When foreign businesses expand their operations in Nepal, they often start with a liaison office before considering more substantial investments. To convert liaison office to subsidiary in Nepal requires understanding the legal framework, following specific procedures, and meeting regulatory requirements. This comprehensive guide outlines the complete process for converting a liaison office to a subsidiary in Nepal, providing detailed insights into the legal requirements, documentation, timelines, and costs involved.

Branch Office Registration in Nepal

Understanding Liaison Offices and Subsidiaries in Nepal

What is a Liaison Office in Nepal?

A liaison office in Nepal is a representative office established by a foreign company to:

- Facilitate communication between the parent company and local entities

- Conduct market research and exploration

- Promote export of goods and services from Nepal

- Act as a channel for the parent company’s business activities

Under Nepal’s legal framework, liaison offices are restricted from:

- Engaging in commercial activities

- Earning income in Nepal

- Signing contracts on behalf of the parent company

What is a Subsidiary Company in Nepal?

A subsidiary company in Nepal is a separate legal entity established under the Company Act 2063, with:

- The ability to conduct commercial activities

- Independent legal personality from the parent company

- Capacity to earn income and generate profits

- Full operational capabilities within Nepal

Legal Framework for Converting Liaison Offices to Subsidiaries

Foreign Investment and Technology Transfer Act (FITTA) 2019

The FITTA 2019 governs foreign investment in Nepal and provides the legal basis for:

- Establishing foreign-owned subsidiaries

- Converting liaison offices to subsidiaries

- Regulating foreign investment sectors and requirements

Key provisions relevant to conversion:

- Section 4: Definition of foreign investment

- Section 7: Sectors open for foreign investment

- Section 8: Investment approval procedures

- Section 12: Technology transfer agreements

Company Act 2063 and Companies Regulation 2064

These regulations govern:

- Company registration procedures

- Minimum capital requirements

- Board composition and governance

- Compliance and reporting obligations

Department of Industry (DOI) and Office of Company Registrar (OCR) Requirements

The DOI and OCR oversee:

