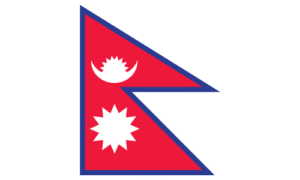

Introduction

A liaison office in Nepal operates as a representative entity for foreign companies seeking to establish market presence without conducting direct business operations. Unlike branch offices or subsidiaries, liaison offices function exclusively for coordination, research, and promotional activities. The registration process requires ministerial recommendation from the relevant ministry rather than direct Department of Industry (DOI) approval, distinguishing it from other business entity registrations. This comprehensive guide outlines the complete registration procedure, tax obligations, compliance requirements, labor law provisions, available incentives, associated costs, and timeline for establishing a liaison office in Nepal.

Liaison Office Registration Process

Definition and Scope

A liaison office represents a foreign company in Nepal for liaison, coordination, and promotional purposes only. It cannot engage in direct business transactions, generate revenue, or conduct commercial activities. The entity serves as a communication bridge between the parent company and Nepalese stakeholders, including government agencies, potential partners, and clients. Registration requires compliance with the Foreign Investment and Technology Transfer Act, 2075 B.S., and associated regulations.

Step-by-Step Registration Procedure

Step 1: Obtain Ministerial Recommendation

The first requirement involves securing a recommendation letter from the relevant ministry overseeing the liaison office’s sector. The applicant must submit a formal application to the appropriate ministry with supporting documentation, including the parent company’s registration certificate, business profile, and proposed activities in Nepal. The ministry evaluates the application based on strategic relevance and national interest. Upon approval, the ministry issues a recommendation letter addressed to the Department of Industry.

Step 2: Prepare Required Documentation

Applicants must compile comprehensive documentation before submitting to the DOI. Required documents include the ministerial recommendation letter, certificate of incorporation of the parent company, board resolution authorizing Nepal operations, memorandum and articles of association, audited financial statements of the parent company for the preceding two years, and detailed project proposal outlining liaison office activities.

Step 3: Submit Application to Department of Industry

The applicant submits the complete application package to the DOI’s Foreign Investment Division. The application must include the ministerial recommendation, all supporting documents, and the prescribed application form. The DOI conducts preliminary verification to ensure all documentation is complete and compliant with regulatory requirements.

Step 4: DOI Verification and Approval

The DOI examines the application against the Foreign Investment and Technology Transfer Act, 2075 B.S., and related regulations. This process typically involves cross-verification with the recommending ministry and assessment of the proposed activities’ alignment with national policies. Upon satisfactory verification, the DOI issues a registration certificate.

Step 5: Obtain Tax Identification Number (TIN)

Following DOI approval, the liaison office must register with the Inland Revenue Department (IRD) to obtain a Tax Identification Number. This registration requires submission of the DOI certificate, office lease agreement, and completed IRD registration forms.

Step 6: Register with Social Security Fund

The liaison office must register with the Social Security Fund (SSF) if it employs Nepalese staff. Registration involves submitting employee details, salary information, and organizational structure documentation to the SSF office.

Step 7: Establish Bank Account

The liaison office opens a corporate bank account with a licensed commercial bank in Nepal. Required documents include the DOI registration certificate, TIN, office lease agreement, and board resolution authorizing bank account opening.

| Registration Step | Responsible Authority | Timeline | Key Requirement |

|---|---|---|---|

| Ministerial Recommendation | Relevant Ministry | 15–30 days | Sector-specific ministry approval |

| DOI Application Submission | Department of Industry | 1 day | Complete documentation package |

| DOI Verification | Department of Industry | 7–14 days | Regulatory compliance check |

| DOI Certificate Issuance | Department of Industry | 1 day | Official registration approval |

| TIN Registration | Inland Revenue Department | 3–5 days | IRD form submission |

| SSF Registration | Social Security Fund | 3–5 days | Employee documentation |

| Bank Account Opening | Commercial Bank | 5–7 days | Bank verification process |

Tax Obligations and Compliance

Corporate Income Tax

Liaison offices in Nepal are subject to corporate income tax under the Income Tax Act, 2075 B.S. The standard corporate tax rate is 25 percent on taxable income. However, liaison offices typically generate minimal taxable income since they cannot conduct direct business operations. Tax liability arises from administrative expenses, staff salaries, and office maintenance costs. The liaison office must file annual income tax returns with the IRD by the prescribed deadline, typically within four months following the fiscal year ending on Ashadh 32 (mid-July).

