Table of Contents

- 1 Introduction to Investment Company Registration in Nepal

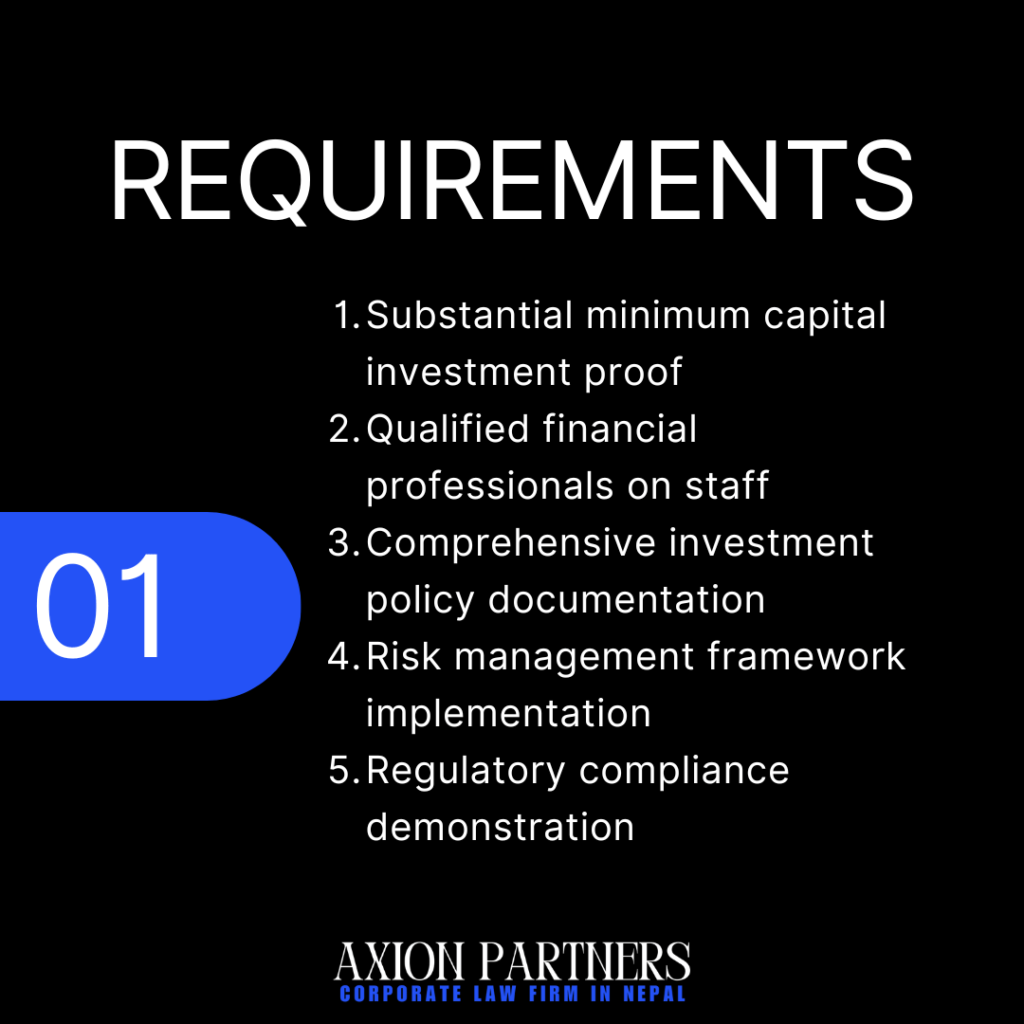

- 2 Legal Requirements for Investment Company Registration Process

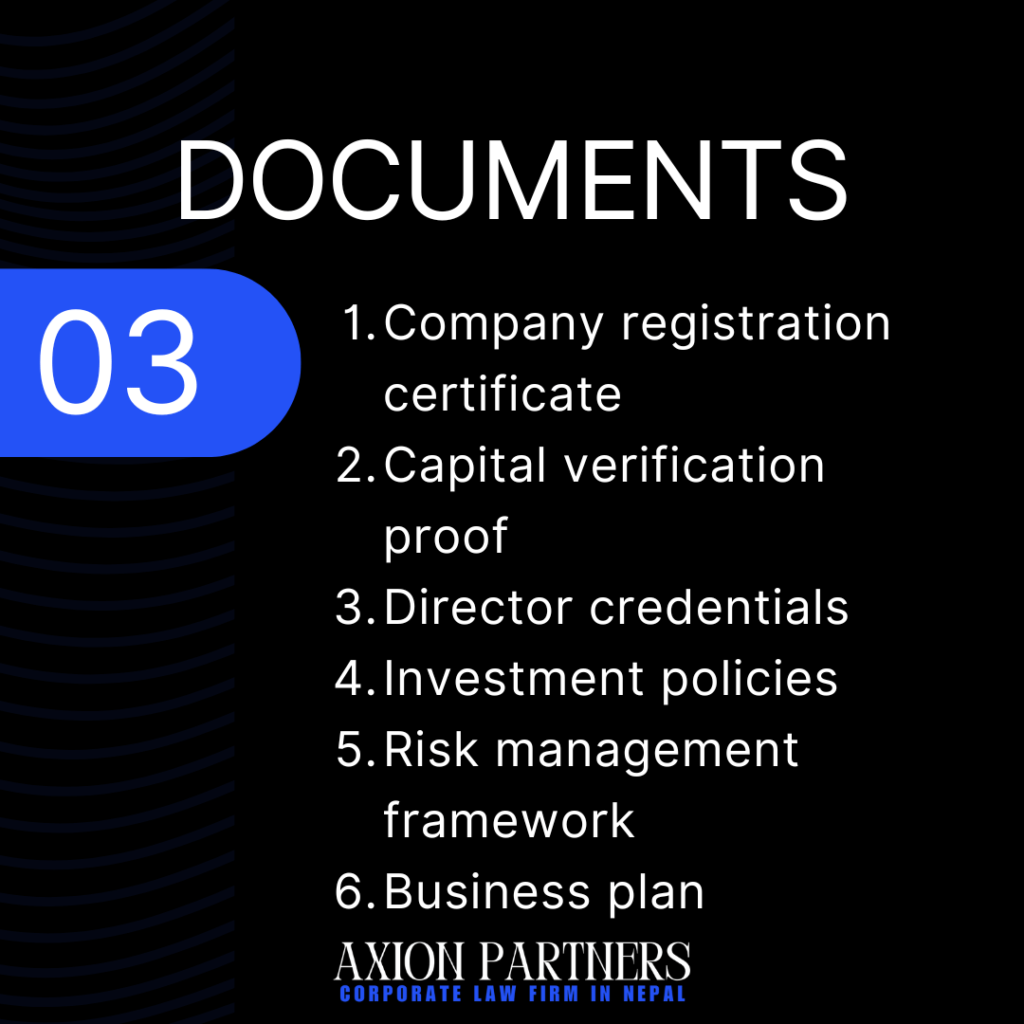

- 3 Essential Documents for Investment Company Registration Nepal

- 4 Step-by-Step Process for Investment Company Formation

- 5 Registration Fees and Costs for Investment Companies

- 6 Government Authorities Involved in Company Registration Process

- 7 Minimum Capital Requirements for Investment Company Nepal

- 8 Compliance Requirements After Investment Company Registration Process in Nepal

- 9 Tax Obligations for New Investment Companies Nepal

- 10 Foreign Investment Policies for Company Registration Nepal

- 11 Banking Requirements for Investment Company Operations Nepal

- 12 Shareholder Structure Requirements for Investment Companies Nepal

- 13 Wealth Creation and Capital Requirements in Nepal

- 14 Professional Services Required for Company Registration Nepal

- 15 Timeline Overview for Investment Company Registration Nepal

- 16 FDI and Private Equity Firms in Nepal

- 17 Post-Registration Compliance for Investment Companies Nepal

- 18 FAQs

- 18.1 What is the minimum capital requirement for an investment company?

- 18.2 How long does it take to register an investment company?

- 18.3 Can foreigners open an investment company in Nepal?

- 18.4 What are the main documents required for registration?

- 18.5 Do I need a local director for my investment company?

- 18.6 What are the annual compliance requirements?

