1 Introduction: Nepal’s Evolving Investment Landscape

Foreign Investment Compliance in Nepal has emerged as a strategic investment destination in South Asia, offering unique opportunities for foreign investors seeking access to growing markets between India and China. The country’s progressive regulatory reforms and strategic location advantages have positioned it as an increasingly attractive hub for foreign direct investment (FDI). According to recent data from Nepal Rastra Bank, the country recorded a net foreign direct investment of Rs 8.40 billion in FY 2023-24, reflecting a 36.1% increase from the previous fiscal year. This growth trajectory demonstrates Nepal’s commitment to creating an investment-friendly environment while maintaining necessary regulatory safeguards.

The Foreign Investment and Technology Transfer Act (FITTA) 2019 serves as the cornerstone legislation governing foreign investments in Nepal, replacing earlier frameworks and modernizing the country’s approach to international capital inflows. This comprehensive legislation, implemented alongside the Foreign Investment and Technology Transfer Regulations (FITTR) 2021, establishes a transparent regulatory structure for foreign investors while protecting national interests. For potential investors, understanding Nepal’s compliance requirements is essential for successful market entry and sustainable operations in this emerging economy.

2 Legal Framework Governing Foreign Investment

Nepal’s foreign investment regime is governed by a comprehensive legal framework designed to balance investment promotion with regulatory oversight. The primary legislation includes:

Table: Key Legal Frameworks for Foreign Investment in Nepal

| Legislation | Year Enacted | Primary Purpose | Key Provisions for Foreign Investors |

|---|---|---|---|

| Foreign Investment and Technology Transfer Act (FITTA) | 2019 | Main regulatory framework for FDI | Minimum capital requirements, investment permissibility, repatriation procedures |

| Foreign Investment and Technology Transfer Regulations (FITTR) | 2021 | Implementation guidelines for FITTA | Detailed procedures, documentation requirements, royalty limits |

| Industrial Enterprises Act (IEA) | 2020 | Industrial development regulation | Industry classification, registration requirements, incentives |

| Companies Act | 2006 | Corporate governance | Company incorporation, board formation, compliance requirements |

| Public Private Partnership and Investment Act (PPPIA) | 2019 | Infrastructure investment promotion | PPP projects, investment facilitation |

The Foreign Investment and Technology Transfer Act (FITTA) 2019 represents the most significant legislative reform in Nepal’s investment landscape, establishing a streamlined approval process while introducing important safeguards. This Act defines the permissibility criteria for foreign investments, establishes minimum capital requirements, and outlines repatriation procedures for both capital and profits. The accompanying Foreign Investment and Technology Transfer Regulations (FITTR) 2021 provide detailed implementation guidelines, including specific documentation requirements, timelines for investment infusion, and limits on royalty payments for technology transfer agreements.

The Industrial Enterprises Act (IEA) 2020 complements FITTA by defining what constitutes an “industry” eligible for foreign investment and providing sector-specific incentives for priority industries. This Act is particularly important as it establishes the classification system for different scales of industries (micro, cottage, small, medium) and outlines the registration requirements that must be completed after obtaining foreign investment approval. Meanwhile, the Companies Act 2006 governs the corporate structure of foreign-invested entities, including requirements for board formation, share registration, and ongoing compliance obligations.

3 Investment Permissibility and Capital Requirements

3.1 Negative List of Industries

Nepal follows a restricted investment approach where foreign investment is permitted in all industries except those specifically excluded in the negative list maintained under FITTA. The two primary conditions for investment permissibility are:

- The industry must not be listed in the “Negative List of Industries for Foreign Investment” provided in the Schedule of the Foreign Investment Act

- The business must be classified as an “industry” under the Industrial Enterprise Act

The negative list includes the following restricted sectors:

- Primary agriculture: Related to animal husbandry, fish farming, beekeeping, fruits, vegetables, oilseeds, pulses, dairy business (except agricultural technology and mechanization that produce and export at least seventy-five percent of their output)

- Cottage and small industries: Traditional and small-scale operations

- Personal services: Hair cutting, tailoring, driving, etc.