Value Added Tax (VAT)

Liaison offices must register for VAT if their annual turnover exceeds the prescribed threshold of NPR 5 million. Since liaison offices do not generate direct revenue from business operations, VAT registration requirements depend on whether they incur taxable supplies. If the office purchases goods or services subject to VAT, it must register and file monthly or quarterly VAT returns. The standard VAT rate is 13 percent, with certain supplies exempted or subject to reduced rates.

Tax Filing and Reporting Requirements

The liaison office must maintain comprehensive financial records documenting all income and expenses. Annual financial statements must be prepared in accordance with Nepal Accounting Standards (NAS) and submitted to the IRD. The office must file Form 1 (Annual Income Tax Return) and supporting schedules detailing income sources, deductible expenses, and tax calculations. Failure to file returns or maintain records results in penalties ranging from NPR 10,000 to NPR 100,000 under the Income Tax Act.

Withholding Tax Obligations

The liaison office must withhold taxes on payments made to contractors, consultants, and service providers as prescribed under the Income Tax Act. Withholding tax rates vary based on the nature of payment, typically ranging from 5 to 20 percent. The office must deposit withheld taxes with the IRD within the prescribed timeframe and file quarterly withholding tax statements.

Compliance Requirements

Annual Compliance Obligations

The liaison office must submit annual compliance reports to the DOI confirming continued adherence to registration conditions and regulatory requirements. These reports include financial statements, employee information, and documentation of liaison activities conducted during the fiscal year. Non-submission results in administrative penalties and potential suspension of registration.

Audit Requirements

Liaison offices with annual expenditure exceeding NPR 10 million must undergo annual statutory audit by a licensed chartered accountant. The audit report must be submitted to the IRD and DOI within the prescribed timeframe. Auditors verify financial statement accuracy, compliance with tax laws, and proper maintenance of accounting records.

Office Location and Infrastructure

The liaison office must maintain a physical office location in Nepal with adequate infrastructure for conducting liaison activities. The office address must be registered with the DOI and communicated to relevant government agencies. Changes to office location require prior notification to the DOI and IRD.

Reporting of Foreign Remittances

If the liaison office receives funds from its parent company, it must report these remittances to the Nepal Rastra Bank (NRB) and maintain documentation of foreign exchange transactions. Remittances must comply with NRB guidelines on foreign investment and capital flows.

Labor Laws and Employment Regulations

Employment of Nepalese Staff

Liaison offices may employ Nepalese citizens for administrative and support functions. Employment must comply with the Labor Act, 2074 B.S., which establishes minimum standards for working conditions, wages, and employee rights. The liaison office must register all employees with the Social Security Fund and maintain employment contracts specifying terms and conditions.

Minimum Wage Requirements

Employers must pay minimum wages as prescribed by the government. The minimum wage varies by sector and location, with the current national minimum wage set at NPR 13,450 per month for general workers. Liaison offices must ensure all employees receive at least the prescribed minimum wage and maintain wage payment records.

Social Security Contributions

The liaison office must contribute to the Social Security Fund on behalf of all employees. The employer contribution rate is 11 percent of employee salary, while employees contribute 8 percent. These contributions fund health insurance, disability benefits, and retirement provisions under the Social Security Act, 2074 B.S.

Working Hours and Leave Provisions

The Labor Act prescribes maximum working hours of 8 hours per day or 48 hours per week. Employees are entitled to weekly rest days, typically one day per week, and annual leave of 15 days for the first year of employment, increasing with tenure. The liaison office must maintain attendance records and comply with leave provisions.

Health and Safety Standards

The liaison office must maintain safe working conditions complying with occupational health and safety standards. This includes adequate ventilation, lighting, sanitation facilities, and emergency procedures. The office must conduct regular safety inspections and maintain incident records.

| Labor Law Requirement | Provision | Compliance Deadline |

|---|---|---|

| Employee Registration | Social Security Fund enrollment | Within 15 days of employment |

| Minimum Wage Payment | NPR 13,450 per month (current rate) | Monthly salary payment |

| Social Security Contribution | 11% employer + 8% employee | Monthly remittance |

| Annual Leave | 15 days minimum per year | As per employment contract |

| Health and Safety | Workplace safety standards | Ongoing compliance |

Available Incentives and Benefits

Tax Incentives

The Government of Nepal offers tax incentives for foreign investment in priority sectors. Liaison offices in sectors designated as priority areas may qualify for reduced corporate income tax rates or tax holidays for specified periods. These incentives apply to sectors including information technology, renewable energy, tourism, and manufacturing. Eligibility requires formal application to the DOI with supporting documentation demonstrating sector alignment.