- 18.7 How much does it cost to register an investment company?

- 19 Professional Conclusion by Axion Partners Law Firm

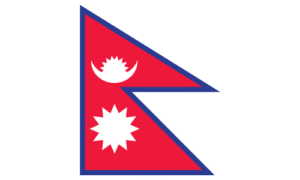

This article provides a clear, step by step guide on how to open an investment company in Nepal. We offer professional support throughout the investment company registration process in Nepal to ensure the process is smooth and hassle-free.

Introduction to Investment Company Registration in Nepal

Nepal’s growing economy offers strong opportunities for investors who want to start investment companies. The process of registering an investment company in Kathmandu, Nepal involves several legal steps and compliance requirements. This guide explains the registration process, legal rules, and key points that entrepreneurs and investors should consider before entering the Nepalese market, including foreign direct investment in Nepal.

Legal Requirements for Investment Company Registration Process

The investment company registration process in Nepal in 2026 requires following specific legal rules. The main laws that govern company formation in Nepal include:

- Companies Act, 2063 (2006)

- Foreign Investment and Technology Transfer Act, 2075 (2019)

- Securities Act, 2063 (2007)

- Investment Board Act, 2068 (2011)

These laws explain the rules for company formation, foreign investment, and securities management. Following these regulations is essential for the successful registration and operation of an investment company, especially for foreign direct investment in Nepal.

