Foreign Direct Investment Approval Process in Nepal refers to the investment made by foreign individuals or entities in Nepali businesses or economic activities. Foreign Direct Investment Approval Process in Nepal involves the transfer of capital, technology, and expertise from foreign sources into Nepal’s economy. The Foreign Investment and Technology Transfer Act (FITTA) 2019 governs FDI in Nepal.

FDI in Nepal can take various forms, including:

- Establishment of wholly-owned subsidiaries

- Joint ventures with Nepali partners

- Acquisition of existing Nepali companies

- Investment in infrastructure projects

Axion Partners has skilled and experienced Foreign Direct Investment FDI Lawyers in Nepal that specialize in Investment and Incorporation Laws to assist companies and investors to enter the Nepali Market.

How to incorporate a company in Nepal as a Foreigner?

- Obtain approval from the Department of Industry (DOI) or Investment Board Nepal (IBN), depending on the investment amount.

- Register the company with the Office of Company Registrar (OCR).

- Obtain a Permanent Account Number (PAN) from the Inland Revenue Department.

- Register with the Nepal Rastra Bank (NRB) for foreign currency transactions.

- Obtain necessary licenses and permits from relevant authorities.

- Open a bank account in Nepal for the company.

- Inject the approved foreign investment amount into the company’s account.

The process requires compliance with the Foreign Investment and Technology Transfer Act (FITTA) 2019 and other relevant laws. Foreign investors must ensure they meet all legal requirements and obtain necessary approvals before commencing business operations in Nepal.

Requirements for Business Incorporation in Nepal through FDI

To incorporate a business in Nepal through FDI, the following requirements must be met:

- Minimum investment amount as prescribed by the government

- Investment in permitted sectors

- Approval from relevant authorities (DOI or IBN)

- Compliance with FITTA 2019 and other applicable laws

- Proper documentation, including business proposal and feasibility study

- Proof of foreign investor’s identity and financial capacity

- Appointment of a local representative or agent in Nepal

- Compliance with environmental and social impact assessments, if applicable

Permitted Sectors for Establishing a Business in Nepal

Nepal welcomes foreign investment in various sectors, including:

- Agriculture and agro-based industries

- Tourism and hospitality

- Energy and hydropower

- Information technology and business process outsourcing

- Manufacturing and processing industries

- Infrastructure development (roads, airports, telecommunications)

- Education and health services

- Financial services (banking, insurance)

- Mining and mineral exploration

- Pharmaceuticals and biotechnology

These sectors offer significant Foreign Direct Investment opportunities in Nepal. The government actively promotes investment in these areas to boost economic growth and development.

Restricted Sectors for Establishing a Business in Nepal

While Nepal encourages FDI in many sectors, some areas are restricted or prohibited for foreign investment:

- Poultry farming

- Fisheries

- Primary agriculture (excluding agriculture industries)

- Real estate business (excluding construction industries)

- Multilevel marketing

- Arms and ammunition industries

- Explosives, gunpowder

- Radioactive materials

- Mass communication media (radio, television, and newspapers)

- Film industries producing Nepali languages

What is the Minimum Investment for FDI Company Registration in Nepal?

The minimum Foreign Investment in Nepal varies depending on the sector and type of investment:

- For manufacturing industries: NPR 20 million (approximately USD 150,000)

- For service industries: NPR 20 million (approximately USD 150,000)

- For technology-based industries: NPR 20 million (approximately USD 150,000)

- For IT-Based Industries: No Minimum Investment Required

These thresholds are subject to change, and investors should verify the current minimum investment requirements with the Department of Industry or Investment Board Nepal before proceeding with their investment plans.

Percentage of Ownership for Businesses in Nepal by Foreign Entities

| Type of Business | Maximum Foreign Ownership |

|---|---|

| Manufacturing Industries | 100% |

| Service Industries | 100% |

| Banking and Financial Institutions | Up to 85% |

| Insurance Companies | Up to 80% |

| Air Transport Services | Up to 49% |

| Domestic Air Transport | Up to 49% |

| Trekking Agencies | Up to 51% |

| Travel Agencies | Up to 67% |

| Consultancy Services | 100% |

| Retail Business | Up to 51% |

It’s important to note that these percentages may be subject to change based on government policies and regulations. Foreign investors should consult with the Department of Industry or Investment Board Nepal for the most up-to-date information on ownership restrictions.

