Establishing a company in Nepal requires navigating complex legal frameworks and compliance requirements. Professional legal advisors for setting up company in Nepal play a crucial role in guiding entrepreneurs through the company registration process, ensuring adherence to Nepalese laws and regulations. With the right legal counsel, both domestic and foreign investors can efficiently establish their business presence in Nepal while avoiding potential legal pitfalls.

There are several legal advisors for setting up company in Nepal who provide tailored guidance for foreign and domestic entrepreneurs.

Engaging experienced legal advisors for setting up company in Nepal is crucial for ensuring compliance with local regulations and facilitating a smooth registration process.

Legal advisors for setting up company in Nepal help navigate the complexities of the legal landscape to ensure compliance with the Companies Act.

Choosing the right legal advisors for setting up company in Nepal can significantly impact the success of your business venture.

Understanding Company Registration in Nepal

Company registration in Nepal is primarily governed by the Companies Act, 2063 (2006), which provides the legal framework for incorporating and operating businesses. The Department of Industry (DOI) and Company Registrar’s Office (CRO) are the key regulatory bodies overseeing company formation. Legal advisors specializing in company registration possess comprehensive knowledge of these regulations and can guide clients through the intricate registration procedures.

The Companies Act categorizes companies into private limited companies, public limited companies, and non-profit companies, each with distinct registration requirements and operational guidelines. Professional legal advisors help entrepreneurs determine the most suitable company structure based on their business objectives, investment capacity, and operational plans.

