Table of Contents

- 1 What is a Company in Nepal ?

- 2 How to Register a Company in Nepal (2026)?

- 3 Documents Required for Company Registration in Nepal

- 4 Company Registration Fees in Nepal (For Private Company)

- 5 Best Company Registration Service in Nepal

- 6 How to Register a Company Online in Nepal?

- 7 Expert Company Registration Lawyer in Nepal

- 8 Post-Company Registration Procedure in Nepal

- 8.1 3-Month Compliance after Private Company Registration Process in Nepal

- 8.2 Annual Compliance after Owning a Company in Nepal

- 8.3 SSF Registration of Companies in Nepal

- 8.4 How to register a company in Nepal?

- 8.5 Can a foreigner own a company in Nepal?

- 8.6 What is LLC in Nepal?

- 8.7 How to register a non-profit company in Nepal?

- 8.8 What documents are required for online company registration?

- 8.9 How long does it take to complete company registration in Nepal?

- 9 Professional Conclusion by Axion Partners

Online company registration in Nepal is the official process of legally establishing a business entity governed by the Companies Act, 2063 (2006). This online company registration process in Nepal is essential for businesses to gain legal recognition, operate lawfully, and access services such as banking, tax registration, and government contracts.

The online company registration Nepal system involves submitting required documents, choosing a company type, and registering through the Office of Company Registrar Nepal (OCR) using the OCR online portal. This process ensures compliance with government regulations and protects the rights of businesses and stakeholders.

Looking to start your journey? Learn about the steps, fees, and documents needed for the new company registration online in Nepal from experts with experience in registering 750+ companies, including businesses that register company online in Kathmandu and across Nepal.

What is a Company in Nepal ?

A company is a legal entity formed by individuals or groups to conduct business activities. Company formation in Nepal is governed by the Companies Act, 2063 (2006). The Act defines a company as a body corporate registered under its provisions, having perpetual succession and a common seal.

Companies in Nepal can be established for profit-making ventures, non-profit activities, or social enterprises and receive a business registration certificate Nepal after successful registration.

