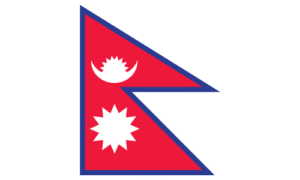

Introduction to Manpower Registration in Nepal

Manpower registration in Nepal refers to the formal process of establishing a recruitment agency that facilitates foreign employment opportunities for Nepali workers. The Foreign Employment Act, 2064 (2007) and Foreign Employment Rules, 2064 (2008) govern the establishment and operation of manpower companies in Nepal. The Department of Foreign Employment (DoFE) serves as the primary regulatory authority overseeing all manpower recruitment agencies.

The registration process involves multiple government agencies and requires substantial financial investment. Entrepreneurs must understand the complete cost structure before initiating the registration process. The total expenditure includes government fees, security deposits, office setup costs, and various administrative expenses. The Foreign Employment Act mandates strict compliance with financial requirements to protect the rights of migrant workers and maintain industry standards.

Legal Framework for Manpower Companies

The Foreign Employment Act, 2064 (2007) establishes the legal foundation for manpower recruitment in Nepal. Section 10 of this Act specifies the licensing requirements for foreign employment businesses. The Act requires all recruitment agencies to obtain a license from the Department of Foreign Employment before commencing operations.

The Foreign Employment Rules, 2064 (2008) provide detailed procedural guidelines for license applications. Rule 4 outlines the documentation requirements, while Rule 5 specifies the financial obligations. The Company Act, 2063 (2006) also applies to manpower companies, requiring them to register as private limited companies before applying for a recruitment license.

The Labor Act, 2074 (2017) and related regulations ensure worker protection and fair recruitment practices. These laws collectively create a comprehensive regulatory framework that governs every aspect of manpower company operations in Nepal.

Government Registration Fees

The Department of Foreign Employment charges specific fees for manpower company registration. According to the Foreign Employment Rules, 2064 (2008), the license application fee amounts to NPR 5,000. This non-refundable fee must accompany the initial application submission.

The license issuance fee stands at NPR 100,000 for new recruitment agencies. This fee becomes payable upon approval of the application and before receiving the official license certificate. The license remains valid for one year from the date of issuance.

Annual renewal fees amount to NPR 50,000, payable before the license expiration date. Late renewal applications incur additional penalty charges as specified in Rule 5 of the Foreign Employment Rules. The Department also charges NPR 2,000 for license amendment requests and NPR 1,000 for duplicate license certificates.

| Fee Type | Amount (NPR) | Validity Period |

|---|---|---|

| Application Fee | 5,000 | Non-refundable |

| License Issuance Fee | 100,000 | One year |

| Annual Renewal Fee | 50,000 | One year |

| Amendment Fee | 2,000 | As needed |

| Duplicate License | 1,000 | As needed |

Security Deposit Requirements

The Foreign Employment Act, 2064 (2007) mandates security deposits to ensure compliance and protect worker interests. Section 10(3) requires recruitment agencies to deposit NPR 2,000,000 (Two Million Rupees) as a bank guarantee with the Department of Foreign Employment.

This security deposit must be maintained throughout the operational period of the manpower company. The bank guarantee should be issued by a recognized commercial bank operating in Nepal. The guarantee remains valid for the entire license period and requires renewal annually.

The Department may forfeit the security deposit if the recruitment agency violates provisions of the Foreign Employment Act or engages in fraudulent activities. Rule 6 of the Foreign Employment Rules specifies conditions under which the security deposit may be partially or fully forfeited.

Company Registration Costs

Before applying for a manpower license, entrepreneurs must register their business as a private limited company under the Company Act, 2063 (2006). The Office of Company Registrar handles company registration procedures.

The minimum authorized capital requirement for a manpower company is NPR 5,000,000 (Five Million Rupees). The paid-up capital must be at least NPR 2,000,000 (Two Million Rupees) at the time of registration.