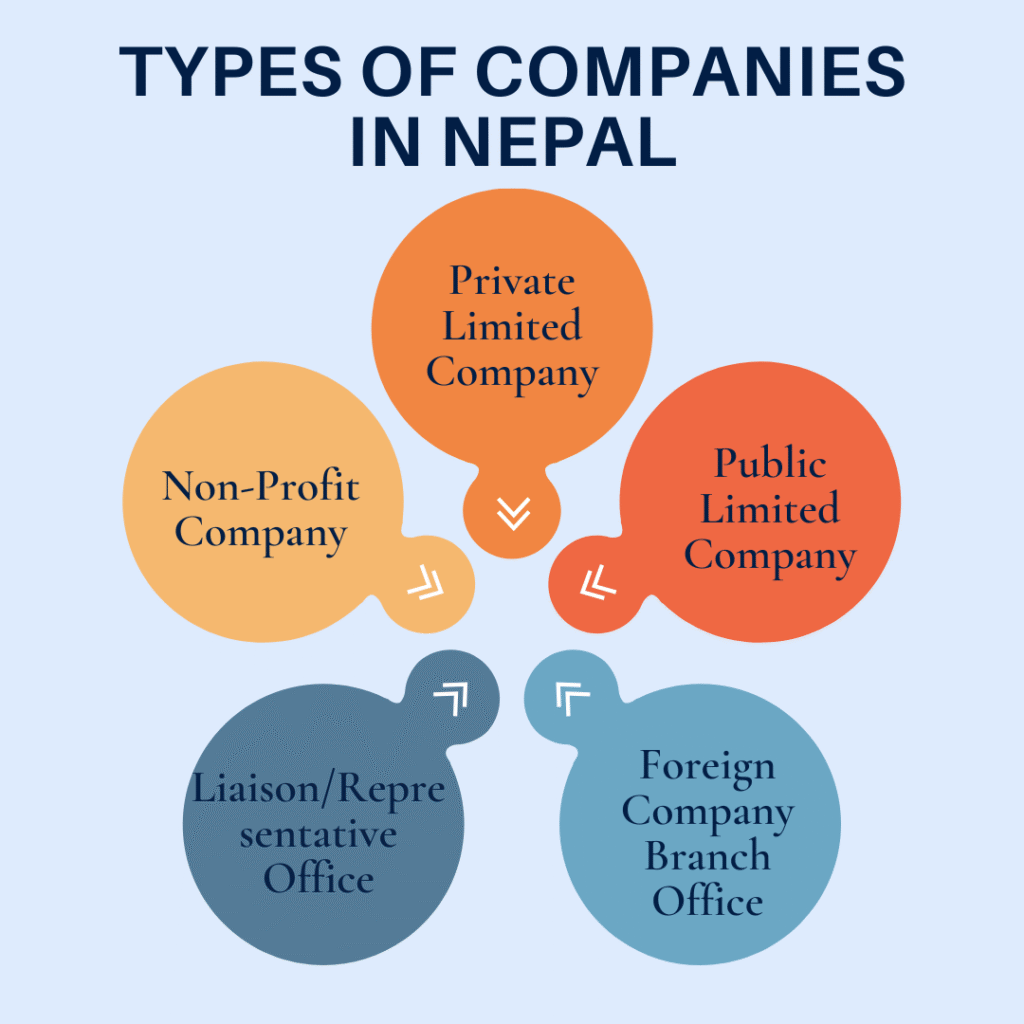

Types of Companies in Nepal

Nepal’s Companies Act, 2063 (2006) recognizes several types of business entities that investors can establish:

- Private Limited Company: Requires a minimum of 1 and maximum of 101 shareholders, with a minimum paid-up capital of NPR 100,000. This is the most common structure for small to medium-sized businesses.

- Public Limited Company: Requires a minimum of 7 shareholders with no maximum limit, and minimum paid-up capital of NPR 10,000,000. These companies can offer shares to the public.

- Foreign Company Branch Office: Foreign companies can establish branch offices in Nepal after obtaining approval from the Department of Industry.

- Liaison/Representative Office: Foreign entities can set up representative offices for non-commercial activities like market research.

- Non-Profit Company: Established for charitable, social, scientific, religious, or educational purposes without profit distribution to members.

Legal advisors assess business objectives to recommend the most appropriate structure while ensuring compliance with sector-specific regulations.

Role of Legal Advisors in Company Formation

It is essential to seek legal advisors for setting up company in Nepal who are familiar with the nuances of the industry.

Professional legal advisors provide comprehensive support throughout the company formation process:

Legal advisors for setting up company in Nepal assist in drafting the necessary documents required for incorporation.

Legal advisors for setting up company in Nepal play a vital role in ensuring that the business structure aligns with local laws.

- Pre-incorporation consultation to determine optimal business structure

- Preparation and verification of all registration documents

- Drafting of company constitution documents including Articles of Association and Memorandum of Association

- Representation before government authorities

- Guidance on sector-specific licenses and permits

- Compliance with foreign investment regulations for international clients

- Tax registration and compliance planning

According to Section 4 of the Companies Act, 2063 (2006), companies must submit properly drafted incorporation documents to the Company Registrar’s Office. Legal advisors ensure these documents meet all statutory requirements, reducing the risk of rejection and delays in the registration process.