- Sensitive industries: Manufacturing arms, ammunition, explosives, nuclear, biological, and chemical weapons

- Restricted services: Real estate business (excluding construction), retail business, internal courier service, local catering service, moneychanger, remittance service

- Tourism restrictions: Travel agency, guide services, trekking and mountaineering guide, rural tourism including homestay

- Media and communications: Mass communication media (newspaper, radio, television and online news) and motion picture of national language

- Professional services: Management, account, engineering, legal consultancy service and language training, music training, and computer training

- Consultancy services: Having foreign investment of more than fifty-one percent

- Transportation restrictions: Ride sharing exceeding seventy percent of foreign investment; aircraft operation with specific foreign investment limits

3.2 Minimum Capital Requirements

Nepal has established a minimum investment threshold to ensure that foreign investments represent a meaningful commitment to the Nepalese economy. The minimum investment required for obtaining foreign investment approval has been fixed at NPR 20 million (approximately USD 154,000). This requirement represents a 60% reduction from the previous threshold, making Nepal more accessible to smaller foreign investors.

Table: Investment Infusion Schedule Under FITTR 2021

| Investment Stage | Timeline | Percentage of Investment | Minimum Amount |

|---|---|---|---|

| Stage 1 | Within 1 year of investment approval | 25% (for NPR 20M), 15% (NPR 20M–250M), or 10% (NPR 250M–1B) | NPR 5 million |

| Stage 2 | Upon commencement of production or commercial transactions | Up to 70% of the investment | NPR 14 million |

| Stage 3 | Within 2 years of production or transaction commencement | Remaining 30% of the investment | NPR 6 million |

The full authorized capital must be injected within two years from the commencement of production or commercial transactions. This staged investment approach allows investors to manage their capital deployment while ensuring committed investment flows into Nepal.