- Investment approval and registration

- Company incorporation procedures

- Compliance monitoring and reporting

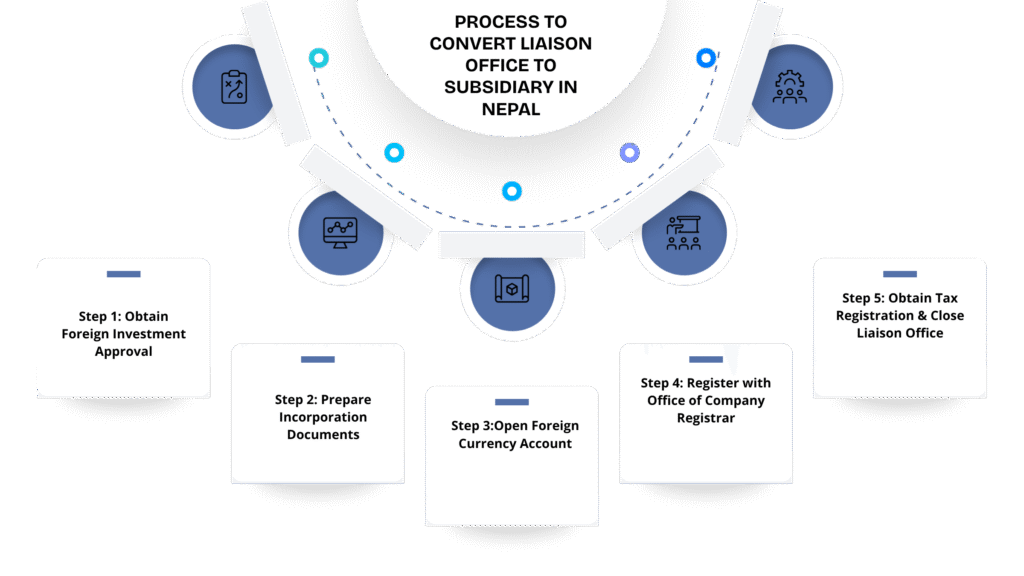

Process to Convert Liaison Office to Subsidiary in Nepal

Step-by-Step Conversion Process

- Obtain Foreign Investment Approval

- Submit application to Department of Industry

- Provide detailed business plan and investment proposal

- Obtain preliminary approval for foreign investment

- Prepare Incorporation Documents

- Draft Memorandum and Articles of Association

- Prepare board resolution from parent company

- Obtain necessary certifications and apostilles

- Open Foreign Currency Account

- Obtain approval from Nepal Rastra Bank

- Open account at a commercial bank in Nepal

- Transfer initial investment capital

- Register with Office of Company Registrar

- Submit incorporation documents

- Pay registration fees

- Obtain company registration certificate

- Obtain Tax Registration

- Register with Inland Revenue Department

- Obtain Permanent Account Number (PAN)

- Register for Value Added Tax (VAT) if applicable

- Close Liaison Office

- Submit closure application to DOI

- Obtain tax clearance certificate

- Complete necessary deregistration procedures

Required Documentation for Conversion

Documents for Department of Industry

- Application form for foreign investment

- Detailed business plan and project report

- Board resolution from parent company

- Financial statements of parent company

- Citizenship/passport copies of proposed directors

- Draft Memorandum and Articles of Association

- Evidence of investment capital

Documents for Office of Company Registrar

- Incorporation application form

- Approved Memorandum and Articles of Association

- Board resolution appointing local representatives

- Address proof for registered office in Nepal

- Citizenship copies of Nepali directors (if applicable)

- Foreign investment approval from DOI

Documents for Nepal Rastra Bank

- Application for foreign currency account

- Evidence of investment capital

- Foreign investment approval from DOI

- Company registration certificate

- PAN certificate from Inland Revenue Department

Timeline and Costs for Conversion

Expected Timeline

| Activity | Estimated Time |

|---|---|

| Foreign Investment Approval | 2-4 weeks |

| Document Preparation | 1-2 weeks |

| Bank Account Opening | 1 week |

| Company Registration | 1-2 weeks |

| Tax Registration | 1 week |

| Liaison Office Closure | 2-3 weeks |

| Total Timeline | 8-13 weeks |

Estimated Costs

| Item | Approximate Cost (USD) |

|---|---|

| Foreign Investment Approval Fee | 500 – 1,000 |

| Company Registration Fee | 100 – 500 |

| Legal Documentation | 1,000 – 3,000 |

| Professional Fees | 2,000 – 5,000 |

| Miscellaneous Expenses | 500 – 1,000 |

| Total Estimated Cost | 4,100 – 10,500 |

Tax Implications of Conversion

Income Tax Considerations

Under the Income Tax Act 2058 (2002):

- Subsidiaries are subject to corporate income tax on Nepal-sourced income

- Current corporate tax rate: 25% for general industries

- Special rates may apply for specific sectors or industries

- Tax incentives available for certain industries and regions

Value Added Tax (VAT)

- VAT registration required if annual turnover exceeds NPR 2 million

- Current VAT rate: 13%

- Input tax credit available for business expenses

Other Tax Considerations

- Withholding tax on certain payments

- Dividend distribution tax

- Tax on repatriation of profits

Compliance Requirements for Subsidiaries

Ongoing Compliance Obligations

- Annual financial statement filing with OCR

- Annual tax return filing with Inland Revenue Department

- Regular audit requirements

- Foreign investment reporting to DOI

- Board meetings and minutes maintenance

Reporting Requirements

- Quarterly financial statements

- Annual return to OCR

- Foreign exchange transaction reporting to NRB

- Industry-specific reporting requirements

Advantages of Converting to a Subsidiary

Operational Benefits

- Ability to conduct commercial activities

- Direct revenue generation in Nepal

- Greater control over operations

- Enhanced business opportunities

Legal and Financial Benefits

- Separate legal entity protection

- Access to local financing

- Tax planning opportunities

- Long-term business establishment

Challenges and Considerations

Regulatory Challenges

- Complex approval procedures

- Minimum capital requirements

- Sector-specific restrictions

- Compliance burden

Operational Considerations

- Need for local directors or representatives

- Cultural and business practice adaptation

- Local market competition

- Talent acquisition and management

Frequently Asked Questions

How long does it take to convert a liaison office to a subsidiary in Nepal?