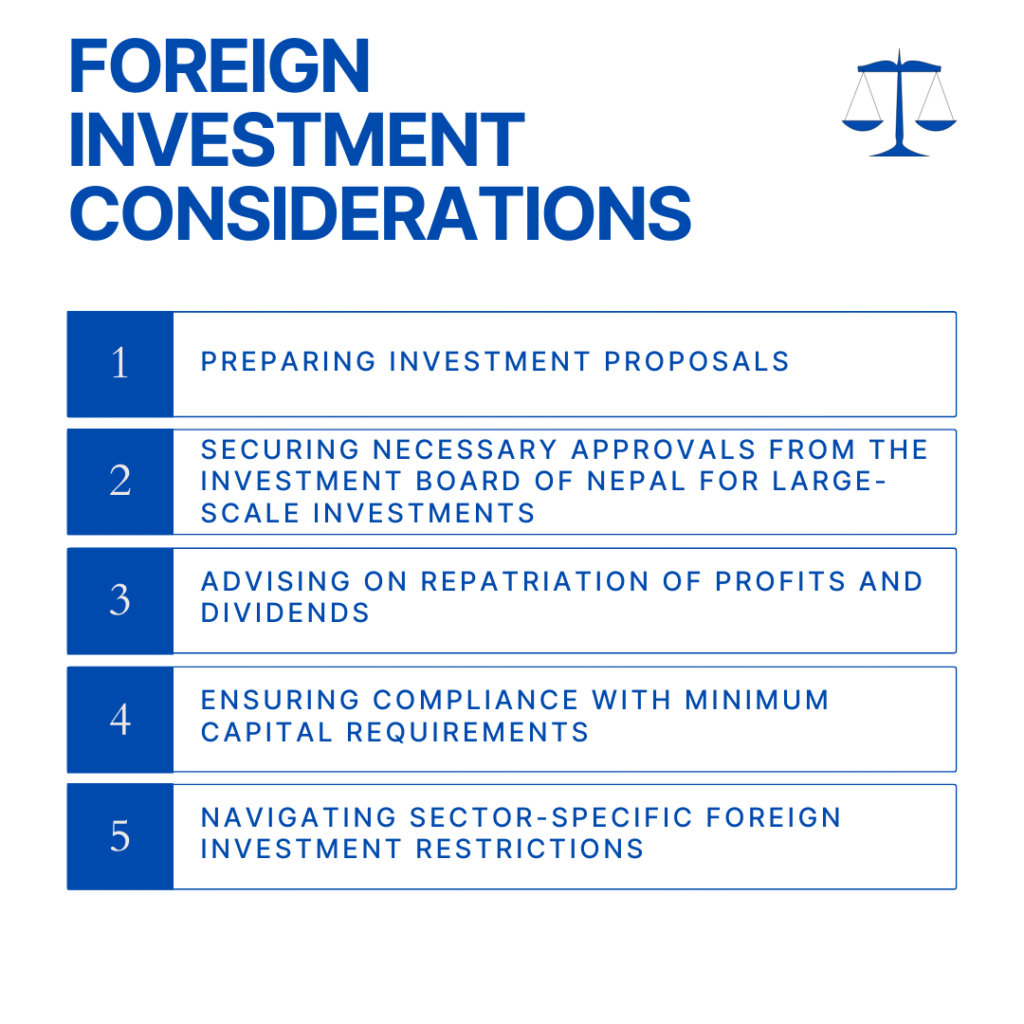

Foreign Investment Considerations

For foreign investors, legal advisors provide specialized guidance on Nepal’s Foreign Investment and Technology Transfer Act, 2075 (2019). This legislation governs foreign investment in Nepal, outlining sectors open to foreign investment and those with restrictions.

Engaging legal advisors for setting up company in Nepal is essential to navigate the complexities of registration and compliance.

Foreign investors must obtain approval from the Department of Industry before establishing a company in Nepal. Legal advisors facilitate this process by:

Using legal advisors for setting up company in Nepal can help prevent costly mistakes during the registration process.

Accessing legal advisors for setting up company in Nepal provides entrepreneurs with peace of mind regarding compliance issues.

Investors should not underestimate the importance of legal advisors for setting up company in Nepal when planning their business strategy.

- Preparing investment proposals

- Securing necessary approvals from the Investment Board of Nepal for large-scale investments

- Advising on repatriation of profits and dividends

- Ensuring compliance with minimum capital requirements

- Navigating sector-specific foreign investment restrictions

For efficient company incorporation, it is advisable to hire legal advisors for setting up company in Nepal who understand local market dynamics.

Legal advisors for setting up company in Nepal provide not only legal assistance but also strategic business insights.

The Industrial Enterprises Act, 2076 (2020) further regulates industrial enterprises and provides various incentives for priority sectors. Experienced legal advisors help foreign investors leverage these incentives while ensuring full compliance with Nepalese laws.

Professional legal advisors for setting up company in Nepal can help navigate sector-specific laws and regulations.

Legal advisors for setting up company in Nepal are essential for understanding the implications of foreign investments.

Documentation and Compliance Requirements

Proper documentation is essential for successful company registration in Nepal. Legal advisors assist in preparing and submitting all required documents to relevant authorities.

Essential Documents for Company Registration

The following documents are required for company registration in Nepal:

- Application for company registration

- Memorandum of Association detailing company objectives and activities

- Articles of Association outlining internal governance rules

- Resolution appointing directors and company officers

- Proof of registered office address

- Identity documents of promoters/shareholders

- Bank certificate confirming capital deposit

- Tax registration documents

- Sector-specific permits and licenses

- For foreign investors: approval from Department of Industry

- For certain sectors: environmental clearances and specialized permits

Section 5 of the Companies Act, 2063 (2006) mandates that these documents be prepared in the prescribed format and submitted to the Company Registrar’s Office. Legal advisors ensure all documents comply with legal requirements, minimizing registration delays.

