Understanding Travel/Tours Companies in Nepal

Registration of tours company in Nepal is a business entity that specializes in organizing, selling, and facilitating travel-related services for individuals or groups. These companies serve as intermediaries between travelers and service providers such as airlines, hotels, transportation services, and local tour operators. In Nepal, tourism is a vital economic sector, making travel companies significant contributors to the national economy. The process of Registration of Tours Company in Nepal is crucial for ensuring that businesses operate within legal frameworks, promoting sustainability, and enhancing visitor experiences. The importance of the Registration of Tours Company in Nepal cannot be overstated, as it ensures that travelers receive quality and reliable services from registered companies.

The tourism industry in Nepal is regulated primarily by the Tourism Act, 2035 (1978) and its subsequent amendments, along with the Tourism Industry Service Directive. These legal frameworks establish the requirements and procedures for operating a travel or tours company in the country.

Understanding the importance of the Registration of Tours Company in Nepal helps in grasping the nuances of the tourism industry, as it not only legitimizes the operations of travel firms but also assures customers of quality services and safety measures during their travel experiences.

The Registration of Tours Company in Nepal process can be extensive, encompassing various legal and operational requirements essential for establishing a trustworthy travel business.

Travel companies in Nepal typically offer services such as tour packages, trekking arrangements, adventure tourism activities, cultural tours, hotel bookings, transportation services, and visa assistance. Given Nepal’s rich cultural heritage and natural attractions, including Mount Everest and numerous other Himalayan peaks, travel companies play a crucial role in promoting and facilitating tourism experiences.

Types of Travel/Tours Companies in Nepal

In Nepal, travel and tours companies can be registered in several forms:

- Private Limited Company: Most common structure for medium to large operations, requiring a minimum paid-up capital of NPR 25 Lakhs.

- Proprietorship Firm: Suitable for small operations, requiring a minimum capital of NPR 15 Lakhs.

- Partnership Firm: Involves two or more partners sharing ownership, with similar capital requirements as proprietorships.

- Public Limited Company: Larger entities that can offer shares to the public, with higher capital requirements.

The Tourism Industry Service Directive categorizes travel agencies based on their services and scope of operations, with different requirements for each category.

Legal Requirements for Travel/Tours Company Registration

The registration of a travel or tours company in Nepal involves compliance with several legal requirements as stipulated by the Tourism Act, 2035 (1978) and the Company Act, 2063 (2006). These requirements ensure that the company meets the necessary standards for operating in the tourism sector, including the Registration of Tours Company in Nepal.

Capital Requirements

Ultimately, the Registration of Tours Company in Nepal aligns with global best practices in tourism management.

Aspects of the Registration of Tours Company in Nepal include detailed assessments of company operations, ensuring that businesses are aligned with the cultural and environmental values of Nepal.

According to the Tourism Industry Service Directive, the capital requirements for travel/tours companies are:

Completing the Registration of Tours Company in Nepal guarantees that businesses adhere to national tourism regulations, which fosters a secure environment for tourists and promotes the local tourism economy.

Compliance with the Registration of Tours Company in Nepal guarantees that businesses not only meet legal standards but also contribute positively to the tourism sector.

- For a Private Limited Company: Minimum paid-up capital of NPR 25 Lakhs (2.5 million)

- For a Proprietorship Firm: Minimum capital of NPR 15 Lakhs (1.5 million)

- Bank Guarantee: A mandatory deposit of NPR 5 Lakhs (500,000) as a bank guarantee with a licensed Class-B bank

The bank guarantee serves as security and must be maintained throughout the company’s operation. This requirement is specified in Section 3(2) of the Tourism Industry Service Directive.