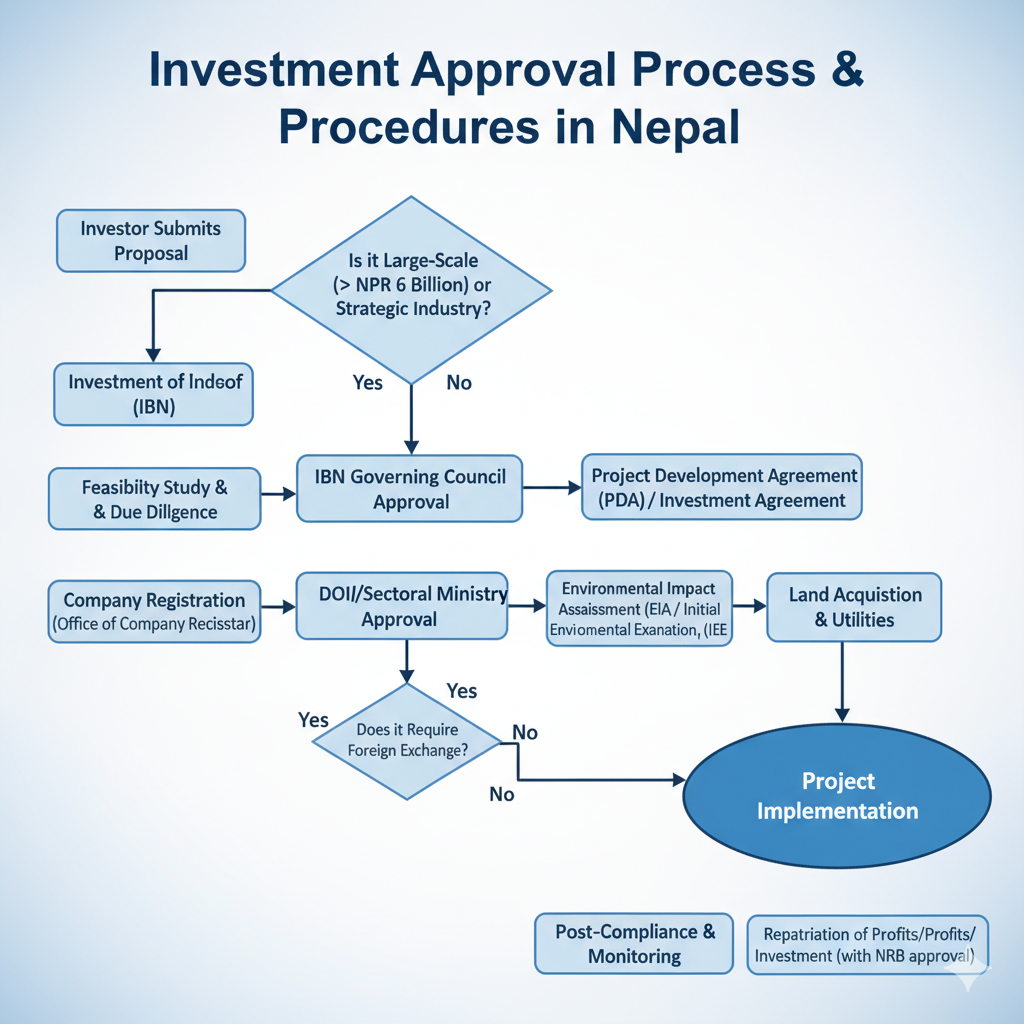

4 Investment Approval Process and Procedures

The foreign investment approval process in Nepal follows a structured sequence designed to ensure regulatory compliance while facilitating efficient market entry. The process typically takes 1-2 months for completion, depending on the complexity of the investment and the efficiency of document preparation.

4.1 Governing Authorities

The approval of foreign investments in Nepal is handled by two primary authorities, depending on the investment scale:

- Department of Industry (DOI): Approves foreign investments less than NPR 6 Billion

- Investment Board of Nepal (IBN): Approves foreign investments more than NPR 6 Billion or hydropower projects with capacity more than 200 MW

After obtaining approval from either DOI or IBN, Nepal Rastra Bank (NRB) provides the final approval to bring the foreign investment into Nepal. This multi-layered approval process ensures that investments align with national priorities while maintaining monetary stability.

4.2 Step-by-Step Approval Process

The complete investment approval process involves the following sequential steps:

- Obtaining Foreign Investment Approval from DOI or IBN

- Incorporation of Company at the Office of the Company Registrar

- Tax Registration at the Inland Revenue Office

- Business Registration at the Local Ward Office

- Registration of Industry at the DOI

- Obtaining Non-Blacklist Certificate from Credit Information Bureau

- Obtaining approval from NRB to infuse the Investment Amount

- Infusion of investment amount in local bank and obtaining Investment Certificate

- Recording of the infused investment amount at the NRB

4.3 Documentation Requirements

The application process requires comprehensive documentation to demonstrate the credibility and viability of the proposed investment:

- Project Report outlining the Project Background, market aspect, technical aspect, financial aspect, details of funds

- Bio-Data/Company Profile of the Foreign Investor

- Copy of Certificate of Registration and other Registration Documents (Memorandum of Association, Articles of Association, etc.) of the Foreign Investor

- Corporate Resolution of the Foreign Investor to Invest in Nepal

- Financial Credibility Certificate issued by any bank of the country of Residence/Registration of the Foreign Investor

- Documents stating the Source of Investment and Time Schedule of Investment

- Power of Attorney authorizing an Individual to complete the approval and Registration Process

- Passport of Foreign Investor (in case of individual) and passport of directors (in case of entities)

- Commitment Letter by Investor stating that Foreign Investor shall not repatriate investment till one year

- Joint Venture Agreement (not required for fully owned subsidiaries)

5 Post-Incorporation Compliance Requirements

Once a foreign-invested company is incorporated and receives initial approval, it must fulfill ongoing compliance obligations to maintain good standing under Nepalese law. These requirements are critical for ensuring regulatory compliance and avoiding potential penalties that could affect business operations.