Essential Documents for Investment Company Registration Nepal

To register an investment company in Nepal, the following documents are usually required as part of the investment company registration process in Nepal:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Company Registration Application Form

- Citizenship certificates or passports of promoters/directors

- No Objection Letters from relevant authorities

- Bank statements showing capital deposit

- Lease agreement for company office space

- Tax clearance certificates (for existing businesses)

- Board resolution for company formation

- Specimen signatures of directors

Making sure all documents are correctly prepared and properly verified is essential for a smooth and successful investment company in Nepal registration process.

Step-by-Step Process for Investment Company Formation

The process of forming an investment company registration process in Nepal 2026 involves several steps under the company formation in Nepal process:

- Name Reservation: Submit proposed company names to the Company Registrar’s Office for approval.

- Document Preparation: Draft and notarize the MOA, AOA, and other required documents.

- Capital Deposit: Open a bank account and deposit the minimum required capital.

- Application Submission: Submit the complete application package to the Company Registrar’s Office.

- Document Verification: The Registrar’s Office reviews and verifies all submitted documents.

- Registration Certificate Issuance: Upon approval, the company registration certificate is issued.

Registration Fees and Costs for Investment Companies

The costs associated with registering an investment company in Nepal include various government and professional fees based on the minimum capital requirement for business registration in Nepal.

- Name reservation fee

- Registration fee (based on authorized capital)

- Stamp duty on MOA and AOA

- Legal and professional service fees

- Notary charges

- Bank account opening fees

The exact costs may differ based on the company’s capital structure and specific needs, including the minimum capital requirement for private equity in Nepal.

Government Authorities Involved in Company Registration Process

Several government bodies are involved in the registration and regulation of investment companies in Nepal:

- Office of Company Registrar (OCR)

- Securities Board of Nepal (SEBON)

- Nepal Rastra Bank (NRB)

- Department of Industry (DOI)

- Investment Board Nepal (IBN)

- Inland Revenue Department (IRD)

Each authority has a clear role in the registration, licensing, and ongoing regulation of a Nepal investment company.

Minimum Capital Requirements for Investment Company Nepal

The minimum capital requirement for an investment company in Kathmandu, Nepal depends on the type of investment activities, including the minimum capital requirement for private limited companies in Nepal.

- Non-Banking Financial Institutions

- Merchant Banking

- Mutual Fund

- Portfolio Management

These requirements may change over time, so it is best to consult the relevant authorities for the latest updates in the investment company registration process in Nepal 2026.

Compliance Requirements After Investment Company Registration Process in Nepal

After registration, an investment company in Nepal must follow ongoing compliance requirements to operate legally and avoid penalties.

- Annual filings with the Company Registrar’s Office

- Regular reporting to SEBON

- Compliance with NRB regulations for financial transactions

- Adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) norms

- Regular tax filings and payments

- Maintenance of proper books of accounts and financial records

Failure to meet these rules may lead to penalties or even cancellation of the license of an investment company Nepal.

Tax Obligations for New Investment Companies Nepal

Investment companies in Nepal are subject to various tax obligations:

- Corporate Income Tax: 25% for financial institutions

- Value Added Tax (VAT): 13% on applicable services

- Tax Deducted at Source (TDS) on various transactions

- Capital Gains Tax on investment profits

- Dividend Tax on distributed profits

Companies must register with the Inland Revenue Department and obtain a Permanent Account Number (PAN) for tax purposes.

Foreign Investment Policies for Company Registration Nepal

Nepal’s foreign investment policies have become more liberal in recent years:

- 100% foreign ownership allowed in many sectors

- Repatriation of profits and dividends permitted

- Equal treatment of foreign and domestic investors

- Protection against nationalization and expropriation

- Double Taxation Avoidance Agreements with several countries

However, some sectors have limits on foreign investment, and approval from the Department of Industry may be required when foreign direct investment in Nepal exceeds specific limits.

Banking Requirements for Investment Company Operations Nepal

Investment companies must follow specific banking rules and procedures as part of operating an investment company Nepal.

- Maintain separate accounts for client funds and company funds

- Adhere to NRB guidelines on fund management and transfers

- Implement robust internal control systems for financial transactions

- Regular reporting of large or suspicious transactions

- Compliance with foreign exchange regulations for international transactions

Establishing strong relationships with reputable banks is crucial for smooth operations.