Company registration fees include:

- Name reservation fee: NPR 100

- Registration fee: 0.5% of authorized capital (minimum NPR 5,000)

- Stamp duty: 0.5% of authorized capital

- Publication charges: NPR 2,000-3,000

- Legal documentation: NPR 10,000-25,000

The total company registration cost typically ranges from NPR 50,000 to NPR 100,000, depending on the authorized capital and professional service fees.

Office Space Requirements and Costs

The Foreign Employment Rules, 2064 (2008) specify minimum office space requirements for manpower companies. Rule 4(2)(ka) mandates that recruitment agencies must maintain a physical office with at least 250 square feet of space in an accessible location.

The office must be located in a commercial area with proper signage displaying the company name and license number. The Department of Foreign Employment conducts physical verification of office premises before license approval.

Office rental costs vary significantly based on location:

- Kathmandu metropolitan area: NPR 30,000-80,000 per month

- Other urban areas: NPR 15,000-40,000 per month

- Advance payment: 6-12 months rent (NPR 180,000-960,000)

Additional office setup costs include furniture, computers, internet connectivity, and communication systems, typically ranging from NPR 200,000 to NPR 500,000.

Documentation and Legal Expenses

The manpower registration process requires extensive documentation and legal procedures. Professional legal services ensure compliance with all regulatory requirements and expedite the approval process.

Required documents include:

- Company registration certificate

- Tax registration certificate (PAN)

- Office lease agreement

- Bank guarantee for security deposit

- Educational certificates of directors

- Character certificates from local authorities

- Citizenship certificates of all directors

- Company memorandum and articles of association

- Board resolution for license application

- Passport-sized photographs

Legal and documentation expenses typically include:

- Legal consultation: NPR 25,000-50,000

- Document preparation: NPR 15,000-30,000

- Notarization and attestation: NPR 5,000-10,000

- Translation services: NPR 3,000-8,000

Technology and Infrastructure Costs

Modern manpower companies require robust technology infrastructure for efficient operations. The Department of Foreign Employment mandates online reporting systems and digital record-keeping.

Essential technology investments include:

- Computer systems: NPR 100,000-200,000

- Biometric devices: NPR 50,000-80,000

- Software licenses: NPR 30,000-60,000 annually

- Internet connectivity: NPR 2,000-5,000 monthly

- Website development: NPR 50,000-150,000

- Database management system: NPR 40,000-100,000

The Foreign Employment Management Information System (FEMIS) requires integration with company systems. This integration may require additional technical support and training, costing NPR 20,000-50,000.

Staff Recruitment and Training Costs

The Foreign Employment Rules require manpower companies to employ qualified staff members. Rule 4(2)(ga) specifies minimum staffing requirements based on company operations.

Minimum staff requirements include:

- Managing Director with relevant experience

- Counselor with foreign employment knowledge

- Administrative staff

- Accounts personnel

Monthly salary expenses typically range from NPR 150,000 to NPR 400,000, depending on staff qualifications and experience. Initial recruitment costs include:

- Advertisement expenses: NPR 10,000-20,000

- Interview and selection: NPR 5,000-10,000

- Training programs: NPR 30,000-60,000

- Orientation materials: NPR 10,000-15,000

The Department of Foreign Employment conducts mandatory training programs for manpower company staff. Training fees range from NPR 15,000 to NPR 25,000 per participant.

Insurance and Compliance Costs

Manpower companies must maintain various insurance policies to protect workers and comply with legal requirements. The Foreign Employment Act, 2064 (2007) mandates specific insurance coverage for migrant workers.

Required insurance policies include:

- Professional indemnity insurance: NPR 50,000-100,000 annually

- Office insurance: NPR 20,000-40,000 annually

- Worker compensation insurance: Variable based on deployment numbers

- Cyber security insurance: NPR 30,000-60,000 annually

Compliance costs also include membership fees for the Nepal Association of Foreign Employment Agencies (NAFEA), which amounts to approximately NPR 25,000 annually. Regular compliance audits and reporting requirements may incur additional costs of NPR 20,000-40,000 annually.

Destination Country Specific Costs

Manpower companies must obtain approvals from destination countries before recruiting workers. Each country has specific requirements and associated costs.