Authorities approving Foreign Investment in Nepal

| Investment Amount | Approving Authority |

|---|---|

| Up to NPR 6 billion | Department of Industry (DOI) |

| Above NPR 6 billion | Investment Board Nepal (IBN) |

| Hydropower projects above 500 MW | Investment Board Nepal (IBN) |

| Special economic zones | Investment Board Nepal (IBN) |

| Public-private partnership projects | Investment Board Nepal (IBN) |

| Industries requiring EIA | Ministry of Forests and Environment |

| Banking and financial institutions | Nepal Rastra Bank (NRB) |

| Insurance companies | Insurance Board |

| Telecommunication services | Nepal Telecommunications Authority |

Foreign investors must obtain approval from the relevant authority based on their investment amount and sector. The approval process may involve multiple agencies depending on the nature of the project.

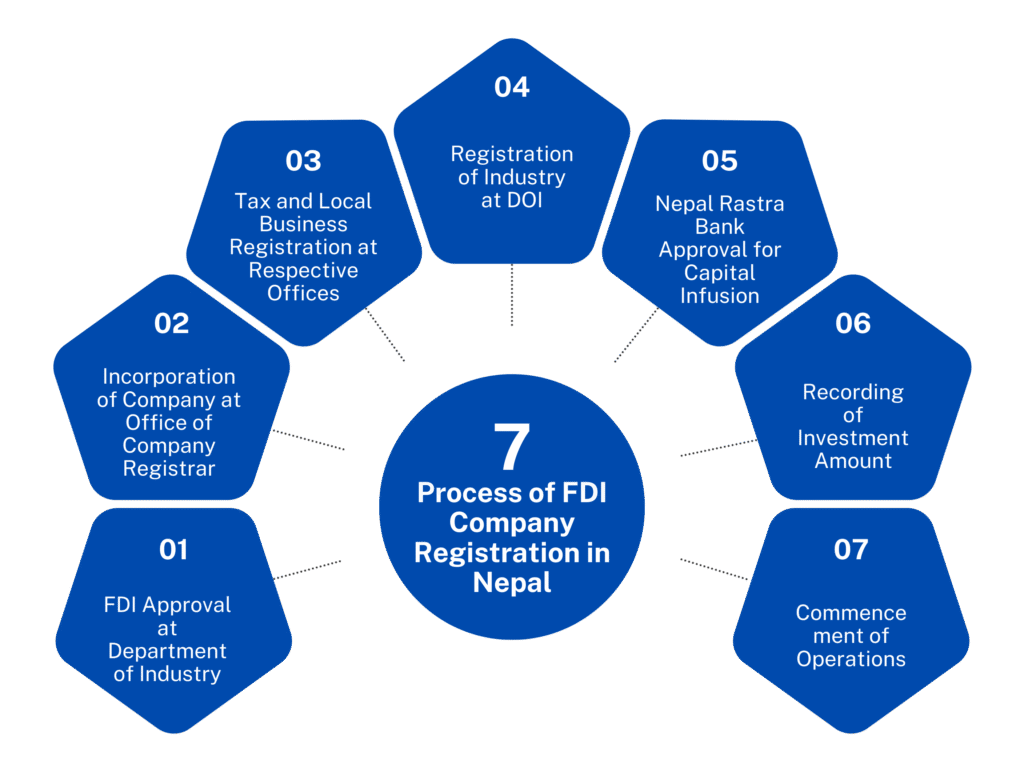

What is the Process of FDI Company Registration in Nepal?

FDI PROCESS IN NEPAL

- Step 1: Foreign Direct Investment Approval at Department of Industry

- Step 2: Incorporation of Company at Office of Company Registrar

- Step 3: Tax and Local Business Registration at Respective Offices

- Step 4: Registration of Industry at DOI

- Step 5: Nepal Rastra Bank Approval for Capital Infusion

- Step 6: Recording of Investment Amount

- Step 7: Commencement of Operations

Step 1: Foreign Investment Approval (DOI/IBN)

Obtain approval for Foreign Direct Investment (FDI) under the Foreign Investment and Technology Transfer Act, 2019 from the Department of Industry (DOI) or Investment Board Nepal (IBN). This process is essential for legal validation of foreign investment and includes submitting detailed project reports, business plans, and investment commitments.

Step 2: Company Incorporation (OCR)

Register the company with the Office of the Company Registrar (OCR) under the Companies Act, 2006. This step involves selecting the company structure, reserving a name, and submitting required documents, including Articles of Association and Memorandum of Association. Registration ensures the company is recognized as a legal entity in Nepal.

Step 3: Tax Registration (Inland Revenue Office)

Register the company with the Inland Revenue Office for Value Added Tax (VAT) and Permanent Account Number (PAN) under the Income Tax Act, 2002. This ensures compliance with Nepal’s tax system and enables legal operations, including invoicing, tax filings, and employee-related tax obligations.