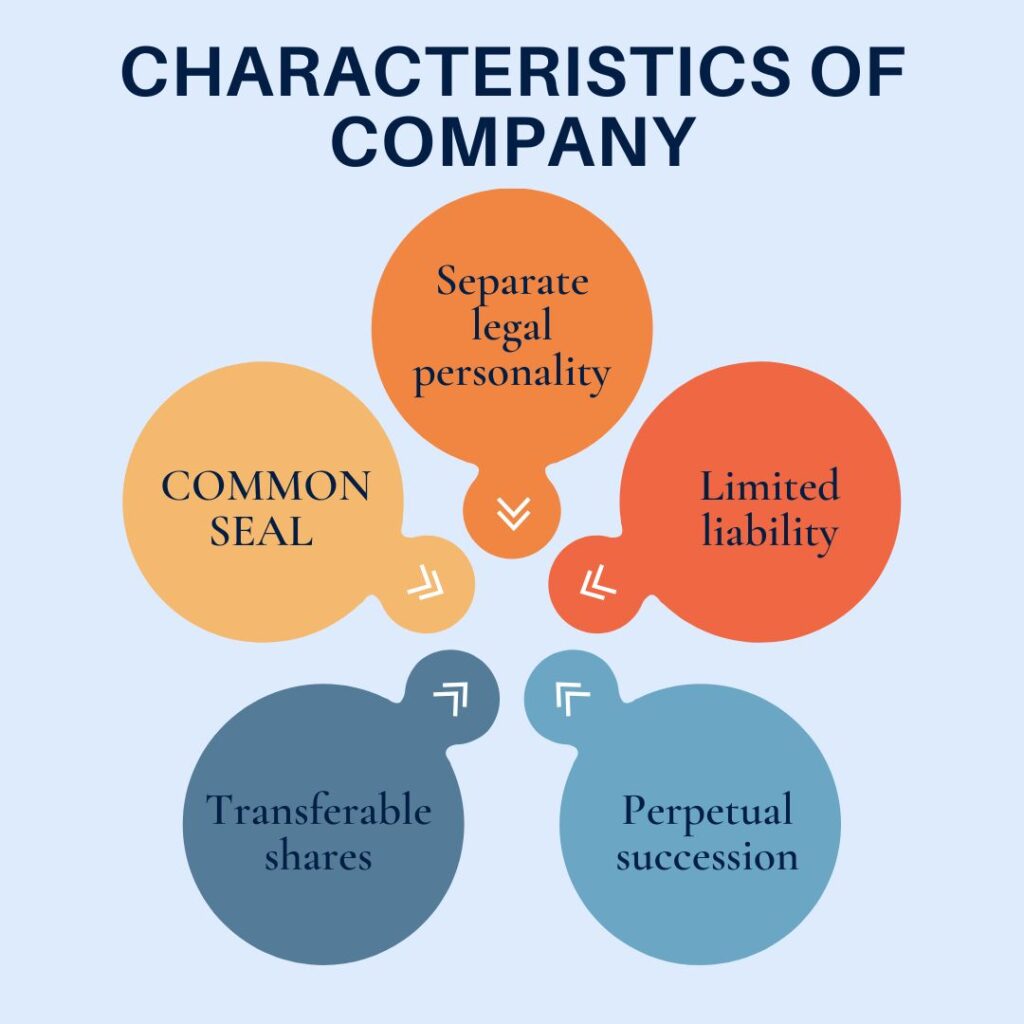

Companies possess several key characteristics:

- Separate legal personality: A company is distinct from its owners and can enter into contracts, own property, and sue or be sued in its own name.

- Limited liability: Shareholders’ liability is typically limited to the amount they have invested in the company.

- Perpetual succession: A company continues to exist regardless of changes in ownership or management.

- Transferable shares: Ownership in a company can be transferred through the sale of shares.

- Common seal: Companies use an official seal to authenticate important documents.

The formation of companies in Nepal is regulated by the Office of Company Registrar Nepal (OCR), which oversees the registration process and maintains records of all registered companies.

What are the types of Companies in Nepal?

The Companies Act 2063 (2006) recognizes several company types eligible for online company registration in Nepal 2026: Private Limited, Public Limited, Non-Profit Distributing, Foreign, Single Shareholder, Holding and Subsidiary Company

| Types of Companies | Features of the Company |

|---|---|

| Private Limited Company | – Limited to 1-101 shareholders- Restrictions on share transfer- Cannot invite public to subscribe for shares- Common for small to medium-sized businesses |

| Public Limited Company | – Minimum of 7 shareholders, no maximum limit- Shares can be freely transferred- Can invite public to subscribe for shares- Subject to stricter regulations |

| Non-Profit Distributing Company | – Established for charitable, social, or educational purposes- Profits cannot be distributed to members- Often used for NGOs and social enterprises |

| Foreign Company | – Branch or liaison office of a company incorporated outside Nepal- Must obtain approval from the Department of Industry |

| Single Shareholder Company | – Owned by a single individual or entity- Limited to certain types of businesses |

| Holding Company | – Controls other companies through share ownership- Must own more than 50% of shares in subsidiary companies |

| Subsidiary Company | – Controlled by a holding company- More than 50% of shares owned by the holding company |

Each structure has different compliance and capital requirements under the company registration process in Kathmandu, Nepal.The choice of company structure depends on factors such as the nature of the business, number of shareholders, capital requirements, and regulatory considerations for small businesses in Nepal.

How to Register a Company in Nepal (2026)?