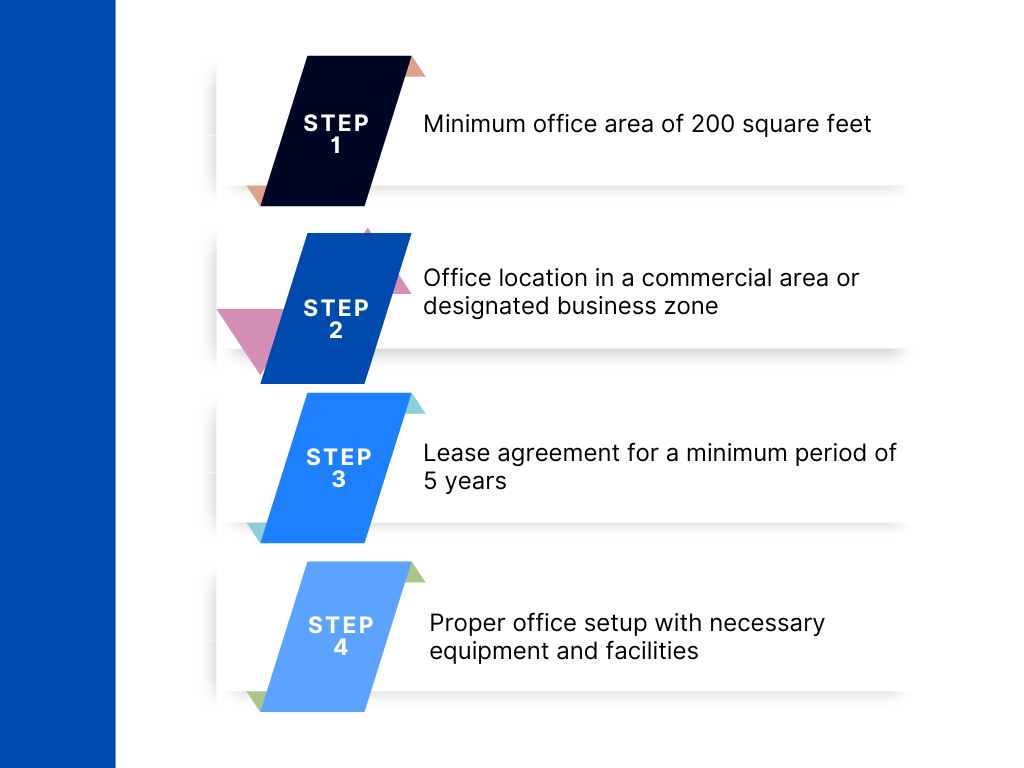

Office Space Requirements

The Tourism Industry Service Directive also stipulates specific requirements for office space:

- Minimum office area of 200 square feet

- Office location in a commercial area or designated business zone

- Lease agreement for a minimum period of 5 years

- Proper office setup with necessary equipment and facilities

These requirements ensure that the company has an appropriate physical presence for conducting business operations.

Human Resource Requirements

Investing in the Registration of Tours Company in Nepal is an investment in the future of tourism in the country.

Understanding the nuances of the Registration of Tours Company in Nepal is key for individuals and organizations looking to capitalize on tourism opportunities.

A travel/tours company must have qualified personnel:

- At least one staff member with tourism-related qualifications or experience

- Authorized representative with knowledge of the tourism industry

- Compliance with labor laws regarding employment terms and conditions

Section 4 of the Tourism Industry Service Directive outlines these human resource requirements to ensure professional service delivery.