Step 4: Business Registration (Local Ward Office)

Obtain business registration approval from the local ward office as per the Local Governance Operations Act, 2017. This involves submitting company details, lease agreements, and other supporting documents to secure a recommendation letter, which is often necessary for industry-specific registrations.

Step 5: Industry Registration (DOI)

Register the industry with the Department of Industry as required by the Industrial Enterprises Act, 2020. This step is mandatory for companies engaging in industrial or manufacturing activities. It involves obtaining a recommendation from the ward office and completing the prescribed forms.

Step 6: Non-Blacklist Certificate (Credit Information Bureau)

Acquire a “Non-Blacklist Certificate” from the Credit Information Bureau (CIB) under Nepal Rastra Bank’s directives. This certificate ensures that the directors and stakeholders are not blacklisted for financial irregularities, enhancing credibility for foreign investors and local partners.

Step 7: NRB Approval for Investment Amount Infusion

Secure prior approval from Nepal Rastra Bank (NRB) to remit the proposed foreign investment amount as per the Foreign Exchange Regulation Act, 1962. This step includes submitting details of the source of funds, investment plan, and proof of compliance with foreign exchange laws.

Step 8: Infusion and Recording of Investment Amount (NRB)

Infuse the approved investment amount through a local bank, which will issue an Investment Certificate. Subsequently, record the investment with NRB to ensure it complies with foreign currency regulations. This process solidifies the legitimacy of the capital brought into Nepal under FDI laws.

What are the Documents Required for Foreign Direct Investment Approval Process in Nepal?

- Application form for foreign investment approval

- Detailed project proposal and feasibility study

- Joint venture agreement (if applicable)

- Copy of foreign investor’s passport or company registration certificate

- Financial statements of the foreign investor

- Board resolution authorizing the investment (for companies)

- Power of attorney for local representative

- Environmental Impact Assessment report (if required)

- Curriculum vitae of key personnel

- Any other sector-specific documents required by regulatory authorities

Timeline of Approvals of Foreign Investment in Nepal

| Stage | Approximate Timeline |

|---|---|

| Initial screening of proposal | 7-10 working days |

| Detailed evaluation | 15-30 working days |

| Approval in principle | 7-10 working days |

| Company registration | 3-5 working days |

| Foreign Investment Approval Certificate from NRB | 5-7 working days |

| Final approval | 7-10 working days |

| Total estimated timeline | 44-72 working days |

Note: These timelines are approximate and may vary depending on the complexity of the project and the efficiency of the approval process.

Government Fees for Foreign Investment in Nepal

| Service | Fee (in NPR) |

|---|---|

| Foreign Investment Application | 20,000 |

| Company Registration (Private Limited) | 9,500 |

| PAN Registration | 500 |

| Foreign Investment Approval Certificate | 10,000 |

| Technology Transfer Agreement Registration | 10,000 |

| Environmental Impact Assessment Approval | 50,000 – 150,000 |

Note: These fees are subject to change, and additional sector-specific fees may apply.

Time for Injecting Foreign Investment Amount in Nepal

Foreign investors must inject the approved investment amount into Nepal within the following timeframes:

- For investments up to NPR 500 million: Within one year of obtaining approval

- For investments above NPR 500 million: Within three years of obtaining approval

Extensions may be granted in exceptional circumstances upon application to the relevant authority.

Sectoral Approvals additionally Required for Investing in Nepal

| Sector | Additional Approval Required |

|---|---|

| Banking and Finance | Nepal Rastra Bank |

| Insurance | Insurance Board |

| Telecommunications | Nepal Telecommunications Authority |

| Hydropower | Ministry of Energy, Water Resources and Irrigation |

| Education | Ministry of Education, Science and Technology |

| Health Services | Ministry of Health and Population |

| Aviation | Civil Aviation Authority of Nepal |

| Mining | Department of Mines and Geology |

| Tourism | Nepal Tourism Board |

Post-FDI Compliance and Regulations in Nepal

After establishing a business through FDI in Nepal, foreign investors must comply with various regulations:

- Annual reporting to the Department of Industry or Investment Board Nepal

- Compliance with labor laws and social security regulations

- Regular tax filings and payments

- Environmental compliance as per approved EIA

- Adherence to foreign exchange regulations

- Maintenance of proper books of accounts

- Compliance with sector-specific regulations

- Renewal of business licenses and permits

- Reporting of any changes in ownership structure or investment amount

- Compliance with corporate governance norms

Failure to comply with these regulations may result in penalties or revocation of FDI approval.