Ongoing Compliance Obligations

Company registration is just the beginning of legal compliance requirements. Legal advisors also guide businesses on ongoing obligations:

- Annual filings with the Company Registrar’s Office

- Tax compliance and filings with the Inland Revenue Department

- Labor law compliance including social security contributions

- Industry-specific regulatory requirements

- Foreign exchange regulations for international transactions

- Environmental compliance where applicable

- Corporate governance requirements

Under Section 80 of the Companies Act, companies must hold annual general meetings and file annual returns. Failure to comply with these requirements can result in penalties or even deregistration. Professional legal advisors help businesses maintain good standing with regulatory authorities.

Specialized Legal Advisory Services

Beyond basic company registration, legal advisors offer specialized services tailored to specific business needs and sectors.

Industry-Specific Regulatory Guidance

Different industries in Nepal are subject to specific regulatory frameworks:

- Banking and Financial Institutions: Regulated by Nepal Rastra Bank under the Banks and Financial Institutions Act, 2073 (2017)

- Tourism: Governed by the Tourism Act, 2035 (1978) with specific licensing requirements

- Information Technology: Subject to the Electronic Transactions Act, 2063 (2008)

- Manufacturing: Regulated under the Industrial Enterprises Act, 2076 (2020)

- Hydropower: Special provisions under the Electricity Act, 2049 (1992)

Legal advisors with industry expertise provide targeted guidance on these sector-specific regulations, ensuring businesses obtain all necessary permits and licenses while structuring operations to comply with industry standards.

Intellectual Property Protection

Protecting intellectual property is crucial for businesses entering the Nepalese market. Legal advisors assist with:

- Trademark registration under the Patent, Design and Trademark Act, 2022 (1965)

- Copyright protection under the Copyright Act, 2059 (2002)

- Patent and design registrations

- Trade secret protection strategies

- Licensing agreements and technology transfers

The Department of Industry’s Patent, Design and Trademark Office handles intellectual property registrations in Nepal. Experienced legal advisors navigate this process efficiently, securing valuable intellectual property rights for their clients.

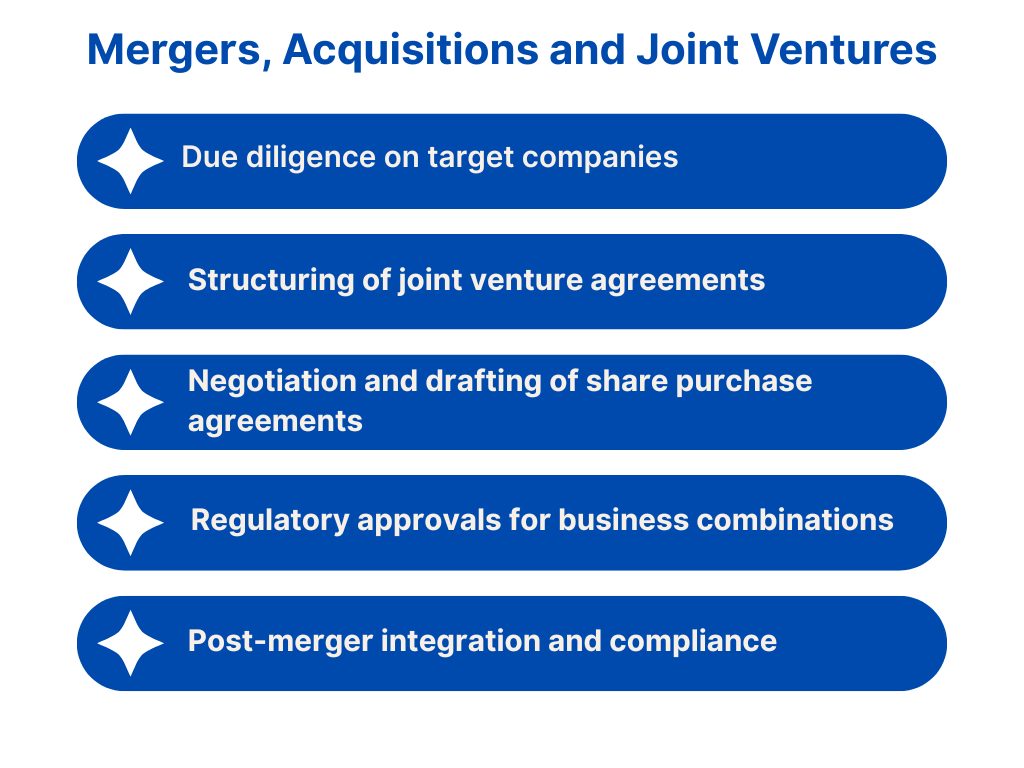

Mergers, Acquisitions and Joint Ventures

For businesses looking to enter the Nepalese market through acquisitions or joint ventures, legal advisors provide specialized services:

- Due diligence on target companies

- Structuring of joint venture agreements

- Negotiation and drafting of share purchase agreements

- Regulatory approvals for business combinations

- Post-merger integration and compliance

Section 177 of the Companies Act governs mergers and acquisitions in Nepal, requiring specific procedures and approvals. Legal advisors ensure these transactions comply with all statutory requirements while protecting their clients’ interests.