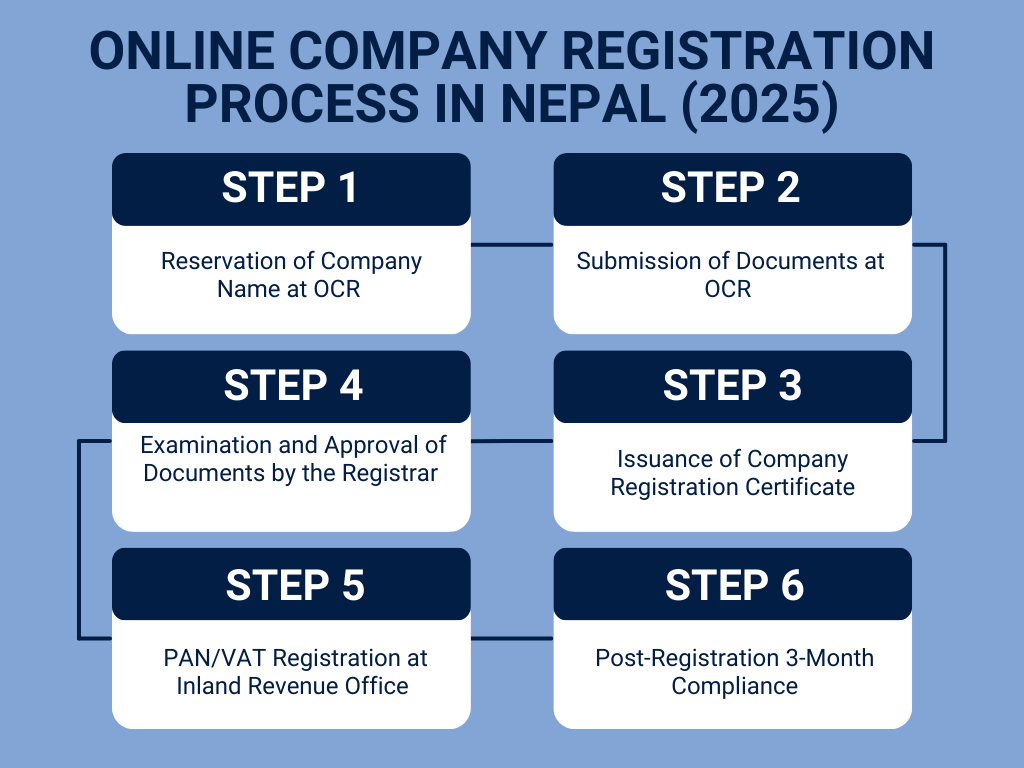

The company registration process in Nepal through the Office of Company Registrar Nepal follows six clear steps:

- Step 1: Reservation of Company Name at OCR

- Step 2: Submission of Documents at OCR

- Step 3: Examination and Approval of Documents by the Registrar

- Step 4: Issuance of Company Registration Certificate

- Step 5: PAN/VAT Registration at Inland Revenue Office

- Step 6: Post-Registration 3-Month Compliance

This process is completed using company registrar login, also referred to as OCR login Nepal or www.ocr.gov.np:

The Nepal company registration with the Office of Company Registrar (OCR) can be conducted in Six Steps: 1. Checking & Reserving Company Name 2. Preparation and Approvals of Documents at OCR 3. Issuance of Company Registration Certificate 4. Tax and Business Registration 5. Post-Registration 3-Month Compliance

Step 1: Reservation of Company Name at OCR

Start by reserving a unique company name via the Office of Company Registrar (OCR) portal as part of the online company registration in Nepal. Register an account through company registrar login on the OCR system and search for name availability in both English and Nepali. Ensure compliance with name rules under the Company Act 2063, avoiding restricted terms or duplications. Approved names must proceed to registration within 90 days, or they expire. Common reasons for rejection include duplication, single-word names, or offensive terms. Once approved, this step allows you to move forward with documentation preparation for online company registration Nepal.

Step 2: Submission of Documents at OCR

Prepare and submit physical documents at the OCR under the company registration process in Nepal. These include shareholder citizenship certificates, address proof, authorized capital details, and objectives required by the Office of Company Registrar Nepal. Draft the Memorandum of Association (MOA) and Articles of Association (AOA) in compliance with the Company Act 2063. These define the company’s objectives and internal governance rules. All documents must be signed by shareholders on every page to proceed with company formation in Nepal.