Customs Duty Exemptions

Liaison offices may import office equipment and machinery with customs duty exemptions under specific conditions. The imported items must be essential for liaison office operations and not available domestically. Exemptions require prior approval from the DOI and customs authority, with documentation of the equipment’s necessity and specifications.

Simplified Compliance Procedures

Liaison offices benefit from streamlined compliance procedures compared to commercial entities. Annual reporting requirements are less stringent, and financial documentation standards are simplified. This reduces administrative burden while maintaining regulatory oversight.

Sector-Specific Incentives

Liaison offices in information technology, renewable energy, and tourism sectors may access sector-specific incentives including technology transfer support, research and development grants, and market development assistance. These incentives aim to attract foreign expertise and facilitate technology transfer to Nepal.

Cost Analysis and Financial Requirements

Registration Fees

The DOI charges a registration fee of NPR 5,000 for liaison office registration. This one-time fee covers the application processing and certificate issuance. Additional fees apply for document verification and certification if required.

Office Establishment Costs

Establishing a liaison office requires securing office space, typically costing NPR 20,000 to NPR 50,000 monthly depending on location and size. Office setup includes furniture, equipment, and utilities, with initial investment ranging from NPR 500,000 to NPR 2,000,000. Internet and communication services cost approximately NPR 5,000 to NPR 15,000 monthly.

Staffing Costs

Liaison offices typically employ 2-5 staff members including office manager, administrative assistant, and support personnel. Monthly staffing costs range from NPR 150,000 to NPR 400,000 depending on employee qualifications and experience. Social Security Fund contributions add approximately 11 percent to salary costs.

Professional Service Fees

Engaging chartered accountants for audit and tax compliance costs NPR 50,000 to NPR 150,000 annually. Legal consultation for regulatory compliance and contract review costs NPR 30,000 to NPR 100,000 annually. These professional services ensure regulatory adherence and minimize compliance risks.

Annual Operating Costs

Total annual operating costs for a liaison office typically range from NPR 2,500,000 to NPR 5,000,000, including office rent, utilities, staffing, professional services, and miscellaneous expenses. Actual costs vary based on office size, location, and staffing requirements.

| Cost Category | Estimated Amount (NPR) | Frequency |

|---|---|---|

| Registration Fee | 5,000 | One-time |

| Monthly Office Rent | 20,000 – 50,000 | Monthly |

| Initial Office Setup | 500,000 – 2,000,000 | One-time |

| Monthly Staffing (2–5 staff) | 150,000 – 400,000 | Monthly |

| Annual Professional Services | 50,000 – 150,000 | Annual |

| Utilities and Communications | 5,000 – 15,000 | Monthly |

Timeline for Registration

The complete liaison office registration process typically requires 45 to 75 days from initial application to final approval and operational status. The timeline varies based on ministerial processing speed, documentation completeness, and DOI verification procedures.

Detailed Timeline Breakdown:

- Days 1-15: Ministerial recommendation application and processing

- Days 16-17: DOI application submission and preliminary verification

- Days 18-31: DOI detailed verification and regulatory compliance assessment

- Days 32-33: DOI certificate issuance

- Days 34-37: Tax Identification Number registration with IRD

- Days 38-42: Social Security Fund registration

- Days 43-49: Bank account opening and activation

- Days 50-75: Operational setup and commencement of liaison activities

Expedited processing may reduce the timeline to 30-45 days if all documentation is complete and no additional verification is required. Delays occur when documentation is incomplete, ministerial processing extends beyond standard timeframes, or DOI requires additional clarification.

Why Choose Axion Partners

Axion Partners stands as the No. 1 service provider for liaison office registration in Nepal, offering comprehensive expertise and streamlined processes. The firm maintains established relationships with relevant ministries, the Department of Industry, and regulatory authorities, facilitating faster approvals and efficient processing.