5.1 Three-Month Compliance Mandates

The Companies Act 2006 mandates several critical compliance tasks that must be completed within three months of incorporation:

- Registration of Office Address: Under Section 184 of the Companies Act, private companies must register their office address with the Office of Company Registrar (OCR) within three months of incorporation, including contact details such as telephone, fax, and email

- Formation of Board of Directors: Section 86 mandates that private companies establish a Board of Directors in accordance with their Articles of Association (AOA) within three months of incorporation

- Appointment of Auditor: As per Section 110, every private company must appoint an auditor, with the OCR notified of the appointment within 15 days

5.2 Investment Injection and Recording

The injection of foreign investment must follow specific procedures to ensure proper recognition by Nepalese authorities:

- Investment must be remitted to Nepal in convertible foreign currency through authorized banking channels

- Funds must be transferred from the investor’s personal bank account (for individuals) or corporate bank account (for entities) to the FDI company’s local bank account

- The transfer must be executed via SWIFT payment with “Capital Investment” or similar remarks on purpose of injection

- Upon completion, the local bank issues an investment inflow certificate and a SWIFT transfer message

- The investment must be recorded with Nepal Rastra Bank (NRB) using the investment inflow certificate and approved share registry within 6 months of injection

💡 Critical Compliance Note: Unrecorded investments may complicate future repatriation of capital or profits. Ensure all investment injections are properly documented and recorded with NRB within the specified timeframe.

5.3 Ongoing Operational Compliance

Foreign-invested companies must adhere to several ongoing compliance requirements:

- Commencement of Operations: FDI companies must commence operations within one year of industry registration with the Department of Industry

- Social Security Fund Registration: Companies must enroll in the contribution-based social security scheme and register their employees

- Annual Compliance: Including annual general meetings, financial statement filing, and tax returns

Table: Post-Incorporation Compliance Checklist

| Compliance Task | Timeline | Responsible Authority | Key Requirements |

|---|---|---|---|

| Office Address Registration | Within 3 months | Office of Company Registrar | Physical address, contact details |

| Board Formation | Within 3 months | Company Management | As per Articles of Association |

| Auditor Appointment | Within 3 months | Office of Company Registrar | Qualified auditor |

| Investment Infusion | As per schedule | Nepal Rastra Bank | Through authorized banking channels |

| Share Registry | After investment | Office of Company Registrar | Investment inflow certificate |

| Business Visa | For foreign personnel | Department of Immigration | Recommendation from DOI |

| Social Security Fund | Within 6 months | Social Security Fund | Employee registration |

| Industry Operation | Within 1 year | Department of Industry | 70% capital injection |

6 Sector-Specific Considerations and Approvals

Beyond the general compliance requirements, foreign investors must navigate sector-specific regulations and obtain additional approvals from relevant regulatory authorities depending on their industry focus. These specialized requirements reflect Nepal’s approach to targeted regulation of sensitive sectors while facilitating investment in priority areas.

6.1 Priority Sectors for Foreign Investment

Nepal has identified several priority sectors that are particularly encouraged for foreign investment:

- Energy Sector: Especially hydropower projects (above 200 MW require IBN approval)

- Tourism and Hospitality: Designated as a priority sector for automatic approval

- Infrastructure Development: Including roads, bridges, and urban infrastructure

- Information Technology: Software development and IT-enabled services

- Manufacturing: Particularly export-oriented industries

- Agricultural Processing: Value addition to agricultural products

6.2 Sector-Specific Approvals

After incorporation, companies may need to obtain additional approvals or licenses from regulatory authorities depending upon the nature of the industry or business:

- Insurance Board: For insurance business

- Nepal Rastra Bank: For bank and financial institutions

- Department of Electricity Development: For electricity projects

- Department of Tourism: For tourism related business

- Department of Food Technology and Quality Control: For food industry

6.3 Technology Transfer Agreements

For investments involving technology transfer, specific regulations apply:

- Royalty Limits: FITTR prescribes limits on royalties and fees for technology transfer

- Registration Requirements: Technology transfer agreements must be registered with the Department of Industry

- Duration Restrictions: Technology transfer agreements typically cannot exceed 5 years without special approval

7 Practical Considerations and Recent Developments

7.1 Investment Climate and Trends

Nepal’s investment climate has shown both promise and challenges in recent years. While the country recorded a 36.1% increase in net FDI in FY 2023-24, it’s important to note that actual inflows have remained paltry compared to commitments. The country received FDI commitments totaling Rs. 64.96 billion in the last fiscal year 2024/25, but the conversion of these commitments into actual investments remains a challenge.