Common destination country requirements include:

- Demand letter verification: NPR 5,000-15,000 per letter

- Embassy attestation: NPR 2,000-10,000 per document

- Country-specific licenses: Variable (NPR 50,000-500,000)

- Agent agreements: NPR 10,000-30,000

- Market research visits: NPR 100,000-300,000 per trip

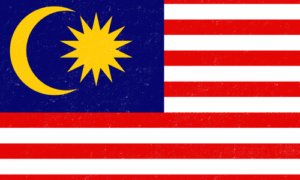

Gulf Cooperation Council (GCC) countries require additional documentation and verification processes. Malaysia, South Korea, and Japan have specific government-to-government agreements that involve separate registration procedures and costs.

Marketing and Branding Expenses

Establishing market presence requires substantial investment in marketing and branding activities. Manpower companies must build trust and credibility among potential workers and foreign employers.

Marketing expenses include:

- Brand development: NPR 50,000-150,000

- Signage and displays: NPR 30,000-80,000

- Promotional materials: NPR 20,000-50,000

- Digital marketing: NPR 15,000-40,000 monthly

- Print advertisements: NPR 10,000-30,000 per campaign

- Radio/TV spots: NPR 50,000-200,000 per campaign

Initial marketing campaigns typically require NPR 200,000 to NPR 500,000 investment. Ongoing monthly marketing expenses range from NPR 30,000 to NPR 100,000, depending on market reach and competition.

Working Capital Requirements

Beyond registration costs, manpower companies need substantial working capital for daily operations. The recruitment process involves advance payments and operational expenses before revenue generation.

Working capital requirements include:

- Pre-departure orientation costs: NPR 5,000-10,000 per worker

- Medical examination arrangements: NPR 3,000-8,000 per worker

- Document processing: NPR 2,000-5,000 per worker

- Travel arrangements: Variable based on destination

- Emergency funds: NPR 500,000-1,000,000

Financial experts recommend maintaining working capital equivalent to 6-12 months of operational expenses. This typically amounts to NPR 2,000,000 to NPR 5,000,000 for new manpower companies.

Total Cost Breakdown Summary

The complete cost structure for registering and establishing a manpower company in Nepal involves multiple components. The following table provides a comprehensive breakdown:

| Cost Category | Minimum Cost (NPR) | Maximum Cost (NPR) |

|---|---|---|

| Government Registration Fees | 105,000 | 105,000 |

| Security Deposit | 2,000,000 | 2,000,000 |

| Company Registration | 50,000 | 100,000 |

| Office Setup | 400,000 | 1,500,000 |

| Documentation & Legal | 50,000 | 100,000 |

| Technology Infrastructure | 250,000 | 600,000 |

| Staff Recruitment | 200,000 | 500,000 |

| Insurance & Compliance | 120,000 | 250,000 |

| Marketing & Branding | 200,000 | 500,000 |

| Working Capital | 2,000,000 | 5,000,000 |

| Total Estimated Cost | 5,375,000 | 10,655,000 |

Step-by-Step Registration Process

The manpower registration process follows a systematic procedure:

- Register a private limited company with the Office of Company Registrar

- Obtain Tax Registration Certificate (PAN) from Inland Revenue Department

- Secure office space meeting minimum requirements

- Arrange bank guarantee for security deposit

- Prepare all required documentation

- Submit application to Department of Foreign Employment

- Undergo office inspection by DoFE officials

- Attend mandatory training programs

- Pay license issuance fee upon approval

- Receive manpower recruitment license

- Register with Nepal Association of Foreign Employment Agencies

- Obtain destination country approvals

- Establish operational systems and procedures

- Commence recruitment activities

Ongoing Operational Costs

After initial registration, manpower companies face continuous operational expenses. These recurring costs must be factored into business planning and financial projections.

