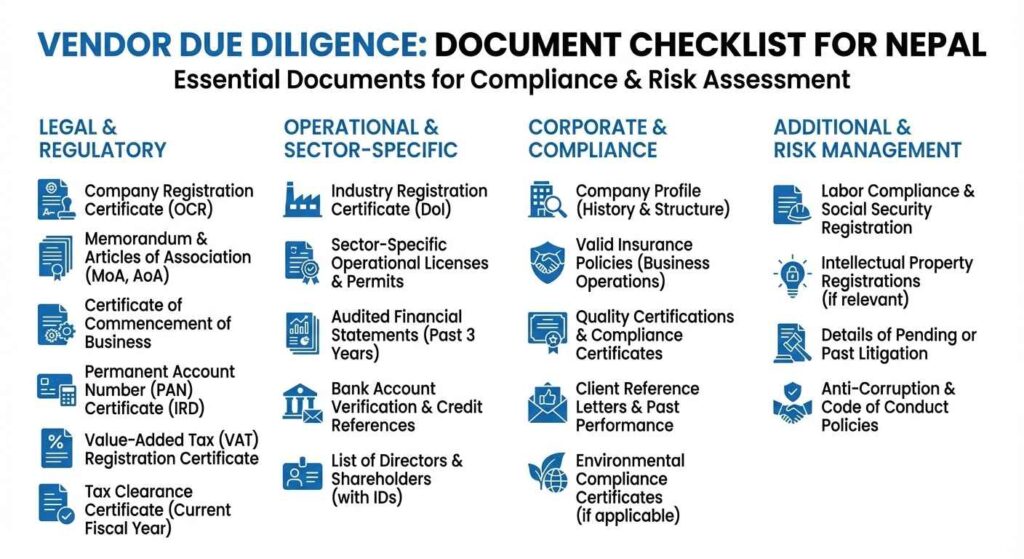

What Documents Are Required for Vendor Due Diligence?

Conducting comprehensive vendor due diligence in Nepal requires collection and verification of numerous documents that establish vendor legitimacy, compliance status, and operational capability. The following documents form the essential documentation package:

- Company registration certificate issued by Office of Company Registrar

- Memorandum of association and articles of association

- Certificate of commencement of business operations

- Permanent account number (PAN) certificate from Inland Revenue Department

- Value-added tax (VAT) registration certificate

- Tax clearance certificate for current fiscal year

- Industry registration certificate from Department of Industry

- Sector-specific operational licenses and permits

- Audited financial statements for past three years

- Bank account verification letters and credit references

- List of directors and shareholders with identification documents

- Company profile including business history and organizational structure

- Valid insurance policies covering business operations

- Quality certifications and compliance certificates

- Client reference letters and past performance records

- Environmental compliance certificates if applicable

- Labor compliance documents and social security registration

- Intellectual property registrations if relevant

- Details of pending or past litigation

- Anti-corruption and code of conduct policies

What Are the Key Verification Areas in Vendor Due Diligence?

Vendor due diligence in Nepal encompasses multiple verification areas that collectively provide a comprehensive assessment of supplier suitability and risk profile. Each verification area addresses specific aspects of vendor operations and compliance status.

| Verification Area | Key Elements | Information Sources | Risk Indicators |

|---|---|---|---|

| Legal Status | Company registration, ownership structure, directorship, legal standing | Office of Company Registrar, Department of Industry | Unregistered operations, frequent ownership changes, director disqualifications |

| Tax Compliance | PAN registration, VAT registration, tax filing status, outstanding liabilities | Inland Revenue Department, tax clearance certificates | Tax defaults, non-filing, pending assessments |

| Financial Health | Profitability, liquidity, debt levels, cash flow, credit history | Audited financial statements, bank references, credit bureaus | Losses, negative cash flow, high debt ratios |

| Operational Capacity | Infrastructure, equipment, workforce, production capacity, quality systems | Site visits, operational licenses, client references | Inadequate facilities, outdated equipment, insufficient workforce |

| Regulatory Compliance | Sector licenses, environmental permits, labor compliance, safety standards | Regulatory authorities, compliance certificates | License violations, environmental breaches, labor disputes |

| Reputation | Market standing, client satisfaction, past performance, business ethics | Client references, market inquiries, media reports | Negative reviews, contract disputes, ethical violations |

| Legal Disputes | Pending litigation, arbitration cases, regulatory proceedings | Court records, arbitration centers, regulatory bodies | Multiple lawsuits, significant claims, regulatory sanctions |

| Related Party Transactions | Conflicts of interest, related party dealings, beneficial ownership | Ownership disclosures, transaction records | Hidden relationships, undisclosed conflicts |

How Long Does Vendor Due Diligence Take in Nepal?

The duration of vendor due diligence nepal processes varies significantly based on investigation scope, vendor complexity, and information accessibility.