The capacity utilization of surveyed FDI enterprises in manufacturing stands at 47.5 percent, while the profitability of surveyed FDI enterprises remains at 10.7 percent in 2023/24. These statistics highlight the operational challenges that foreign investors may face in the Nepalese market.

7.2 Recent Regulatory Reforms

The Government of Nepal has implemented several significant reforms to improve the investment climate:

- Automatic Route Introduction: In October 2023, Nepal introduced an automatic route for foreign investment approvals up to $38 million, streamlining the process for smaller investments

- Minimum Capital Reduction: The minimum investment threshold was reduced by 60% to NPR 20 million (approx. $154,000), making Nepal more accessible to smaller investors

- Business Visa Reforms: In November 2022, Nepal tightened the business visa issuance system to prevent misuse while facilitating legitimate investment

7.3 Challenges and Risk Mitigation

Foreign investors in Nepal should be aware of several potential challenges:

- Repatriation Issues: Challenges in the repatriation of profits remain a concern for investors

- Currency Exchange Limitations: Controlled currency exchange facilities can create operational hurdles

- Bureaucratic Delays: Despite reforms, investors may still encounter administrative delays

- Corruption Concerns: Corruption remains a challenge in doing business

⚠️ Risk Mitigation Strategy: Investors should conduct thorough due diligence, engage local legal experts, and ensure full compliance with all regulatory requirements to mitigate potential risks in Nepal’s investment environment.

FAQs: Nepal Foreign Investment Compliance

What is the minimum capital requirement for foreign investment in Nepal?

The minimum investment required for foreign direct investment (FDI) in Nepal is NPR 20 million (approximately USD 154,000). This threshold was reduced by 60% to make Nepal more accessible to smaller foreign investors. This amount must be infused into the company’s local bank account through proper banking channels.

How long does the entire FDI approval and company registration process take in Nepal?

The complete process, from obtaining initial investment approval to final company registration and industry registration, typically takes between 1 to 2 months. The timeline can vary based on the complexity of the project, the completeness of your documentation, and the efficiency of the approving authorities (Department of Industry or Investment Board Nepal).

Can I repatriate profits and the original investment from Nepal?

Yes, repatriation of profits and the original investment is permitted under Nepal’s foreign investment law. However, you must first ensure your investment is properly recorded with Nepal Rastra Bank (NRB) using the investment inflow certificate. Additionally, investors are generally required to commit to not repatriating their principal investment for at least one year from the date of infusion.

Can I own 100% of a foreign company in Nepal, or is a local partner mandatory?

You can own 100% of a company in most industrial sectors. A local partner is not mandatory unless you are investing in a restricted industry. Foreign investment is permitted in any business classified as an “industry” under the Industrial Enterprises Act, 2020, as long as it is not on the “Negative List” of prohibited sectors for foreign investment.

What are the most critical post-incorporation compliance tasks for an FDI company?

The most critical post-incorporation tasks that must be completed include:

Registering the office address with the Office of Company Registrar within 3 months.

Appointing an auditor and notifying the Registrar within 15 days.

Infusing the investment amount as per the schedule approved by the authorities.

Recording the investment with Nepal Rastra Bank (NRB) within 6 months of infusion.

Commencing business operations within one year of industry registration.What are the biggest challenges foreign investors face in Nepal?

Foreign investors often cite several challenges, including navigating bureaucratic processes, potential delays in approvals, and difficulties with profit repatriation. While the government is working to streamline procedures, investors should conduct thorough due diligence and engage local legal experts to mitigate these risks and ensure compliance.