Monthly operational expenses include:

- Office rent: NPR 30,000-80,000

- Staff salaries: NPR 150,000-400,000

- Utilities and communication: NPR 15,000-30,000

- Marketing activities: NPR 30,000-100,000

- Transportation: NPR 20,000-50,000

- Administrative expenses: NPR 10,000-25,000

Annual recurring costs include:

- License renewal: NPR 50,000

- Insurance premiums: NPR 100,000-200,000

- Association membership: NPR 25,000

- Software subscriptions: NPR 30,000-60,000

- Audit and compliance: NPR 50,000-100,000

Financial Planning Considerations

Prospective manpower company owners must develop comprehensive financial plans. The high initial investment requires careful capital planning and funding strategies.

Funding sources may include:

- Personal investment from promoters

- Bank loans and credit facilities

- Partnership arrangements

- Venture capital investment

- Family and friend contributions

Banks typically require 30-40% equity contribution from promoters before extending loans. Interest rates for business loans range from 10-14% annually. The loan repayment period usually spans 5-7 years.

Financial projections should account for a break-even period of 12-24 months. Revenue generation depends on successful worker placements and commission structures with foreign employers.

Read More:

- https://lawaxion.com/legal-services-in-birgunj/

- https://lawaxion.com/lawyer-in-janakpur/

- https://lawaxion.com/lawyer-in-butwal/

- https://lawaxion.com/lawyer-in-nepalgunj/

- https://lawaxion.com/establishment-of-business-in-nepal-by-foreign-investors/

Risk Factors and Contingencies

The manpower business involves various risks that may impact financial requirements. Companies should maintain contingency funds to address unexpected situations.

Common risk factors include:

- Regulatory changes and policy updates

- Destination country restrictions

- Market competition and price pressures

- Worker-related disputes and complaints

- Economic fluctuations affecting demand

- Currency exchange rate variations

Contingency planning should include reserve funds equivalent to 15-20% of total investment. This buffer helps manage unforeseen expenses and regulatory compliance requirements.

Conclusion

Establishing a manpower company in Nepal requires substantial financial investment and regulatory compliance. The total cost ranges from NPR 5,375,000 to NPR 10,655,000, covering registration fees, security deposits, infrastructure, and working capital. The Foreign Employment Act, 2064 (2007) and related regulations establish strict requirements to protect migrant workers and maintain industry standards. Prospective entrepreneurs must conduct thorough financial planning, secure adequate funding, and ensure complete compliance with all legal requirements. The manpower recruitment sector offers significant business opportunities but demands professional management, ethical practices, and sustained financial commitment. Success in this industry requires understanding both domestic regulations and international labor market dynamics while maintaining the highest standards of worker protection and service delivery.

What is the minimum capital required to start a manpower company in Nepal?

The minimum paid-up capital requirement is NPR 2,000,000, with total initial investment ranging from NPR 5,375,000 to NPR 10,655,000 including all registration and operational setup costs.

How long does the registration process take?

The complete registration process typically takes 3-6 months from company registration to receiving the manpower license, depending on documentation completeness and government processing times.

Is the security deposit refundable?

Yes, the NPR 2,000,000 security deposit is refundable when the company surrenders its license and completes all pending obligations, subject to Department of Foreign Employment verification.

Can foreign nationals invest in manpower companies?

The Foreign Investment and Technology Transfer Act, 2075 (2019) allows foreign investment in recruitment agencies, subject to approval from the Department of Industry and compliance with foreign investment regulations.

What are the penalties for operating without a license?

Section 45 of the Foreign Employment Act, 2064 (2007) prescribes imprisonment up to 5 years and fines up to NPR 500,000 for operating recruitment activities without proper licensing.

How often must the license be renewed?

The manpower recruitment license requires annual renewal. Companies must submit renewal applications at least 30 days before license expiration with the prescribed renewal fee of NPR 50,000.

Are there any tax benefits for manpower companies?

Manpower companies are subject to standard corporate tax rates. However, companies may claim deductions for legitimate business expenses under the Income Tax Act, 2058 (2002).

What happens if the company violates regulations?

Violations may result in license suspension, security deposit forfeiture, financial penalties, or permanent license cancellation, depending on the severity of the violation as per Foreign Employment Rules.