Step 3: Document Examination by OCR

OCR reviews submitted documents to ensure compliance with the Company Act 2063. They verify consistency between online submissions through the ocr online portal and physical documents, including correctness of objectives and completeness of signatures. Errors or discrepancies, such as unsigned pages or mismatched information, will require corrections and resubmission. Once documents meet all requirements, you pay the applicable government registration fee based on authorized capital to complete the company registration process in Nepal.

Step 4: Issuance of Company Registration Certificate

Upon successful examination, OCR issues the company registration certificate OCR Nepal, formally recognizing the legal establishment of your business through online company registration in Nepal. Review all details on the certificate for accuracy, including the company name and shareholder information. Notify the Office of Company Registrar Nepal promptly in case of discrepancies to ensure correct issuance of the online company registration certificate Nepal.

Step 5: PAN/VAT Registration at Inland Revenue Office

After receiving the registration certificate, register your business for tax purposes with the Inland Revenue Office (IRO) as part of how to register a company in Nepal. Apply online via the IRD portal using the company registration certificate Nepal issued through online company registration Nepal. Submit the online form, company registration certificate, address proof, shareholders’ citizenship, board minutes, and company stamp during the visit to IRO. PAN registration ensures compliance with tax laws, enabling lawful business transactions.

Step 6: Post-Registration 3-Month Compliance

Within three months of registration, ensure compliance with initial legal and procedural requirements under the company registration process in Nepal. This includes holding the first board meeting to record important resolutions, appointing directors, and defining roles. Update the company’s statutory register, including shareholder and director details. File necessary reports with OCR through ocr login Nepal using www.ocr.gov.np login, and ensure VAT filings (if registered) are timely. Failure to comply with these requirements may result in penalties or fines under the Company Act 2063 and tax laws. Additionally, set up proper accounting systems to manage finances in line with Nepalese regulatory standards.

Documents Required for Company Registration in Nepal

The Documents Required for Online Company Registration are:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Application form for company registration

- Citizenship certificates of all promoters/shareholders (copies)

- Passport-sized photographs of all promoters/shareholders

- No Objection Letters from promoters/shareholders

- Resolution of the Board of Directors (if applicable)

- Power of Attorney (if applying through a representative)

- Approval from relevant government agencies (for specific sectors)

- Lease agreement or ownership document of company’s registered office

- Bank statement showing capital deposit (for public limited companies)

Foreign investors must also provide the following documents for Company Registration in Nepal:

- Copy of passport

- Visa documentation

- Approval from Department of Industry

All documents must be in Nepali or English. Translations must be certified if original documents are in other languages.

Company Registration Fees in Nepal (For Private Company)

The Company Registration Cost in Nepal, usually based on the Registration Fees, as of 2025 are as follows:

| Authorized Capital (NPR) | Registration Fee (NPR) |

|---|---|

| Up to NPR 100,000 | NPR 1,000 |

| NPR 100,001 to NPR 500,000 | NPR 4,500 |

| NPR 500,001 to NPR 2,500,000 | NPR 9,500 |

| NPR 2,500,001 to NPR 10,000,000 | NPR 16,000 |

| NPR 10,000,001 to NPR 20,000,000 | NPR 19,000 |

| NPR 20,000,001 to NPR 30,000,000 | NPR 22,000 |

| NPR 30,000,001 to NPR 40,000,000 | NPR 25,000 |

| NPR 40,000,001 to NPR 50,000,000 | NPR 28,000 |

| Above NPR 50,000,000 | NPR 30,000 |

Fees for Registration of Companies

| Fee Description | Amount (NPR) |

|---|---|

| Name Reservation Fee | —– |

| MOA Registration Fee | —– |

| AOA Registration Fee | —— |

| Application Processing Fee | —– |

Best Company Registration Service in Nepal

Axion Partners offers a professional and efficient Company Registration Service in Nepal, providing a seamless experience for business owners through online company registration in Nepal. Our team is highly experienced and reliable, ensuring that your company is registered correctly and swiftly. We handle every aspect of the registration process, from name reservation via the Office of Company Registrar Nepal to document submission and obtaining the registration certificate.