The complete process typically takes 8-13 weeks, depending on the efficiency of document preparation, government approvals, and compliance requirements. The foreign investment approval from the Department of Industry usually takes 2-4 weeks, while company registration with the Office of Company Registrar requires 1-2 weeks.

What is the minimum capital requirement to establish a subsidiary in Nepal?

The minimum capital requirement varies by industry sector. For most service industries, the minimum foreign investment is NPR 5 million (approximately USD 42,000), while for manufacturing and production industries, it's NPR 10 million (approximately USD 84,000). Certain industries may have higher requirements.

Can a foreign company own 100% of a subsidiary in Nepal?

Yes, foreign companies can own 100% of subsidiaries in most sectors in Nepal. However, some restricted sectors require local partnership or joint venture arrangements. The Foreign Investment and Technology Transfer Act 2019 outlines the sectors open for full foreign ownership and those with restrictions.

What are the main advantages of converting a liaison office to a subsidiary?

The main advantages include the ability to conduct commercial activities, generate revenue directly in Nepal, greater operational control, access to local financing, tax planning opportunities, and establishing a long-term business presence in the market.

Is it mandatory to have Nepali directors in a foreign-owned subsidiary?

While not mandatory for all subsidiaries, having at least one Nepali director is often beneficial for navigating local business practices and regulatory requirements. Certain industry sectors may have specific requirements regarding local representation.

What happens to the employees of the liaison office during the conversion process?

Employees of the liaison office can be transferred to the new subsidiary entity. This requires proper documentation, including new employment agreements, and compliance with Nepal's labor laws regarding employee transfers.

Can a subsidiary repatriate profits to the parent company?

Yes, subsidiaries can repatriate profits to the parent company after paying applicable taxes in Nepal. This requires approval from Nepal Rastra Bank and compliance with foreign exchange regulations.

Conclusion

Converting a liaison office to a subsidiary in Nepal represents a significant step in establishing a long-term business presence in the country. While the process involves navigating complex regulatory requirements and multiple government agencies, the benefits of full operational capabilities and revenue generation often outweigh the challenges.

For businesses considering this conversion, it’s essential to work with experienced legal professionals who understand Nepal’s regulatory landscape and can guide you through the process efficiently. Our team of legal experts specializes in foreign investment and company registration in Nepal, ensuring a smooth transition from liaison office to subsidiary.

If you’re planning to convert your liaison office to a subsidiary in Nepal, contact us for a consultation tailored to your specific business needs and industry requirements.

Table of Contents

- 1 Understanding Liaison Offices and Subsidiaries in Nepal

- 2 Legal Framework for Converting Liaison Offices to Subsidiaries

- 3 Process to Convert Liaison Office to Subsidiary in Nepal

- 4 Required Documentation for Conversion

- 5 Timeline and Costs for Conversion

- 6 Tax Implications of Conversion

- 7 Compliance Requirements for Subsidiaries

- 8 Advantages of Converting to a Subsidiary

- 9 Challenges and Considerations

- 10 Frequently Asked Questions

- 10.1 How long does it take to convert a liaison office to a subsidiary in Nepal?

- 10.2 What is the minimum capital requirement to establish a subsidiary in Nepal?

- 10.3 Can a foreign company own 100% of a subsidiary in Nepal?

- 10.4 What are the main advantages of converting a liaison office to a subsidiary?

- 10.5 Is it mandatory to have Nepali directors in a foreign-owned subsidiary?

- 10.6 What happens to the employees of the liaison office during the conversion process?

- 10.7 Can a subsidiary repatriate profits to the parent company?

- 11 Conclusion