Read More:

- Legal Guide to Selling and Purchasing a Company in Nepal

- Legal Compliance and Advisor in Nepal

- Large Industry Registration Process in Nepal

Shareholder Structure Requirements for Investment Companies Nepal

The shareholder structure of investment companies in Nepal must follow specific legal guidelines to ensure compliance and smooth operations:

- Minimum number of promoters/shareholders: 7 for public companies, 1 for private companies

- Maximum number of shareholders: Unlimited for public companies, 101 for private companies

- Restrictions on share transfers for private companies

- Compliance with SEBON regulations for public offerings

- Disclosure of substantial shareholdings and changes in ownership

Planning the shareholder structure carefully helps an Nepal investment company stay compliant while maintaining flexibility for future growth.

Wealth Creation and Capital Requirements in Nepal

Wealth creation in Nepal for Nepali citizens can be achieved through entrepreneurship, investment, and legally registered businesses. Before starting a company, it is important to understand the minimum capital for private limited company in Nepal as these factors directly affect business planning and compliance.

Professional Services Required for Company Registration Nepal

Engaging professional services can significantly streamline the registration process:

- Legal Consultants: For document preparation and regulatory compliance

- Chartered Accountants: For financial planning and tax advisory

- Company Secretaries: For ongoing compliance and corporate governance

- Investment Advisors: For strategic planning and market analysis

- Banking Partners: For financial services and fund management

Choosing reputable professionals with experience in the investment sector is crucial for success.

Timeline Overview for Investment Company Registration Nepal

The timeline for registering an investment company in Nepal can vary:

- Name reservation: 1-3 days

- Document preparation: 1-2 weeks

- Capital deposit and bank account opening: 1-2 weeks

- Application submission and processing: 2-4 weeks

- License issuance from SEBON: 4-8 weeks

- Additional permits and licenses: 2-4 weeks

The entire process usually takes 2–4 months, depending on how complex the company structure is and how quickly documents are prepared during the investment company registration process in Nepal.

FDI and Private Equity Firms in Nepal

FDI in Nepal plays a key role in economic growth by attracting foreign investors and encouraging capital inflow across various sectors. Through private equity firms in Nepal, both local and foreign investors can support startups, expanding businesses, and long-term projects. These investment models also offer legal ways to build wealth in Nepal by following government regulations and approved investment routes. For entrepreneurs and investors, understanding legal ways to create wealth in Nepal through structured investments helps reduce risk while ensuring sustainable returns.

A zero investment business in Nepal allows individuals to start earning through skills, services, or digital platforms without major upfront costs. Similarly, a no initial investment business in Nepal focuses on using knowledge and experience rather than capital, making it ideal for beginners and young entrepreneurs.

Post-Registration Compliance for Investment Companies Nepal

After registration, investment companies in Nepal must follow ongoing compliance requirements to operate legally and smoothly:

- Annual General Meetings (AGMs) and filing of annual returns

- Regular board meetings and maintenance of minutes

- Timely submission of financial statements and audit reports

- Compliance with SEBON regulations on investment activities

- Regular updates to KYC information for clients

- Continuous professional development for key personnel

Establishing robust compliance systems from the outset is essential for long-term success and regulatory adherence.

FAQs

What is the minimum capital requirement for an investment company?

The minimum capital requirement varies by business type and has no fixed amount. For exact guidance on the minimum capital requirement for business registration in Nepal, contact Axion Partners for professional assistance.

How long does it take to register an investment company?

The investment company registration process in Nepal usually takes 2–4 months, depending on how quickly documents are prepared and approvals are received.

Can foreigners open an investment company in Nepal?

Yes, foreigners can open investment companies in Nepal, and many sectors allow 100% foreign ownership under foreign direct investment in Nepal, subject to specific laws and approvals.

What are the main documents required for registration?

The main documents required include the Memorandum of Association, Articles of Association, registration application form, identification of promoters or directors, and proof of capital deposit as part of the investment company registration process in Nepal.

Do I need a local director for my investment company?

Although it is not mandatory, having a local director can make operations and regulatory compliance easier for an investment company in Nepal.

What are the annual compliance requirements?

Annual compliance requirements include filing annual returns, holding AGMs, submitting audited financial statements, and following SEBON and NRB rules for an investment company in Nepal.

How much does it cost to register an investment company?

Registration costs vary based on the company structure and services used. They usually include name reservation, registration fees, stamp duty, and professional charges, along with the minimum capital requirement for business registration in Nepal.

Professional Conclusion by Axion Partners Law Firm

Registering an investment company registration process in Nepal is a structured legal process that offers strong opportunities for both local and foreign investors. This guide explains the complete investment company registration process in Nepal, including legal requirements, capital considerations, compliance obligations, and foreign investment rules. With the right planning and professional support, businesses can benefit from FDI in Nepal and long-term wealth creation in Nepal for Nepali citizens. Axion Partners provides end-to-end legal and advisory services to help investors register and operate investment companies in Nepal smoothly, legally, and efficiently.