With more than 750 successful company registration and approval projects, our expertise in navigating Nepal’s legal and regulatory framework is unmatched. We ensure that all your documents comply with the Company Act 2063 and related laws, supporting a smooth, so you can focus on growing your business without any concerns.

Axion Partners guarantees a trusted and hassle-free company registration process. Choose our Company Registration Service in Nepal for quick, reliable, and professional assistance in how to register a company in Nepal that meets all your business needs.

How to Draft MOA and AOA in Nepal?

The Memorandum of Association (MOA) and Articles of Association (AOA) are fundamental documents for online company registration. Here’s how to draft them:

Memorandum of Association (MOA):

- Name Clause: State the company’s name as approved by OCR

- Registered Office Clause: Specify the location of the registered office

- Objects Clause: Detail the company’s main objectives and activities

- Liability Clause: State that liability of members is limited

- Capital Clause: Specify the authorized share capital

- Subscription Clause: List initial subscribers and their shareholdings

Articles of Association (AOA):

- Share Capital: Detail types of shares and rights attached

- Share Transfer: Procedures for transferring shares

- General Meetings: Rules for conducting meetings

- Directors: Appointment, removal, and powers of directors

- Dividends: Procedures for declaring and paying dividends

- Accounts: Requirements for maintaining financial records

Both documents must comply with the Companies Act 2063 and be in Nepali or English for company registration process in Kathmandu Nepal. It’s advisable to seek legal assistance to ensure compliance with all legal requirements.

How to Reserve Company Name through OCR Website?

The process of reserving a company name in Nepal through camis.ocr.gov.np under the ocr online portal are as follows:

- Visit www.ocr.gov.np

- Click on “Online Services” and select “Name Reservation”

- Create an account or log in if you have one

- Fill out the name reservation form

- Provide three name options in order of preference

- Pay the name reservation fee online

- Submit the application

- Wait for OCR approval (usually within 1-3 working days)

- Download the name approval certificate

How to Register a Company Online in Nepal?

Online Registration of Company in Nepal can be completed as follows:

- Visit the CAMIS OCR Website

- Create an account or log in

- Select “New Company Registration”

- Fill out the online application form

- Upload scanned copies of required documents

- Pay the registration fee online

- Submit the application

- Track the application status online

- Respond to any queries from OCR promptly

- Download the registration certificate once approved

The online system streamlines the process, but ensure all information and documents are accurate and complete to avoid delays.

Requirements for Private Company Registration

- Minimum of 1 promoter/shareholder (for private companies)

- Unique company name

- Registered office address in Nepal

- Minimum paid-up capital (varies by company type)

- Nepali citizenship for at least one director (for local companies)

- Compliance with sector-specific regulations (if applicable)

- Properly drafted MOA and AOA

- Complete set of required documents

- Payment of registration fees

Foreign investors may have additional requirements, such as approval from the Department of Industry and investment commitments.

Expert Company Registration Lawyer in Nepal

Axion Partners is home to over 10 expert Company Registration Lawyers in Nepal, each specializing in corporate law and company formation in Nepal. Our team is fully accredited with membership in the Nepal Bar Association and has extensive experience working with the Office of the Company Registrar (OCR) and other relevant government bodies.

With in-depth knowledge of sector-specific regulations, our lawyers provide comprehensive legal advice tailored to your business needs. Whether you’re establishing a small enterprise or a large corporation, our experts ensure a smooth and compliant company registration process in Nepal.

Axion Partners stands out as one of the leading firms in Nepal, offering top-notch legal services in online company registration in Nepal. For the best Company Registration Lawyer in Nepal, consult with our team to benefit from professional, reliable, and efficient service.