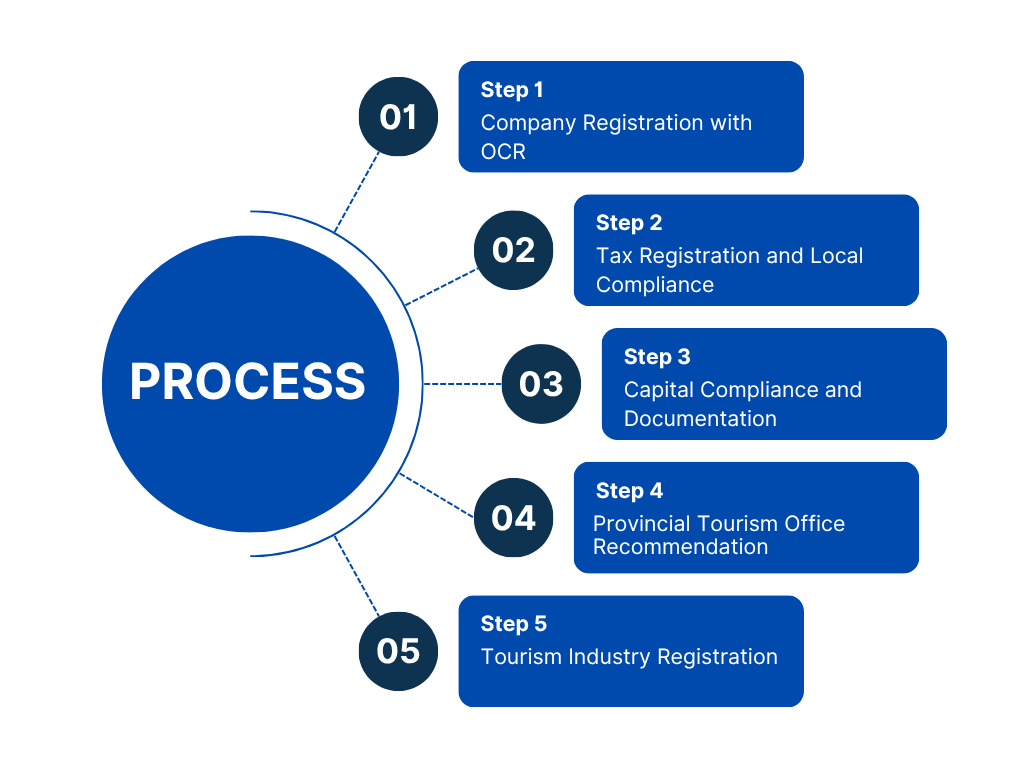

Step-by-Step Process for Registering a Travel/Tours Company

Step 1: Company Registration with OCR

The first step involves registering your company with the Office of the Company Registrar (OCR):

- Reserve a unique company name through the OCR online portal

- Prepare Memorandum of Association (MOA) and Articles of Association (AOA)

- Submit registration application with required documents

- Pay the registration fee based on authorized capital

- Receive the Company Registration Certificate

This process is governed by the Company Act, 2063 (2006), which requires all business entities to be formally registered before commencing operations.

The Registration of Tours Company in Nepal serves as a gateway to broader opportunities in the travel sector.

Step 2: Tax Registration and Local Compliance

After company registration, complete the following:

- Register for Permanent Account Number (PAN) and Value Added Tax (VAT) with the Inland Revenue Department

- Register with the local ward office of the municipality where the office is located

- Open a corporate bank account with a commercial bank

- Deposit the minimum required capital in the company account

Tax registration is mandatory under the Income Tax Act, 2058 (2002) and the Value Added Tax Act, 2052 (1996).

Step 3: Capital Compliance and Documentation

Ensure capital compliance by:

Once successful in the Registration of Tours Company in Nepal, businesses can offer diverse tourism services that cater to both domestic and international clients.

- Registering the minimum share capital of NPR 25 Lakhs with the OCR

- Preparing board resolutions approving the registration as a travel company

- Drafting a power of attorney for the authorized representative

- Preparing a letter of commitment addressed to the Tourism Office

These documents establish the financial foundation of the company and demonstrate compliance with capital requirements.

Step 4: Provincial Tourism Office Recommendation

Obtain a recommendation from the Provincial Tourism Office:

- Submit application form for recommendation along with a declaration letter

- Provide copies of company registration documents, PAN certificate, MOA, and AOA

- Submit proof of minimum capital compliance

- Present the NPR 5 Lakhs bank guarantee

- Provide office lease agreement and related documents

- Submit biographical information of the authorized representative

For those seeking to enter the tourism market, understanding the Registration of Tours Company in Nepal is essential for navigating legal requirements and ensuring operational success.