Timeline factors affecting due diligence duration include:

- Basic verification (1-2 weeks) – Simple checks of company registration, tax status, and basic documentation for small vendors with straightforward operations

- Standard due diligence (3-4 weeks) – Comprehensive investigation including legal verification, financial analysis, operational assessment, and reference checks for medium-sized vendors

- Extensive due diligence (6-8 weeks) – Detailed investigation involving multiple verification sources, site visits, third-party reports, and complex financial analysis for large or high-risk vendors

- Document collection time – Depends on vendor cooperation and responsiveness in providing requested documentation

- Government verification delays – Processing times at Office of Company Registrar, Inland Revenue Department, and other regulatory bodies may extend timelines

- Site visit scheduling – Coordination of facility inspections and management interviews requires advance planning

- Third-party report preparation – Credit reports, background checks, and specialized investigations add additional time

- Report compilation and review – Final documentation, analysis, and internal review processes require adequate time allocation

What Are the Costs of Vendor Due Diligence in Nepal?

The costs associated with conducting vendor due diligence in Nepal vary based on investigation scope, vendor complexity, and whether businesses use internal resources or engage external service providers.

| Cost Component | Basic Due Diligence (NPR 35,000) | Advanced Due Diligence (NPR 75,000) | Extended Due Diligence (NPR 1,25,000) | Description |

|---|---|---|---|---|

| Document Verification | Included | Included | Included | Certified copies from Office of Company Registrar, tax clearance certificates, and statutory documents |

| Credit & Financial Snapshot | Limited review | Detailed review | Comprehensive review | Credit bureau check and preliminary or full financial background verification |

| Site Visit & Operational Check | Not included | Limited (local) | Included (detailed) | Physical verification of office, facility, or operational presence |

| Legal Review & Compliance Check | Basic | Detailed | Extensive | Review of legal standing, contracts, licenses, and compliance status |

| Financial Analysis | Basic ratios | Detailed ratios | Full financial assessment | Analysis of financial statements, cash flow, debt, and risk indicators |

| Reputation & Background Check | Basic reference check | Enhanced checks | In-depth investigation | Market reputation, client references, media screening, and ethics review |

| Translation & Language Support | Not included | Included (limited) | Included (full) | Translation of documents where required |

| Due Diligence Report | Summary report | Detailed report | Comprehensive report | Structured report with findings, risk grading, and observations |

| Final Package Cost | NPR 35,000 | NPR 75,000 | NPR 1,25,000 | Fixed consolidated pricing per due diligence level |

What Are Post-Due Diligence Requirements?

After completing vendor due diligence in Nepal, businesses must implement ongoing monitoring and compliance verification procedures to maintain supply chain integrity and manage vendor relationships effectively.

Essential post-due diligence requirements include:

- Contract documentation – Formalize vendor relationships through written agreements incorporating due diligence findings and risk mitigation provisions

- Periodic compliance verification – Conduct annual or biannual reviews of vendor tax compliance, license renewals, and regulatory standing

- Financial monitoring – Review updated financial statements annually to track vendor financial health and identify emerging risks

- Performance evaluation – Assess vendor delivery performance, quality standards, and service levels against contractual commitments

- Relationship management – Maintain regular communication channels with vendors to address issues and ensure alignment

- Risk reassessment – Update risk profiles based on changing business conditions, market developments, or vendor circumstances

- Documentation updates – Maintain current files with renewed licenses, updated financial statements, and compliance certificates

- Audit rights exercise – Conduct periodic audits as permitted under vendor agreements to verify ongoing compliance

- Termination procedures – Establish clear processes for vendor relationship termination if performance or compliance issues arise

- Record retention – Maintain due diligence documentation for minimum seven years as required under various Nepalese laws

What Types of Vendor Due Diligence Exist?

Different types of vendor due diligence in Nepal address specific business needs, risk profiles, and transaction contexts. Organizations select appropriate due diligence approaches based on vendor importance, transaction value, and risk exposure.

| Due Diligence Type | Scope | Duration | Typical Use Cases |

|---|---|---|---|

| Basic Due Diligence | Company registration verification, tax status check, basic financial review | 1–2 weeks | Low-value transactions, non-critical suppliers, routine purchases |

| Standard Due Diligence | Comprehensive legal, financial, and operational assessment | 3–4 weeks | Medium-value contracts, regular suppliers, standard procurement |

| Enhanced Due Diligence | Detailed investigation including site visits, third-party reports, extensive verification | 6–8 weeks | High-value contracts, strategic suppliers, critical services |

| Financial Due Diligence | In-depth financial analysis, credit assessment, payment capacity evaluation | 2–3 weeks | Large financial commitments, credit extension, long-term contracts |

| Legal Due Diligence | Detailed legal compliance review, litigation search, regulatory verification | 2–4 weeks | Complex contracts, regulated industries, high legal risk |

| Operational Due Diligence | Facility inspection, capacity assessment, quality system evaluation | 2–3 weeks | Manufacturing suppliers, technical services, production contracts |

| Reputational Due Diligence | Background checks, reference verification, market inquiry | 1–2 weeks | Brand-sensitive relationships, public-facing services |

| Ongoing Due Diligence | Continuous monitoring, periodic reviews, compliance tracking | Continuous | Existing vendor relationships, long-term partnerships |

| Total Due Diligence Time Period | Consolidated due diligence for standard cases | Up to 2 weeks | Basic to limited-scope due diligence engagements |

What Benefits Does Vendor Due Diligence Provide?