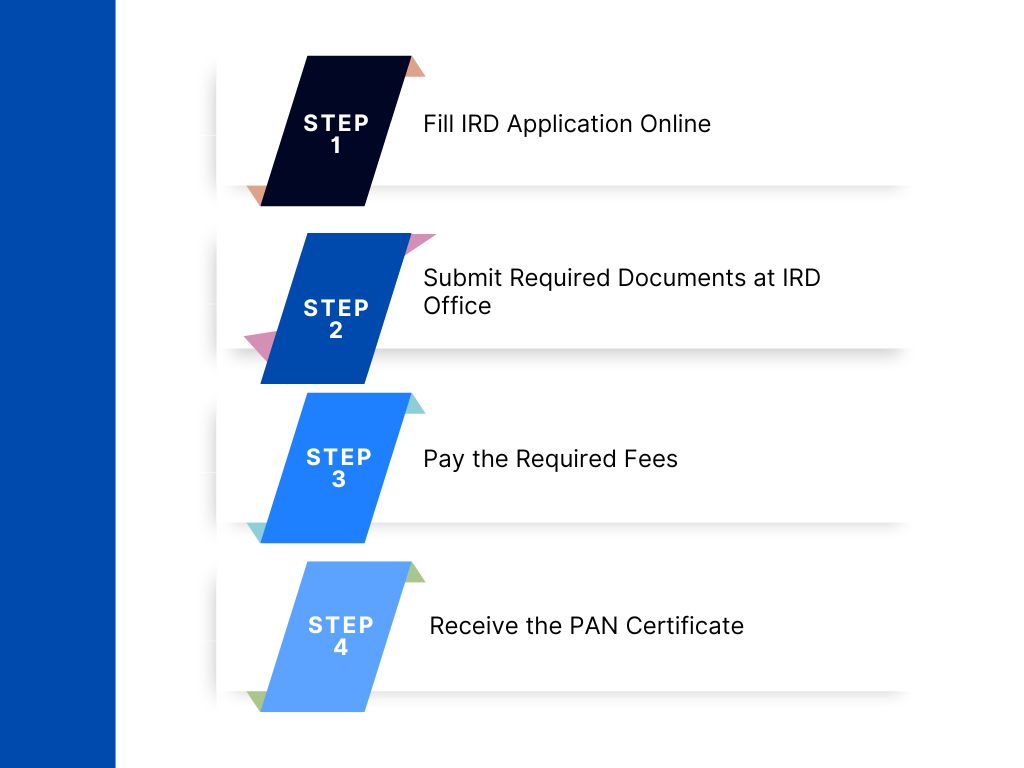

PAN/Tax Registration in Nepal

- Step 1: Fill IRD Application Online

- Step 2: Submit Required Documents at IRD Office

- Step 3: Pay the Required Fees

- Step 4: Receive the PAN Certificate

Step 1: Apply Online of IRD Application

Visit the Inland Revenue Department (IRD) website and fill out the PAN registration form after completing online company registration. Ensure all details are accurate before submitting the online application.

Step 2: Submit Required Documents

Submit the necessary documents, including the company registration certificate issued under the company registration process in Nepal, MOA, AOA, citizenship certificates of directors, and the lease agreement for the registered office.

Step 3: Pay the Registration Fee

Make the required payment for PAN registration. Ensure that the payment is processed successfully to move forward with obtaining your PAN certificate.

Step 4: Receive PAN Certificate

Once the documents and fee are processed, receive your PAN certificate and number. This completes your company’s tax registration with the Inland Revenue Department.

Local Ward Office Registration in Nepal

Companies must register with the local ward office where their registered office is located:

- Submit an application to the ward office

- Provide company registration certificate and other relevant documents

- Pay the local registration fee

- Obtain a local registration certificate

Read More

How to Establish a Branch Office in Nepal

Agriculture Company Registration in Nepal

Post-Company Registration Procedure in Nepal

After registration under the company registration process in Nepal, companies may need additional approvals depending on their nature of business:

- Industry Registration: Required for manufacturing companies

- Tourism Registration: For travel agencies, hotels, and restaurants

- Education Registration: For educational institutions

- Health Registration: For hospitals and clinics

- Banking and Finance: Approval from Nepal Rastra Bank

- Insurance: Approval from Insurance Board of Nepal

These approvals ensure compliance with sector-specific regulations and standards after online company registration in Nepal.