How can a foreign investor get a business visa to work in Nepal?

Foreign investors or their representatives can obtain a business visa to stay and conduct business in Nepal. The primary requirement is a recommendation letter from the Department of Industry (DOI) or the Investment Board Nepal (IBN) confirming the foreign investment. This letter, along with a bio-data and passport copy, is submitted to the Department of Immigration.

8 Conclusion and Strategic Recommendations

Nepal offers significant opportunities for foreign investors seeking access to South Asian markets, particularly in sectors such as hydropower, tourism, manufacturing, and information technology. The country’s strategic location between two large economies, combined with its natural resources and growing domestic market, creates a compelling investment proposition for those willing to navigate the regulatory landscape.

The regulatory framework governed primarily by FITTA 2019 and FITTR 2021 provides a structured approach to foreign investment while offering necessary protections for both investors and national interests. Recent reforms, including the reduction in minimum capital requirements and introduction of an automatic approval route for smaller investments, demonstrate Nepal’s commitment to creating a more investment-friendly environment.

For successful investment in Nepal, foreign investors should consider the following strategic recommendations:

- Thorough Due Diligence: Conduct comprehensive research on sector-specific requirements and market conditions

- Local Partnership: Consider engaging with local partners who understand the regulatory environment

- Professional Guidance: Engage qualified legal and financial professionals with expertise in Nepalese law

- Compliance Focus: Prioritize compliance with all regulatory requirements to avoid future complications

- Patience and Persistence: Recognize that bureaucratic processes may require time and persistence

As Nepal continues to develop its regulatory framework and economic infrastructure, foreign investors who approach the market with proper preparation and strategic patience are well-positioned to benefit from the country’s emerging opportunities. The government’s commitment to reform, combined with Nepal’s strategic advantages, suggests a positive trajectory for foreign investment in the coming years.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Investors should consult with qualified legal professionals familiar with Nepalese law before making any investment decisions. Regulations and requirements may change, and this article may not reflect the most current legal developments.

- Cost of Registering Education Consultancy in Nepal

- Cost of Registering Travel Agency With License in Nepal

- Cost of Registering Tour and Trek Business in Nepal

- Cost of Registering a Company in Nepal

- Cost of Registering Foreign Business in Nepal

- Cost of Registering a Foreigner Business in Nepal

- Cost of Business Visa in Nepal

- Cost of Student Visa in Nepal

- Cost of Trademark Registration in Nepal

- Cost of FDI Company Registration in Nepal

- Cost of Renewing a Company in Nepal

- Cost of Import Export License in Nepal

- Cost of Registering E-Commerce Business in Nepal

- Total Cost of Registering a New Business in Nepal

- Total Cost of Registering a Star Hotel in Nepal

- Total Cost of Registering Manpower in Nepal

- Total Cost of Registering Media in Nepal

- Total Cost of Obtaining NRN Citizenship in Nepal

- Cost of Obtaining Share Lagat in Nepal

- Total Cost of Registering NGO in Nepal

- Total Cost of IT Company Registration in Nepal

- Total Cost of Copyright Registration in Nepal

- Total Cost of Court Marriage in Nepal

- Total Cost of Divorce in Nepal

- Total Cost of Registering a Firm in Nepal

- Cost of Getting Monthly Legal Retainer in Nepal

- Visa Overstay in Nepal: Fines, Process, and Lawyer

- Tourism Visa Expiry: How to Stay Longer in Nepal

- How to Buy Property in Nepal as a Foreigner

- Lawyer for Franchising in Nepal

- Lawyer for Government Relations and Lobbying in Nepal

- OCR in Online Company Registration in Nepal

- Online Company Registration Process in Nepal Explained

- Company Registration in Nepal Using the OCR Portal

- Online Private Limited Company Registration in Nepal

- Incorporate a Company in Nepal Online With OCR Portal

- Can Foreigners Use Online Services to Register a Company in Nepal?