Selecting the Right Legal Advisor

Choosing the right legal advisor is critical for successful company establishment in Nepal. Several factors should be considered when selecting legal counsel.

Key Qualifications to Consider

When evaluating legal advisors for company registration in Nepal, consider these qualifications:

- Expertise in Nepalese corporate law and company registration procedures

- Experience with foreign investment regulations for international clients

- Industry-specific knowledge relevant to your business

- Track record of successful company registrations

- Relationships with regulatory authorities

- Multilingual capabilities for international clients

- Understanding of cross-border tax implications

Reputable legal advisors like Axion Partners have consulted over 100 foreign investors on establishing businesses in Nepal, demonstrating their expertise in navigating the complex regulatory landscape.

Cost Structures and Service Packages

Legal advisory services for company registration typically follow these fee structures:

- Fixed fee packages for standard company registration

- Hourly rates for complex consultations

- Retainer arrangements for ongoing legal support

- Success fees for certain regulatory approvals

- Combined approaches based on service complexity

Transparent fee structures with clearly defined deliverables help businesses budget appropriately for legal services. Established firms like Axion Partners offer customized service packages tailored to specific business needs and budgets.

FAQs About Legal Advisors for Company Registration

What services do legal advisors provide for company registration in Nepal?

Legal advisors provide comprehensive services including pre-incorporation consultation, document preparation, representation before government authorities, tax registration, and compliance planning. They guide clients through the entire registration process, from selecting the appropriate business structure to obtaining all necessary permits and licenses as required by the Companies Act, 2063 (2006).

How long does company registration take with professional legal assistance?

With professional legal assistance, private limited company registration typically takes 2-4 weeks from document submission to receipt of registration certificate. This timeline assumes all documents are properly prepared and no unusual complications arise. Foreign investment approvals may extend this timeline by an additional 2-3 weeks as per the Foreign Investment and Technology Transfer Act, 2075 (2019).

What are the costs associated with hiring legal advisors for company setup?

Legal advisory fees for company registration generally range from NPR 50,000 to NPR 150,000 for standard private limited companies, depending on complexity and services required. Additional costs include government registration fees (approximately NPR 9,500), stamp duties, and sector-specific license fees. Foreign investment registrations typically incur higher advisory fees due to additional regulatory requirements.

Can foreign investors establish 100% foreign-owned companies in Nepal?

Yes, foreign investors can establish 100% foreign-owned companies in most sectors in Nepal under the Foreign Investment and Technology Transfer Act, 2075 (2019). However, certain sectors have ownership restrictions or are prohibited for foreign investment, including rural tourism, personal service businesses, and some agricultural activities. Legal advisors can provide sector-specific guidance on foreign investment limitations.

What ongoing legal support do businesses need after registration?

After registration, businesses require ongoing legal support for annual compliance filings, tax matters, labor law compliance, contract reviews, and regulatory updates. Section 80 of the Companies Act mandates annual returns and financial statement filings. Professional advisors also assist with business expansions, structural changes, and addressing any regulatory issues that may arise during operations.

How do legal advisors help with tax registration and compliance?

Legal advisors assist with obtaining Permanent Account Number (PAN) registration from the Inland Revenue Department, VAT registration if applicable, and establishing proper tax compliance systems. They advise on tax planning strategies, help prepare required tax filings, and ensure compliance with the Income Tax Act, 2058 (2002) and Value Added Tax Act, 2052 (1996), minimizing tax-related risks and penalties.

What makes firms like Axion Partners effective for foreign investors?

Firms like Axion Partners are particularly effective for foreign investors due to their extensive experience with international clients, understanding of cross-border legal issues, multilingual capabilities, and established relationships with regulatory authorities. Having consulted over 100 foreign investors on business establishment in Nepal, they offer practical insights into navigating cultural and regulatory challenges specific to international investors.