3-Month Compliance after Private Company Registration Process in Nepal

Within three months of registration, companies must complete several compliance tasks:

- Hold first board meeting and document minutes

- Appoint auditor and set their remuneration

- Issue share certificates to shareholders

- Prepare and file returns of allotment of shares with OCR

- Set up statutory registers (members register, directors register, etc.)

- Obtain PAN/VAT registration (if not done earlier)

- Register with local ward office

- Open corporate bank account

- Implement accounting system as per Nepal Financial Reporting Standards

Failure to comply with these requirements can result in penalties or legal complications.

Annual Compliance after Owning a Company in Nepal

Companies in Nepal must fulfill several annual compliance obligations:

- Hold Annual General Meeting (AGM) within 6 months of fiscal year-end

- Prepare and file annual returns with OCR

- Submit audited financial statements to OCR

- File income tax returns with Inland Revenue Department

- Renew company registration annually

- Update any changes in company information with OCR

- Maintain proper books of accounts

- Pay applicable taxes and fees

- Comply with labor laws and social security contributions

- Adhere to sector-specific regulatory requirements

Proper compliance ensures good standing with regulatory authorities and avoids legal issues.

SSF Registration of Companies in Nepal

The Social Security Fund (SSF) is a mandatory social protection scheme for formal sector employees in Nepal. Companies registered through the company registration process in Nepal must enroll with SSF and contribute on behalf of their employees.

The process involves:

- Register on the SSF online portal (ssf.gov.np)

- Submit required documents:

- Company registration certificate

- PAN certificate

- List of employees

- Obtain SSF registration number

- Enroll employees in the scheme

- Make monthly contributions (11% from employer, 31% from employee’s salary)

SSF provides various benefits including medical, accident, and retirement coverage for employees. Compliance with SSF regulations is mandatory for all eligible companies in Nepal.

How to register a company in Nepal?

1. Reserve a unique company name via OCR Portal.

2. Submit signed MOA, AOA, and required documents to OCR.

3. Pay registration fees and undergo document examination.

4. Obtain a company registration certificate and register for PAN.

Can a foreigner own a company in Nepal?

1. Obtain prior approval from the Department of Industry.

2. Submit necessary for business visa and investment approval.

3. Register the company at OCR following standard procedures.

4. Register for PAN and meet compliance regulations.

What is LLC in Nepal?

A Limited Liability Company (LLC) in Nepal is governed by the Company Act 2063. Under this law, owners’ liability is restricted to their investment in the company, ensuring personal asset protection. LLCs are commonly used by small to medium-sized enterprises.

How to register a non-profit company in Nepal?

1. Draft MOA and AOA with non-profit objectives under Company Act 2063.

2. Submit signed documents and application to OCR.

3. Obtain approval from relevant government departments if required.

4. Register for PAN and comply with tax exemptions.

What documents are required for online company registration?

Required documents include:

MOA & AOA

Application form

Citizenship copies of shareholders

Passport-size photographs

Office lease agreement/ownership proof

Power of Attorney (if applicable)

Foreign investors must also provide passports, visas, and Department of Industry approval.

How long does it take to complete company registration in Nepal?

The process usually takes 7–15 working days, depending on the accuracy of documents, timely submission through application ocr, approval speed from OCR, and any additional sector-specific clearances if required.

Professional Conclusion by Axion Partners

This guide clearly explains the complete online company registration in Nepal, covering legal requirements, documentation, timelines, and compliance obligations involved in the company registration process in Nepal. With proper planning and accurate documentation, businesses can avoid delays and penalties. With professional support from Axion Partners, companies can complete registration smoothly and operate with full legal compliance in Nepal.