- Online Company Registration vs Traditional Process for Foreign Investors in Nepal

- NRN Online Company Registration in Nepal

- Private Limited Company Registration for NRNs in Nepal

- Foreign Company Registration in Nepal (FITTA 2019)

- Understanding Nepal’s Foreign Investment Laws

- Foreign Currency Law for Company Registration

- Visas and Work Permits for Foreign Directors in Nepal

- Repatriation of Profits From Nepal

- Why Global Companies Are Incorporating in Nepal

- Benefits of Incorporating in Nepal as a Foreigner

- Investing in Nepal: What to Register and Compliances

- Company Registration in Nepal for Non-Residents

- Foreign Company Incorporation in Nepal

- Checklist for Incorporating a Foreign Company in Nepal

- FAQ for Foreign Entrepreneurs Incorporating in Nepal

- Understanding Nepal’s Company Laws for Foreign Investors

- Registering a BPO Outsourcing Company in Nepal for Foreigners

- Why Foreign Companies Need a Local Partner in Nepal

- Can You Incorporate in Nepal Without a Local Partner?

- Industries for Foreign Company Incorporation in Nepal

- Registration for NGOs and INGOs in Nepal

- How to Open a Liaison or Branch Office in Nepal

- Representative Office vs Branch Office in Nepal

- Liaison Office Rules in Nepal 2026

- Foreign Direct Investment: What’s Allowed in Nepal

- Incorporating Foreign SaaS Business in Nepal

- Garment Manufacturing Registration Incentives in Nepal 2026

- Single Person Private Company Registration in Nepal

- Timeline for Private Company Registration in Nepal

- Name Reservation Rules for Private Companies in Nepal

- Private Company Registration Checklist in Nepal 2026

- Documents for Private Company Registration in Nepal 2026

- Requirements for Private Company Registration in Nepal 2026

- Registering a Startup Private Business in Nepal 2026

- Benefits of Registering a Private Company in Nepal

- How to Register an IT Company in Nepal

- Can Foreigners Register a Private Company in Nepal?

- Legal Process for Private Company Registration in Nepal

- Private Limited vs Public Limited: Laws and Differences in Nepal

- Private Company Registration Cost in Nepal

- Company Formation in Nepal: Requirements, Types, Compliance

- Cost of Company Formation in Nepal

- Company Formation Guide by Lawyer in Nepal

- How Long Does Company Formation Take in Nepal?

- How to Register a Cafe in Nepal

- Restaurant Registration in Nepal: A Legal Guide

- How to Register at Commerce in Nepal: Trade License

- How to Register Agricultural Business in Nepal

- Where to Submit a Company Registration Application in Nepal

- How to Open a Business in Kathmandu

- Cheque Bounce Lawyer in Nepal

- Liquor Shop Registration in Nepal

Table of Contents

- 1 1 Introduction: Nepal’s Evolving Investment Landscape

- 2 2 Legal Framework Governing Foreign Investment

- 3 3 Investment Permissibility and Capital Requirements

- 4 4 Investment Approval Process and Procedures

- 5 5 Post-Incorporation Compliance Requirements

- 6 6 Sector-Specific Considerations and Approvals

- 7 7 Practical Considerations and Recent Developments

- 7.1 7.1 Investment Climate and Trends

- 7.2 7.2 Recent Regulatory Reforms

- 7.3 7.3 Challenges and Risk Mitigation

- 7.4 FAQs: Nepal Foreign Investment Compliance

- 7.5 What is the minimum capital requirement for foreign investment in Nepal?

- 7.6 How long does the entire FDI approval and company registration process take in Nepal?

- 7.7 Can I repatriate profits and the original investment from Nepal?

- 7.8 Can I own 100% of a foreign company in Nepal, or is a local partner mandatory?

- 7.9 What are the most critical post-incorporation compliance tasks for an FDI company?

- 7.10 What are the biggest challenges foreign investors face in Nepal?

- 7.11 How can a foreign investor get a business visa to work in Nepal?