Conducting thorough vendor due diligence in Nepal delivers substantial benefits that protect business interests, enhance operational efficiency, and support sustainable growth through reliable supply chain partnerships.

Key benefits of vendor due diligence nepal processes include:

- Risk mitigation – Identifies potential legal, financial, operational, and reputational risks before entering vendor relationships

- Compliance assurance – Verifies vendor adherence to tax laws, labor regulations, environmental standards, and industry-specific requirements

- Financial protection – Prevents losses from vendor defaults, bankruptcies, or inability to fulfill contractual obligations

- Quality assurance – Confirms vendor capability to meet quality standards, delivery schedules, and performance expectations

- Legal safeguards – Reduces exposure to litigation, regulatory penalties, and contractual disputes through proper vendor vetting

- Reputation protection – Avoids association with vendors involved in unethical practices, corruption, or regulatory violations

- Negotiation leverage – Provides factual basis for contract terms, pricing discussions, and risk allocation provisions

- Operational continuity – Ensures supply chain stability through selection of reliable, financially stable vendors

- Cost efficiency – Prevents expensive mistakes, contract failures, and emergency vendor replacements

- Strategic decision-making – Supports informed vendor selection based on objective assessment rather than assumptions

- Regulatory compliance – Demonstrates due care in vendor selection for regulatory reporting and audit purposes

- Competitive advantage – Builds superior supply chain through partnerships with verified, capable vendors

FAQs

Should I do Vendor Due Diligence in Nepal?

Vendor due diligence verifies supplier legitimacy, financial stability, legal compliance, and operational capacity before establishing commercial relationships. This process identifies risks, ensures regulatory adherence, and protects businesses from financial losses, legal liabilities, and reputational damage through systematic vendor assessment and verification procedures.

How much does vendor due diligence cost in Nepal?

Vendor due diligence nepal costs range from NPR 50,000 to NPR 1.5 Lakhs,000 depending on investigation scope and vendor complexity. Basic verification costs NPR 35,000, standard due diligence costs NPR 75,000, and comprehensive investigations cost NPR 1.25 Lakhs or more for complex cases.

What Documents are Required for Vendor Due Diligence?

1. Company registration certificate

2. Tax registration and clearance certificates

3. Audited financial statements

4. Operational licenses and permits

5. Bank references and credit reports

How long does the due diligence process take?

Basic vendor due diligence requires one to two weeks for simple verification. Standard comprehensive due diligence takes three to four weeks. Extensive investigations for high-risk or complex vendors require six to eight weeks depending on information accessibility and verification requirements.

Where can I verify company registration in Nepal?

Visit the Office of Company Registrar located in Tripureshwor, Kathmandu, or access their online portal at https://www.ocr.gov.np. The office maintains comprehensive records of registered companies, annual filings, directorship details, and compliance status for verification purposes during vendor due diligence nepal investigations.

What Law conducts Vendor Due Diligence in Nepal?

Companies Act 2063, Contract Act 2056, Public Procurement Act 2063, Income Tax Act 2058, and VAT Act 2052 establish legal frameworks. Industrial Enterprises Act 2076, Labor Act 2074, and sector-specific regulations also govern vendor relationships and compliance obligations.

Can I conduct due diligence without vendor?

Limited due diligence is possible through public records at Office of Company Registrar, Inland Revenue Department, and court registries. However, comprehensive assessment requires vendor cooperation for financial statements, operational licenses, client references, and facility access. Non-cooperation itself indicates potential risks.

Who Provides Due Diligence Service in Nepal?

Axion Partners offer expertise in legal verification, financial analysis, regulatory compliance assessment, and risk evaluation. They access specialized databases, maintain government relationships, understand Nepalese business practices, and deliver comprehensive reports efficiently, ensuring thorough vendor due diligence nepal investigations.

Axion Partners stands as Nepal’s leading provider of vendor due diligence services, offering comprehensive investigation, verification, and risk assessment solutions. With extensive experience in Nepalese commercial law, regulatory compliance, and business practices, we deliver thorough vendor due diligence nepal services that protect your business interests and support informed decision-making. Our team of legal experts, financial analysts, and investigation specialists provides end-to-end due diligence solutions tailored to your specific requirements, ensuring complete vendor verification and risk mitigation. Contact us today for professional vendor due diligence services that safeguard your business relationships and supply chain integrity.