RELATED LINKS

- Registration of Tours Company in Nepal

- Legal and Advisory Services for FDI Companies in Nepal

- Legal Advisor for Companies in Nepal

- Legal Advisor for Public Companies in Nepal

- Procedure of FDI via Venture Capital Funds in Nepal

- Legal Advisors for Setting Up Company in Nepal

- FDI Through Share Purchase in Nepal (Foreigner Buying Company)

- Project Proposal Change/Amendment for Industry in Nepal

- Project Proposal Approval Process in Nepal

- Foreign Recruitment Company Registration in Nepal

- Registration of Travel Company in Nepal

- Registration of Adventurous Tourism Company in Nepal

- Registration of Brand in Nepal – A Lawyer’s Guide

- Registration of Foreign Franchise in Nepal

- 1-Star Hotel Registration in Nepal

- 2-Star Hotel Registration in Nepal

- 3-Star Hotel Registration in Nepal

- 4-Star Hotel Registration in Nepal

- 5-Star Hotel Registration in Nepal

- 5-Star Deluxe Hotel Registration in Nepal

- Documents Required for Industry Registration in Nepal

- Registration of Large Industry in Nepal

- Department of Industry (DoI) Approval in Nepal

- Cost of Registering an Industry in Nepal

- Cost of Registering a Company in Nepal

- Cost and Fees for FDI Approval in Nepal

- Cost and Fees for Foreign Branch Registration in Nepal

- Cost and Fees for Foreign Company Registration in Nepal

- Cost and Fees for Trademark Registration in Nepal

- How to Open a Commercial Bank in Nepal

- Obtaining Nepal Rastra Bank (NRB) Approval in Nepal

- Opening a Micro Financial Institution in Nepal

Read More

- Documents Required for Industry Registration in Nepal

- Registration of Large Industry in Nepal

- Department of Industry (DOI) Approval in Nepal

- Cost of Registering an Industry in Nepal

- Cost of Registering a Company in Nepal

What is the process of company registration in Nepal?

Company registration involves name approval, drafting of Memorandum and Articles of Association, submission to the Company Registrar’s Office, capital deposit verification, and obtaining registration and tax certificates.

How long does it take to register a company in Nepal?

With complete documents, a private limited company can be registered within 7–15 working days. If foreign investment approval is involved, the process may take 4–6 weeks.

What types of companies can be registered in Nepal?

The Companies Act allows private limited companies, public limited companies, foreign branch/liaison offices, and non-profit companies, depending on business objectives and capital requirements.

What documents are required for company registration in Nepal?

Key documents include the application form, Memorandum & Articles of Association, identity proof of promoters, proof of office address, bank deposit certificate, and sector-specific licenses (if applicable).

Can foreign investors establish 100% foreign-owned companies in Nepal?

Yes, in most sectors under the Foreign Investment and Technology Transfer Act, 2019. However, certain industries have restrictions or prohibitions.

What ongoing compliance is required after company registration?

Companies must file annual returns, maintain proper accounts, pay taxes, hold annual general meetings, comply with labor and social security laws, and meet industry-specific obligations.

Table of Contents

- 1 Understanding Company Registration in Nepal

- 2 Documentation and Compliance Requirements

- 3 Specialized Legal Advisory Services

- 4 Selecting the Right Legal Advisor

- 5 FAQs About Legal Advisors for Company Registration

- 5.1 What services do legal advisors provide for company registration in Nepal?

- 5.2 How long does company registration take with professional legal assistance?

- 5.3 What are the costs associated with hiring legal advisors for company setup?

- 5.4 Can foreign investors establish 100% foreign-owned companies in Nepal?

- 5.5 What ongoing legal support do businesses need after registration?

- 5.6 How do legal advisors help with tax registration and compliance?

- 5.7 What makes firms like Axion Partners effective for foreign investors?

- 5.8 Read More

- 5.9 What is the process of company registration in Nepal?

- 5.10 How long does it take to register a company in Nepal?

- 5.11 What types of companies can be registered in Nepal?

- 5.12 What documents are required for company registration in Nepal?

- 5.13 Can foreign investors establish 100% foreign-owned companies in Nepal?

- 5.14 What ongoing compliance is required after company registration?