Comprehensive Service Delivery

Axion Partners provides end-to-end liaison office registration services, including ministerial recommendation coordination, DOI application preparation, tax registration, and compliance setup. The firm’s experienced team handles all documentation, regulatory submissions, and follow-up communications, ensuring timely completion of all registration steps.

Regulatory Expertise

The firm possesses deep knowledge of Nepal’s foreign investment regulations, tax laws, and labor requirements. Axion Partners ensures all registrations comply with current legal provisions and regulatory standards, minimizing compliance risks and potential penalties.

Established Government Relations

Axion Partners maintains strong relationships with relevant government ministries and the Department of Industry, enabling priority processing and efficient coordination. These relationships facilitate faster ministerial recommendations and DOI approvals compared to independent applications.

Cost-Effective Solutions

The firm offers competitive service fees and transparent pricing structures, eliminating hidden costs. Axion Partners’ efficient processes reduce overall registration timelines and associated expenses, providing cost-effective solutions for foreign companies establishing liaison offices in Nepal.

Post-Registration Support

Axion Partners provides ongoing compliance support, including annual reporting, tax filing, and regulatory updates. The firm ensures liaison offices maintain continuous compliance with evolving legal requirements and government directives.

Read More:

- https://lawaxion.com/business-registration-things-to-know-in-nepal/

- https://lawaxion.com/business-registration-in-nepal-cost-fees-taxes-hidden-charges/

- https://lawaxion.com/business-registration-services-in-nepal/

- https://lawaxion.com/business-registration-sole-vs-partnership-vs-pvt-ltd-in-nepal/

- https://lawaxion.com/which-to-choose-branch-or-liaison-or-subsidiary-in-nepal/

Frequently Asked Questions

Q1: What is the primary difference between a liaison office and a branch office?

A liaison office conducts only coordination and promotional activities without generating direct revenue, while a branch office engages in commercial operations and generates taxable income. Liaison offices have restricted operational scope and different registration requirements.

Q2: Can a liaison office conduct business transactions?

No, liaison offices cannot conduct direct business transactions, sign contracts on behalf of the parent company, or generate revenue. They function exclusively for liaison, research, and coordination purposes.

Q3: Is ministerial recommendation mandatory for liaison office registration?

Yes, ministerial recommendation from the relevant sector ministry is mandatory before DOI application. This requirement distinguishes liaison office registration from other business entity registrations.

Q4: What tax rate applies to liaison office income?

Liaison offices are subject to 25 percent corporate income tax on taxable income. However, since they cannot conduct business operations, taxable income typically remains minimal.

Q5: How many employees can a liaison office employ?

The Foreign Investment and Technology Transfer Act does not specify maximum employee limits. However, liaison offices typically employ 2-5 staff for administrative functions.

Q6: What happens if a liaison office violates operational restrictions?

Violation of operational restrictions results in administrative penalties, registration suspension, or cancellation. The DOI may impose fines ranging from NPR 50,000 to NPR 500,000 depending on violation severity.

Q7: Can a liaison office be converted to a branch office?

Yes, a liaison office can be converted to a branch office through formal application to the DOI. The conversion requires submission of amended business plans and compliance with branch office registration requirements.

Q8: What is the validity period of liaison office registration?

Liaison office registration remains valid indefinitely, subject to annual compliance reporting and regulatory adherence. Registration can be renewed or modified as required.

Read More:

- https://lawaxion.com/lawyer-in-janakpur/

- https://lawaxion.com/lawyer-in-butwal/

- https://lawaxion.com/lawyer-in-nepalgunj/

- https://lawaxion.com/establishment-of-business-in-nepal-by-foreign-investors/

- https://lawaxion.com/branch-office-registration-process-in-nepal/

Conclusion

Liaison office registration in Nepal requires ministerial recommendation, comprehensive documentation, and compliance with foreign investment regulations. The process involves coordination with relevant ministries, the Department of Industry, tax authorities, and social security agencies. Liaison offices must maintain strict operational boundaries, comply with tax obligations, and adhere to labor law requirements. Axion Partners, as the No. 1 service provider for liaison office registration, offers expert guidance, efficient processing, and comprehensive compliance support throughout the registration process and beyond. The firm’s established government relationships and regulatory expertise ensure successful registration and ongoing operational compliance for foreign companies establishing liaison offices in Nepal.