The recommendation is a prerequisite for final registration as a tourism industry entity.

Step 5: Tourism Industry Registration

Register the company as a tourism industry entity:

- Submit application to the Department of Tourism with the Provincial recommendation

- Provide all required documents including bank guarantee proof

- Pay the prescribed registration fee

- Undergo inspection of office premises by tourism officials

- Receive the Tourism Industry Registration Certificate

The Registration of Tours Company in Nepal fosters a competitive market, encouraging companies to maintain high standards of service, which ultimately benefits tourists. Additionally, the Registration of Tours Company in Nepal provides a framework for businesses to follow, ensuring compliance with legal and safety standards.

This registration is required under Section 3 of the Tourism Act, 2035 (1978).

Potential investors should consider the importance of the Registration of Tours Company in Nepal as it lays the foundation for operational success and compliance with local laws.

Step 6: Final Compliance and Licensing

Complete the final registration process:

- Register with the Tourism Industry Division of the Ministry of Culture, Tourism and Civil Aviation

- Obtain membership with the Nepal Association of Tour and Travel Agents (NATTA)

- Apply for any additional permits required for specific tourism activities

- Ensure compliance with all tourism industry regulations

These final steps establish the company’s legitimacy within the tourism sector and industry associations.

Step 7: Post-Registration Compliance

After registration, ensure ongoing compliance:

- Maintain the bank guarantee throughout the company’s operation

- Renew the tourism license annually

- File regular tax returns and financial statements

- Comply with tourism industry standards and regulations

- Maintain proper records of all tourism activities and transactions

Ongoing compliance is essential to maintain the company’s legal status and operating permissions.

Documents Required for Travel/Tours Company Registration

Essential Company Documents

In summary, the Registration of Tours Company in Nepal is not merely a formality but a critical step in ensuring that tourism operators uphold industry standards.

The following documents are required for the registration process:

- Duly filled application form for company registration

- Memorandum of Association (MOA) and Articles of Association (AOA)

- Citizenship certificates of all shareholders and directors

- Recent passport-size photographs of all shareholders and directors

- Biodata of the authorized representative

- Board meeting resolution approving registration as a travel company

- Power of attorney for the authorized representative

These documents establish the company’s legal structure and ownership.

Financial and Guarantee Documents

Financial documentation requirements include:

- Proof of minimum paid-up capital of NPR 25 Lakhs

- Bank guarantee slip of NPR 5 Lakhs from a Class-B bank

- Bank statements showing capital deposits

- Share registry showing capital distribution among shareholders

- Tax clearance certificates (if applicable for existing businesses)

These documents demonstrate the company’s financial capacity and compliance with capital requirements.

Office and Infrastructure Documents

Office-related documentation includes:

- House rent agreement for a minimum of 5 years

- Landlord’s citizenship certificate

- House number and location map

- Recent water/electricity bills as proof of address

- Office layout plan showing the minimum required area

- Photographs of office premises and facilities

These documents verify the company’s physical presence and operational capacity.

Tourism-Specific Documents

Additional tourism-specific documents include:

- Letter of commitment addressed to the Tourism Office

- Declaration letter regarding compliance with tourism regulations

- Application for recommendation from the Provincial Tourism Office

- Membership application for relevant tourism associations

- Detailed business plan for tourism operations

These documents demonstrate the company’s commitment to operating within the tourism industry framework.

Timeline and Cost for Registration

Expected Timeline

The registration process typically takes:

- Company registration with OCR: 3-7 days

- Tax registration (PAN/VAT): 2-3 days

- Bank account opening and capital deposit: 1-3 days

- Provincial Tourism Office recommendation: 7-14 days

- Tourism Industry registration: 7-14 days

- Final compliance and licensing: 3-7 days

To maximize the benefits of the Registration of Tours Company in Nepal, it is vital to engage with industry experts and legal advisors.