Repatriation Process of Foreign Investment from Nepal

Foreign investors can repatriate their investments and profits from Nepal subject to certain conditions:

- Obtain approval from the Department of Industry or Investment Board Nepal

- Comply with tax obligations and obtain tax clearance

- Adhere to foreign exchange regulations set by Nepal Rastra Bank

- Provide necessary documentation, including audited financial statements

- Ensure compliance with the original FDI approval terms

The repatriation process involves submitting an application to the relevant authority, which then reviews the request and grants approval if all conditions are met. The approved amount can then be remitted through authorized banking channels.

How to increase Foreign Direct Investment in Nepal?

To attract more FDI, Nepal can implement the following strategies:

- Streamline the FDI approval process and reduce bureaucratic hurdles

- Improve infrastructure, particularly in transportation and energy sectors

- Enhance political stability and policy consistency

- Strengthen the legal framework for investor protection

- Develop skilled human resources through education and training programs

- Promote Nepal’s investment opportunities internationally

- Offer tax incentives and other benefits for strategic sectors

- Improve ease of doing business rankings

- Develop special economic zones and industrial parks

- Foster public-private partnerships in key infrastructure projects

These measures can help improve Nepal’s attractiveness as an investment destination and boost FDI inflows.

What is Foreign Direct Investment (FDI) in Nepal?

Foreign Direct Investment (FDI) in Nepal, according to FITTA 2019, is a form of international investment where foreign individuals or companies invest capital in Nepalese businesses, gaining ownership or control of business assets. Nepal allows 100% FDI in most sectors except for a few restricted areas.

Which Sectors are open for FDI in Nepal?

Sectors open for FDI in Nepal include manufacturing, energy, tourism, agriculture, information technology, mining, construction, healthcare, education, and service industries. However, sectors like personal security services, arms manufacturing, and real estate trading remain restricted.

What is the minimum investment required to open a company in Nepal?

The minimum investment required to open a company in Nepal through FDI is NPR 20 million (approximately USD 150,000) as per FITTA 2019. However, there is no Minimum Investment Threshold for establishing IT Companies. This threshold applies to all foreign investors seeking to establish businesses in Nepal.

What is the process of Foreign Investment?

FDI Process in Nepal: 1. Obtaining DOI Approval 2. Registration of Company at OCR 3. Local Business and Tax Registration 4. Registration of Industry at DOI Step 5: Opening a Local Bank Account 6. Approval from NRB to infuse capital. Foreign investors must first obtain approval from the Investment Board Nepal or Department of Industry.

Who approves FDI in Nepal?

FDI approval in Nepal is granted by two authorities: the Investment Board Nepal (IBN) for investments exceeding NPR 6 billion, and the Department of Industry (DOI) for investments below NPR 6 billion. Both operate under the Ministry of Industry.

What is the Condition of FDI in Nepal?

The current condition of FDI in Nepal shows steady growth despite challenges. Total FDI inflow reached NPR 19.48 billion in 2022/23, with major investments from China, India, and other countries focusing on energy, manufacturing, and service sectors.

What is FITTA 2019?

FITTA 2019 (Foreign Investment and Technology Transfer Act 2019) is Nepal’s primary legislation governing foreign investment. It provides the legal framework for FDI, technology transfer, and repatriation of earnings while protecting foreign investors’ rights.

What documents are required for FDI in Nepal?

Documents required for FDI in Nepal include: passport copy, company registration certificate from home country, financial credibility certificate, board resolution, project proposal, joint venture agreement (if applicable), and citizenship certificate of local partner.

How can a Foreigner Open a Company in Nepal?

A foreigner can open a company in Nepal by following these steps: obtaining DOI approval, registering the company at OCR, getting PAN/VAT registration, opening a bank account, getting industry registration, and obtaining necessary permits. The process typically takes 2-3 months.

Resources: Survey Report on Foreign Direct Investment Investment Board on FDI Status of Foreign Direct Investment in Nepal

Table of Contents

- 1 How to incorporate a company in Nepal as a Foreigner?

- 2 What is the Process of FDI Company Registration in Nepal?

- 3 What are the Documents Required for Foreign Direct Investment Approval Process in Nepal?

- 3.1 What is Foreign Direct Investment (FDI) in Nepal?

- 3.2 Which Sectors are open for FDI in Nepal?

- 3.3 What is the minimum investment required to open a company in Nepal?

- 3.4 What is the process of Foreign Investment?

- 3.5 Who approves FDI in Nepal?

- 3.6 What is the Condition of FDI in Nepal?

- 3.7 What is FITTA 2019?

- 3.8 What documents are required for FDI in Nepal?

- 3.9 How can a Foreigner Open a Company in Nepal?