The total timeline ranges from 20 to 45 days, depending on document preparation efficiency and processing times at various government offices.

Understanding the steps and requirements for the Registration of Tours Company in Nepal can significantly aid entrepreneurs in navigating the tourism landscape effectively.

Registration Costs

The costs associated with registration include:

- Company registration fee: NPR 9,500 for capital up to NPR 1 crore

- PAN/VAT registration: NPR 1,000

- Bank guarantee commission: Approximately 1-2% of guarantee amount

- Tourism Industry registration fee: NPR 10,000

- NATTA membership fee: NPR 25,000 (one-time) plus annual fee

- Legal and professional service fees: Varies based on service provider

Government fees may vary based on the company’s capital structure and specific requirements.

Annual Compliance Requirements

Regulatory Compliance

Travel/tours companies must maintain ongoing compliance with:

- Annual renewal of tourism license with the Department of Tourism

- Maintenance of the NPR 5 Lakhs bank guarantee

- Submission of annual activity reports to the Tourism Department

- Compliance with tourism service standards and guidelines

- Adherence to environmental and cultural preservation regulations

These requirements are stipulated in the Tourism Act and related directives.

Financial Compliance

Financial compliance obligations include:

- Filing annual tax returns with the Inland Revenue Department

- Submitting audited financial statements to the OCR

- Renewing PAN/VAT registration annually

- Maintaining proper accounting records of all transactions

- Paying applicable taxes including VAT, TDS, and income tax

These requirements are mandated by the Income Tax Act, 2058 (2002) and the Company Act, 2063 (2006).

Operational Compliance

Operational compliance involves:

- Maintaining proper client records and service agreements

- Ensuring proper insurance coverage for tourism activities

- Complying with labor laws for employee management

- Adhering to ethical business practices and consumer protection standards

- Maintaining proper safety and security measures for tourists

These operational standards ensure the company provides quality services while protecting client interests.

FAQs About Registering a Travel/Tours Company in Nepal

What is the minimum capital requirement for a travel company in Nepal?

The minimum paid-up capital requirement is NPR 25 Lakhs (2.5 million) for a private limited company and NPR 15 Lakhs (1.5 million) for a proprietorship firm. Additionally, a bank guarantee of NPR 5 Lakhs must be maintained with a Class-B bank as per the Tourism Industry Service Directive.

How long does it take to register a travel company in Nepal?

The complete registration process typically takes between 20 to 45 days from the date of company name reservation. This timeline depends on the efficiency of document preparation, processing times at government offices, and the applicant’s promptness in addressing any requirements or queries.

Can foreigners own a travel company in Nepal?

Yes, foreigners can own a travel company in Nepal, but with certain restrictions. Foreign investment in the tourism sector is permitted under the Foreign Investment and Technology Transfer Act, 2075 (2019). However, foreign investors must bring in a minimum investment of USD 200,000 and can own up to 80% of the company, with the remaining 20% required to be held by Nepali nationals.

What are the annual renewal requirements for a travel company?

Travel companies must renew their tourism license annually with the Department of Tourism by submitting an application along with renewal fees, tax clearance certificate, audit report, and proof of maintained bank guarantee. The renewal should be completed within three months of the expiry of the fiscal year as per Section 5 of the Tourism Act, 2035 (1978).

Is membership in tourism associations mandatory?

While not legally mandatory, membership in associations like the Nepal Association of Tour and Travel Agents (NATTA) is highly recommended and often practically necessary. These associations provide industry recognition, networking opportunities, and access to various tourism-related resources and events that can benefit the company’s operations.

What specific permits are needed for adventure tourism activities?

Companies offering adventure tourism activities such as trekking, mountaineering, rafting, or paragliding require additional specific permits from relevant authorities. For example, trekking companies need registration with the Trekking Agencies’ Association of Nepal (TAAN), while mountaineering services require permits from the Nepal Mountaineering Association (NMA) as stipulated in the Mountaineering Expedition Regulation, 2059 (2002).

What are the consequences of operating without proper registration?

Operating a travel or tours company without proper registration is illegal under Section 10 of the Tourism Act, 2035 (1978). Penalties include fines up to NPR 50,000, potential imprisonment, immediate closure of business operations, and blacklisting from future tourism industry participation. Additionally, unregistered companies cannot legally issue trekking permits, climbing permits, or other official tourism documentation.

Read More

- 2 Star Hotel Registration in Nepal

- 3 Star Hotel Registration in Nepal

- 4 Star Hotel Registration in Nepal

- 5 Star Hotel Registration in Nepal

- 5 Star Deluxe Hotel Registration in Nepal

The benefits of the Registration of Tours Company in Nepal extend beyond compliance; they enhance marketability and trust among potential customers.

To maximize tourism opportunities, understanding the nuances of the Registration of Tours Company in Nepal is essential for success.

The benefits derived from the Registration of Tours Company in Nepal include enhanced brand credibility, customer trust, and overall industry sustainability.

How do I register a tours and travel company in Nepal?

To register a tour company, reserve a name at OCR, draft company documents, submit the application, and obtain PAN and local licenses. Finally, apply for a Tour/Travel Operating License from the Department of Tourism.

What documents are required to register a tour company in Nepal?

Required documents include company statutes (MOA, AOA), name reservation certificate, citizenship copies of shareholders, passport-size photos, office address proof, and PAN registration. For license, submit application, bank guarantee, and business plan to the Department of Tourism.

What is the cost and government fee for tour company registration in Nepal?

The registration fee depends on authorized capital. For up to NPR 1 million, the OCR fee is NPR 10,000. PAN registration is free. Tour license fee is NPR 15,000 with a bank guarantee of NPR 300,000.

How long does it take to complete the registration process for a tour company in Nepal?

The full process takes around 15–20 working days. Name reservation and document approval by OCR takes 7–10 days. PAN and local registration takes 2–4 days. Tour license may take an additional 5–7 working days.

Do I need a special license to operate a tour or travel agency in Nepal?

Yes, after company registration, you must obtain a Tour/Travel Operating License from the Department of Tourism. It requires a bank guarantee, physical office inspection, and approval of your travel operation documents.

Can a foreign national open or invest in a tour company in Nepal?

Yes, foreign nationals can invest through a joint venture by fulfilling the minimum FDI threshold (NPR 20 million). Approval from the Department of Industry and Nepal Rastra Bank is required before registering the company.

Success in the tourism industry hinges on a thorough understanding of the Registration of Tours Company in Nepal and its implications for business operation.

Ultimately, the Registration of Tours Company in Nepal reinforces the commitment to quality service and customer satisfaction.

Table of Contents

- 1 Understanding Travel/Tours Companies in Nepal

- 2 Legal Requirements for Travel/Tours Company Registration

- 3 Step-by-Step Process for Registering a Travel/Tours Company

- 3.1 Step 1: Company Registration with OCR

- 3.2 Step 2: Tax Registration and Local Compliance

- 3.3 Step 3: Capital Compliance and Documentation

- 3.4 Step 4: Provincial Tourism Office Recommendation

- 3.5 Step 5: Tourism Industry Registration

- 3.6 Step 6: Final Compliance and Licensing

- 3.7 Step 7: Post-Registration Compliance

- 4 Documents Required for Travel/Tours Company Registration

- 5 Timeline and Cost for Registration

- 6 Annual Compliance Requirements

- 7 FAQs About Registering a Travel/Tours Company in Nepal

- 7.1 How do I register a tours and travel company in Nepal?

- 7.2 What documents are required to register a tour company in Nepal?

- 7.3 What is the cost and government fee for tour company registration in Nepal?

- 7.4 How long does it take to complete the registration process for a tour company in Nepal?

- 7.5 Do I need a special license to operate a tour or travel agency in Nepal?

- 7.6 Can a foreign national open or invest in a tour company in Nepal?